- Moody’s downgrade could significantly impact the U.S. economy amid inflation concerns.

- The Fed’s Raphael Bostic notes potential increases in U.S. funding costs.

- Crypto markets face potential volatility, with Bitcoin maintaining stability so far.

The recent downgrade of the U.S. credit rating by Moody’s has sparked significant discussions about the broader economic impacts, especially amid rising inflation concerns.

Federal Reserve’s Raphael Bostic highlighted potential economic risks following Moody’s downgrade of the U.S. rating, noting such developments as crucial in the current economic climate.

Bostic Highlights Economic Risks Post-Moody’s Downgrade

Bostic indicated potential cost increases for U.S. funding, while tariff-related consumer impacts remain uncertain. A clearer market picture may take three to six months to emerge.

In similar past scenarios, such as the 2011 U.S. credit rating downgrade by S&P, markets experienced immediate volatility, underscoring today’s potential impacts.

In similar past scenarios, such as the 2011 U.S. credit rating downgrade by S&P, markets experienced immediate volatility, underscoring today’s potential impacts.

Crypto Market Faces Volatility amid Moody’s Downgrade

Did you know? In similar past scenarios, such as the 2011 U.S. credit rating downgrade by S&P, markets experienced immediate volatility, underscoring today’s potential impacts.

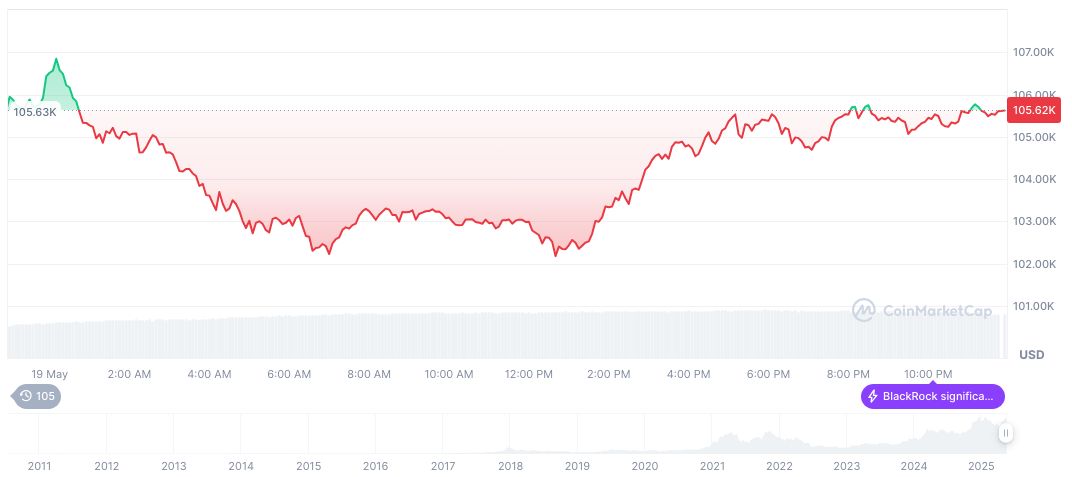

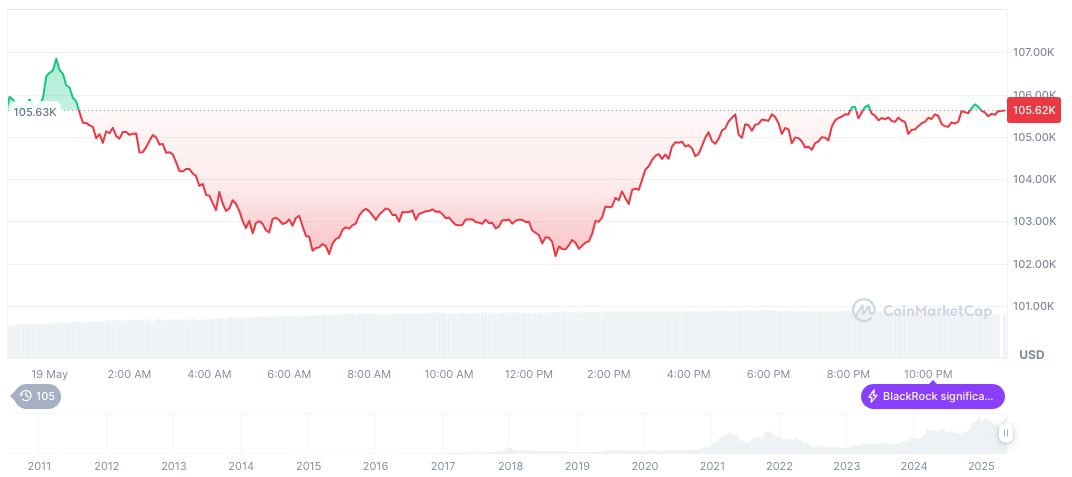

Bitcoin, according to CoinMarketCap, is trading at a price of $105,861.69, with a market cap of approximately $2.10 trillion. BTC’s 24-hour trading volume reflects a 15.89% change, and the market dominance stands at 63.01%. Pricing trends show notable monthly stability despite macroeconomic pressures.

The Coincu research team notes that Moody’s downgrade could intensify financial volatility, affecting crypto market liquidity and potentially engendering regulatory scrutiny on fiscal policies. Long-term technological investments remain pivotal for stabilizing market shifts.

Source: https://coincu.com/338577-fed-bostic-moodys-downgrade-impact/