- Trump announces unilateral tariffs without negotiations.

- Tariffs to be imposed in 2-3 weeks.

- Potential impacts on global trade and crypto markets.

Earlier this week, Donald Trump announced in the UAE that new U.S. tariffs will be imposed unilaterally in the next two to three weeks, bypassing direct negotiations with affected nations. Experts and stakeholders consider the announcement’s implications for international trade and cryptocurrency markets, with potential economic shifts anticipated.

Trump’s announcement in the UAE to implement unilateral tariffs marks a notable shift in U.S. trade strategy. The decision is expected to impact global trade partnerships as the United States bypasses traditional negotiation routes. Many trading partners may face new tariffs within two to three weeks, although specifics remain unspecified.

Bitcoin’s Role Amid Trade Turbulence and Tariffs

The policy shift suggests significant economic ramifications, raising concerns among global trading entities. The move could potentially reconfigure international trade dynamics and affect various global markets, including the cryptocurrency sector. However, exact changes aren’t immediately clear as stakeholders await further information.

Industry and political leaders are analyzing the situation, with reactions measuring potential impacts on trade relationships and market conditions. The Financial Times has cited keen international interest in how these tariffs might affect economic flows and market responses across multiple sectors.

“The competition for traffic in the cryptocurrency field is intense, and CMC Launch is dedicated to helping new projects precisely reach and connect with users seeking potential tracks. As a ‘cryptocurrency hub,’ we welcome Aster as the first CMC Launch project to showcase its innovative value to the global community.” — Rush, CEO, CoinMarketCap

Market Data and Insights

Did you know? In past geopolitical tensions, Bitcoin often attracted interest as a ‘hedge’ asset, but current sources show no direct link between new tariffs and immediate price shifts.

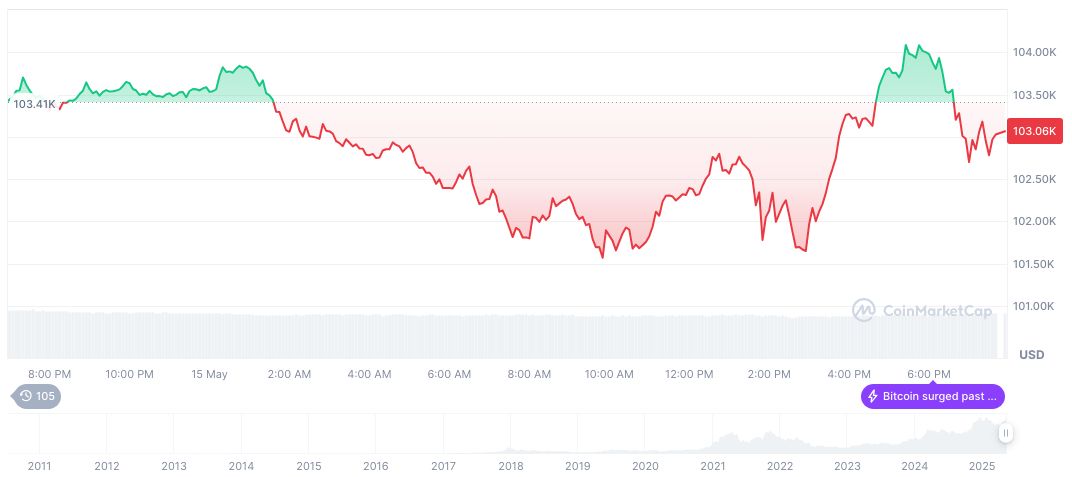

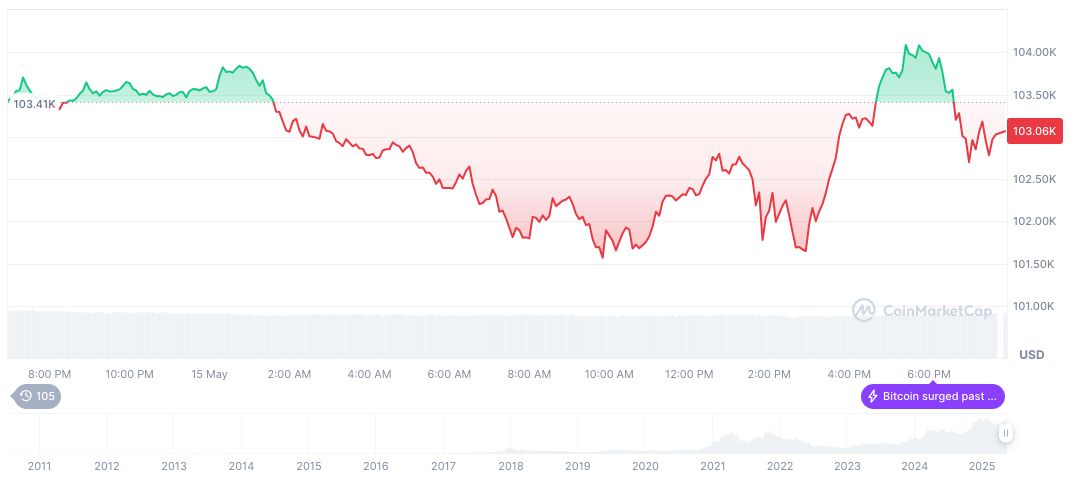

CoinMarketCap data indicates Bitcoin (BTC) holds a market value of $103,791.68, with a market cap of $2.06 trillion. The leading cryptocurrency saw a modest 1.49% price rise in 24 hours. Trading volume reached $51.86 billion, reflecting an active market despite uncertainty.

Coincu research team highlights potential market instability due to these tariffs, comparing them to historical precedent. While Bitcoin often plays a mitigating role during geopolitical disruptions, its price will depend on longer-term ramifications in the trade landscape. Analysts note the importance of monitoring official statements and economic indicators for further insights.

Source: https://coincu.com/337924-trump-announces-new-tariffs-uae/