- Basel Medical Group Ltd plans $1 billion Bitcoin acquisition.

- Share-swap approach preserves company’s cash reserves.

- Basel stock fell 15% following the announcement.

Basel Medical Group Ltd, a Singapore-based company listed on NASDAQ, has announced plans to acquire Bitcoin worth $1 billion through a share-swap arrangement. The move aims to diversify financial reserves while maintaining focus on medical services expansion in Asia.

Transformative Shift to Digital Assets Sparks Mixed Reactions

The acquisition plan is spearheaded by Dr. Darren Yen Feng Chhoa, Basel’s CEO. Dr. Chhoa confirmed the negotiations via SEC filings, emphasizing enhanced capacity for Asian growth. “This decision is not about hype or headlines, but is part of a financial pivot designed to support the company’s growth across Asia while providing more flexibility in managing its reserves.” This strategic financial restructuring involves using a share-swap model, allowing high-net-worth individuals and institutions to exchange Bitcoin for Basel stock.

Historical Context, Price Data, and Expert Analysis

The proposed plan signifies a noteworthy shift towards digital assets by Basel. While hailed as a bold initiative, the market response was mixed, with Basel’s stock declining by approximately 15%. This reflects investor concerns regarding cryptocurrency investments by healthcare firms. Prominent voices like The Bitcoin Historian on Twitter highlighted the acquisition as part of a “corporate adoption wave.” This sentiment captures the growing trend of digital currency integration across sectors, driven by market demand and evolving financial strategies.

The acquisition plan is spearheaded by Dr. Darren Yen Feng Chhoa, Basel’s CEO. Dr. Chhoa confirmed the negotiations via SEC filings, emphasizing enhanced capacity for Asian growth.

Market Data and Insights

Did you know? Basel Medical Group’s Bitcoin acquisition marks one of the largest cryptocurrency investments by a non-tech-related, publicly traded company, indicating a broader institutional shift toward digital assets.

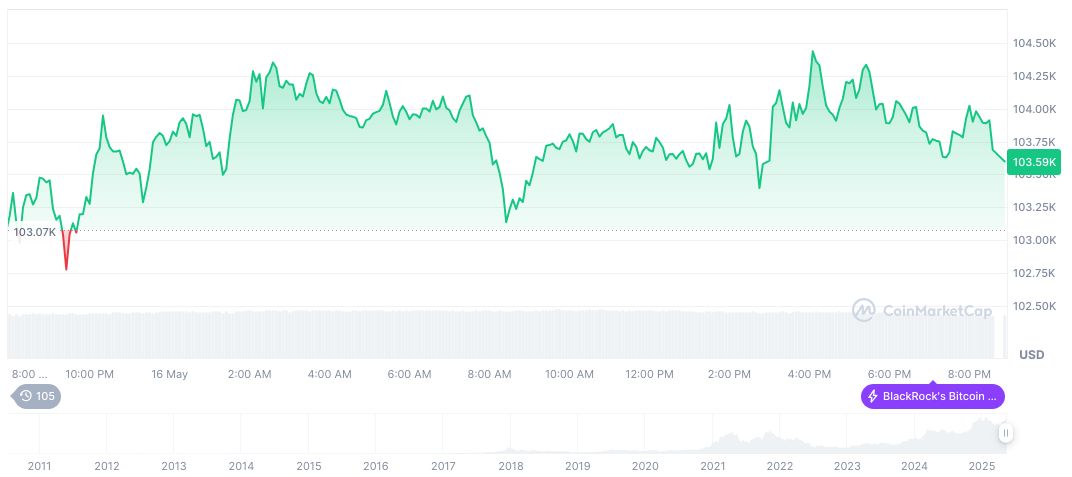

Bitcoin (BTC) remains a focal point within cryptocurrency markets. As of May 17, 2025, Bitcoin holds a market cap of $2.05 trillion with a circulating supply of 19,865,290 BTC. Recently, Bitcoin’s price decreased by 0.55% over 24 hours to $103,479.54, according to CoinMarketCap.

Insights from the Coincu research team suggest Basel’s move could prompt similar actions in different sectors. Financial diversification through cryptocurrencies may offer increased flexibility and innovative investment opportunities amidst evolving global market demands. Follow the latest insights and updates from 99BitcoinsHQ.

Source: https://coincu.com/338059-basel-medical-bitcoin-acquisition/