- The Trump Tax Bill passed the House Ways and Means Committee with Republican backing despite internal disagreements.

- GOP faced internal resistance over spending cuts.

- Tax reductions forecasted for average earners under the proposed bill.

The Trump Tax Bill successfully passed the House Ways and Means Committee on May 14, 2025, in Washington, D.C. Internal Republican disagreements over the bill’s provisions were insufficient to prevent its progression through the committee (source).

With passage in committee, the bill now heads to the House floor, seeking approval amidst continuing GOP debates over financial cuts. Conservative members express unease over proposed spending cuts, yet the bill promises lower taxes for middle-income earners, potentially impacting federal revenue streams.

Trump Tax Bill Moves Forward Amid GOP Tensions

Following intense negotiations, the Trump Tax Bill passed the committee with support from Republican members. This signature legislative initiative seeks to further President Trump’s economic agenda by addressing tax concerns. Key figures such as Speaker Mike Johnson aim to push the bill forward without Democratic support, relying on Republican votes to advance it. He stated, “working to muscle the party’s signature package to passage without any votes from Democrats.”

Immediate implications include major tax reductions projected for average-income individuals, potentially altering spending patterns. The bill also proposes limited reforms in Medicaid, raising concerns among conservatives looking for more aggressive cuts. Rep. Ralph Norman highlights the shallow impact of the proposed $2 trillion cuts, labeling it a “teardrop in the ocean.”

Market reactions focus on potential gains for middle-class taxpayers, though certain GOP lawmakers from high-tax states emphasize the need for deeper SALT deductions. Senator Rand Paul comments on the irony of conservatives approving a debt ceiling increase, which revives debates over fiscal responsibility.

Historical Context, Price Data, and Expert Insights

Did you know? The Trump Tax Bill, while divisive, reflects similar tensions seen during the 2017 Tax Cuts and Jobs Act’s enactment, underscoring recurring fiscal battles in Congress.

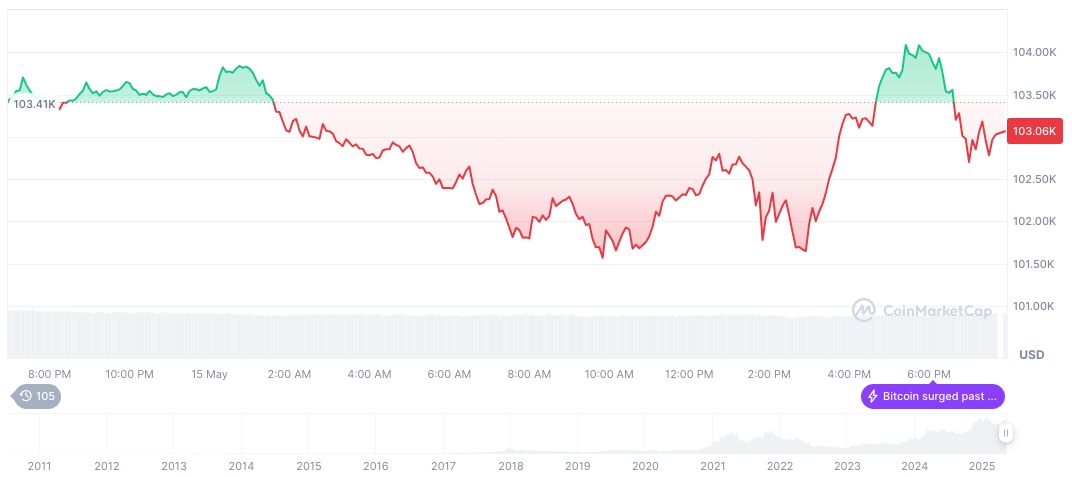

Bitcoin (BTC) trades at $104,167.76, with a market cap of $2.07 trillion, dominating 62.01% of the market. Recent movements show a 0.93% rise over 24 hours, and an uptrend of 24.40% in 60 days. Data from CoinMarketCap indicates the potent influence Bitcoin holds in the digital asset market.

Coincu analysis suggests the bill could shift financial focus towards middle-class benefits but warns of long-term economic strain without balanced cuts. Historical data suggests potential regulatory challenges ahead, impacting digital currencies and broader financial markets.

Source: https://coincu.com/337966-bitcoin-rises-trump-tax-bill/