- Tether now holds over $120 billion in U.S. Treasury bonds.

- Tether surpasses economies like Germany in Treasury holdings.

- Significant gains emphasize Tether’s commitment to stability.

Tether Holdings has reported U.S. Treasury bond holdings exceeding 120 billion dollars, surpassing Germany’s 111.4 billion dollars, according to its Q1 2025 report.

This development positions Tether as a significant player in both the crypto and traditional finance sectors, emphasizing its commitment to stability amidst market volatility.

Tether’s $120 Billion Treasury Stake Surpasses Global Economies

Tether has made substantial gains in its financial positioning. The stablecoin issuer now holds over $120 billion in U.S. Treasury bonds as revealed in its Q1 2025 attestation report. This milestone places Tether as the world’s 19th largest holder of U.S. Treasuries, surpassing notable economies such as Germany, Canada, and Norway in the last year.

The increase in Treasury holdings reflects Tether’s strategy to secure its USDT peg amid the fluctuating cryptocurrency landscape. Over 80% of its assets are in government securities, with traditional investment income from both Treasuries and gold reportedly surpassing $1 billion in the first quarter alone.

Market analysts and key figures, including Tether’s CEO Paolo Ardoino, have positively acknowledged these achievements, underscoring Tether’s leadership in risk management. Ardoino highlighted on social media that Tether is prioritizing safe and liquid assets to safeguard its stablecoin users and maintain their dominance in the digital economy.

“Tether continues to prioritize conservative risk management, investing in safe and liquid assets to protect USDT holders and reaffirm our leadership in the global digital economy.” – Paolo Ardoino, CEO, Tether

Record Growth Spurs Regulatory Dialogue in Crypto Market

Did you know? Tether’s rapid Treasury asset growth from $33 billion to $120 billion within just six months marks a record leap, surpassing many sovereign nations’ reserve expansions.

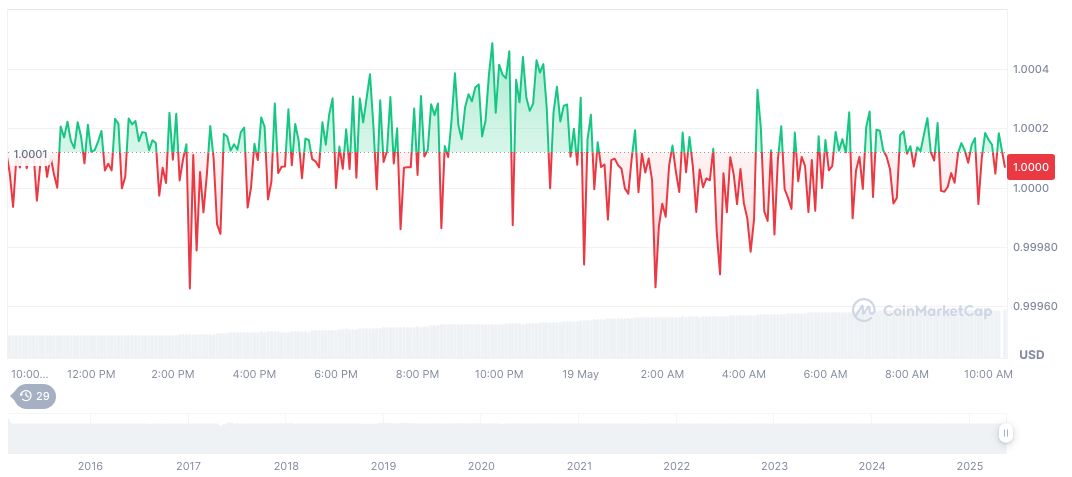

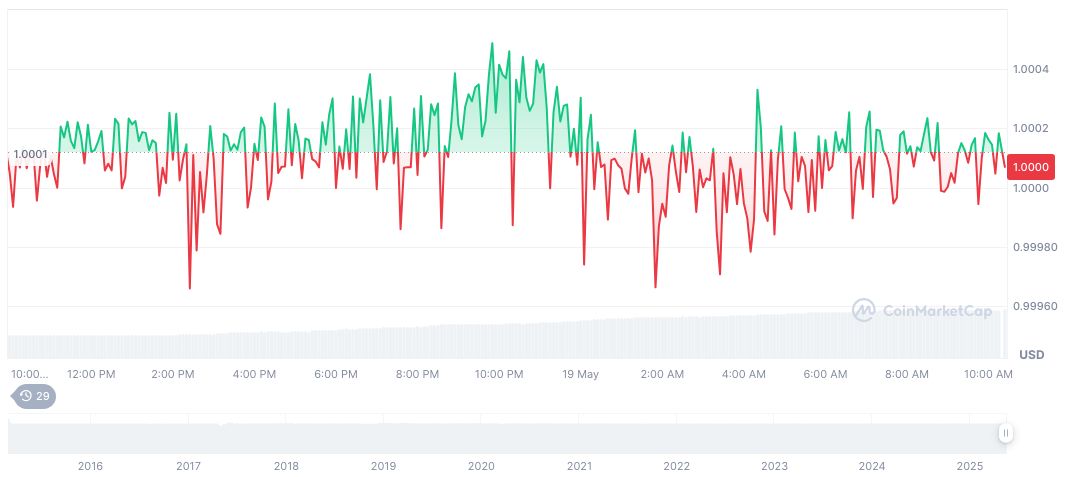

According to CoinMarketCap, Tether USDt (USDT) maintained its dollar peg at $1.00 with an 83.65% surge in 24-hour trading volume, reaching 109 billion dollars. The coin remains a primary liquidity source, supported by its extensive Treasury reserve, reflecting stable price levels over recent months.

The Coincu research team suggests Tether’s Treasury exposure may drive unique regulatory dialogues, potentially setting benchmarks for future stablecoin reserving practices. Such volatility protection mechanisms underscore Tether’s role in merging crypto with traditional markets, crafting a roadmap for stablecoin security and efficiency amid regulatory shifts.

Source: https://coincu.com/338505-tether-holds-120-billion-treasuries/