- Basel Medical announces $1 billion Bitcoin plan, diversification agenda.

- Shares fall over 14 percent post-announcement.

- Bitcoin allocation aims at stability, growth in Asian markets.

Basel Medical Group Ltd has begun exclusive negotiations for a $1 billion Bitcoin acquisition, expanding its financial reserves.

The acquisition represents a major entry into cryptocurrency by a healthcare company, prompting mixed market reactions, including a 14% drop in the company’s stock.

Basel Medical Group’s $1 Billion Bitcoin Strategy Faces Market Skepticism

Basel Medical Group’s unprecedented strategy involves a share-swap arrangement with a consortium of institutional investors, aimed at treasury diversification. Dr. Darren Chhoa, CEO, emphasizes the deal’s role in ensuring growth and stability for the Singapore-based medical services firm.

Market response was swift: Basel’s share price reacted negatively, dropping over 14%. This volatility reflects investor caution over such significant exposure to Bitcoin, noted for its price fluctuations. However, the move also positions Basel as a leader in financial innovation within healthcare.

“The transaction aims to diversify our treasury, boost balance sheet liquidity, and create financial flexibility for expansion within Asian healthcare markets.” — Dr. Darren Chhoa, CEO, Basel Medical Group

The acquisition’s sheer size and structure have raised eyebrows. Key market figures remain silent, while the company’s SEC filing underscores Dr. Chhoa’s leadership. The ripple effect in Bitcoin spot markets remains speculative, with debates on regulatory perspectives forming in investor circles.

Bitcoin Industry Insights and Historical Corporate Moves

Did you know? MicroStrategy’s Bitcoin treasury reallocation had a similar impact, with rapid initial stock price shifts, emphasizing how corporate Bitcoin adoption can significantly influence market and valuation dynamics.

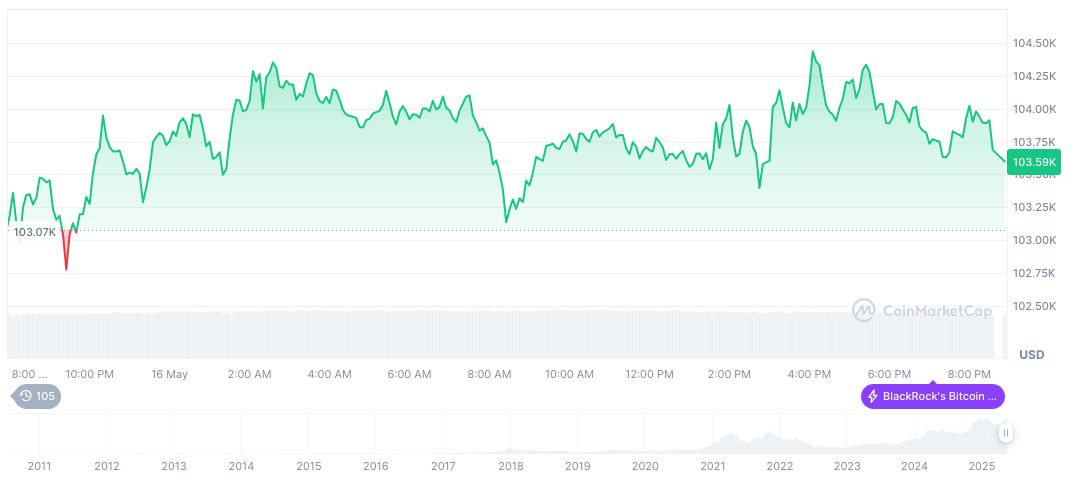

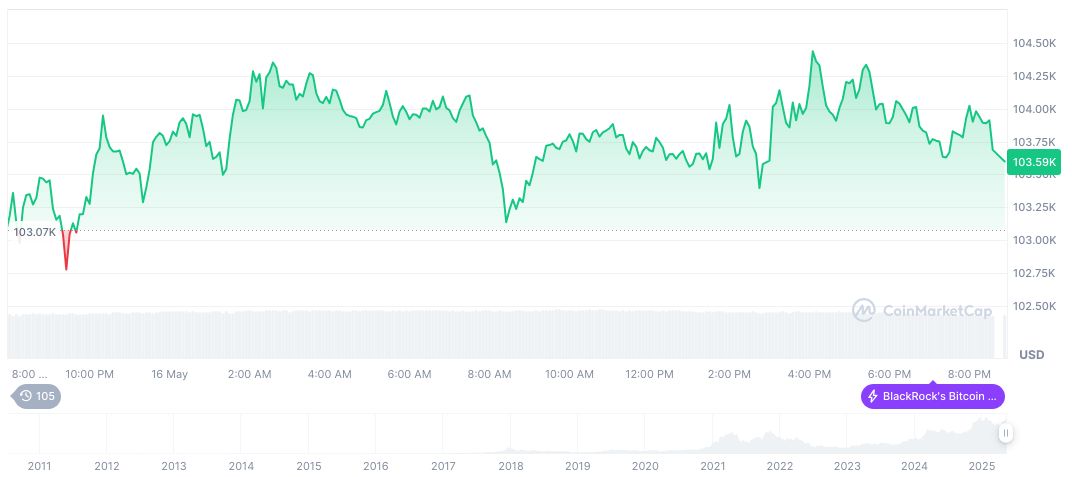

According to CoinMarketCap, Bitcoin (BTC) currently trades at $103,468.60, showing a modest 0.53% increase over seven days. Its market cap stands at $2.05 trillion, commanding a 62.32% market dominance. Notable price change of 22.55% over 30 days indicates strengthened sector interest.

The Coincu research team underlines how Basel’s crypto venture mirrors historical precedents set by corporates like Tesla. Such moves signal a broader institutional gravitation towards cryptocurrency for treasury diversification and potentially extend reshaping global financial landscapes.

Source: https://coincu.com/338008-basel-medical-bitcoin-acquisition-plan/