- BlackRock’s Bitcoin ETF reaches a record $64.697 billion.

- Bitcoin ETF surpasses gold funds, signaling a shift in institutional investment preferences.

- Consistent capital inflow points to cryptocurrency’s growing acceptance.

BlackRock’s IBIT Bitcoin ETF reached $64.697 billion on May 15, 2025, overtaking Strategy’s $59.146 billion, according to PANews. This event showcases a pivotal shift as institutional investors increasingly favor cryptocurrency over traditional gold assets.

BlackRock’s Bitcoin ETF surpassing gold funds emphasizes growing cryptocurrency adoption among major financial players, validating Bitcoin’s role as a significant asset class.

BlackRock’s Bitcoin ETF Hits $64.697 Billion, Defeats Gold

BlackRock’s recent achievement of its IBIT Bitcoin holdings surpassing $64.697 billion marks a notable shift in the investment landscape. This milestone positions BlackRock’s ETF ahead of Strategy, highlighting a broader institutional embrace of cryptocurrency. BlackRock, as the largest asset manager globally, reported these high holdings on May 15. This event represents a growing interest in Bitcoin over traditional asset classes, particularly gold, reflecting a broader trend towards digital finance.

The consistent inflows into BlackRock’s IBIT ETF, with substantial net inflows of $6.96 billion since January 2025, indicate a significant institutional pivot. Goldman Sachs, for instance, has increased its holdings by 28% in Q1 2025. While the ETF’s momentum parallels the volatility in Bitcoin’s price, IBIT’s performance demonstrates a strong investor conviction in Bitcoin’s potential.

Market analysts like Eric Balchunas from Bloomberg highlight the unique position of BlackRock’s ETF. With a competitive 0.25% expense ratio, IBIT attracts substantial fund flows potentially being fueled by high-profile investors. Balchunas suggests the ETF’s success comes amid a backdrop of broader financial shifts away from other digital assets.

IBIT is taking in SO much more than the rest of them. Usually there’s much more parity… My theory, return of the HF [hedge fund] basis trade and some big fish biting after the decoupling and subsequent rally.

Institutional Confidence Spurs Bitcoin ETF and Market Rally

Did you know? BlackRock’s Bitcoin ETF’s streak of 19 consecutive inflow days is the longest for any Bitcoin fund in 2025, showcasing enduring investor interest despite price fluctuations.

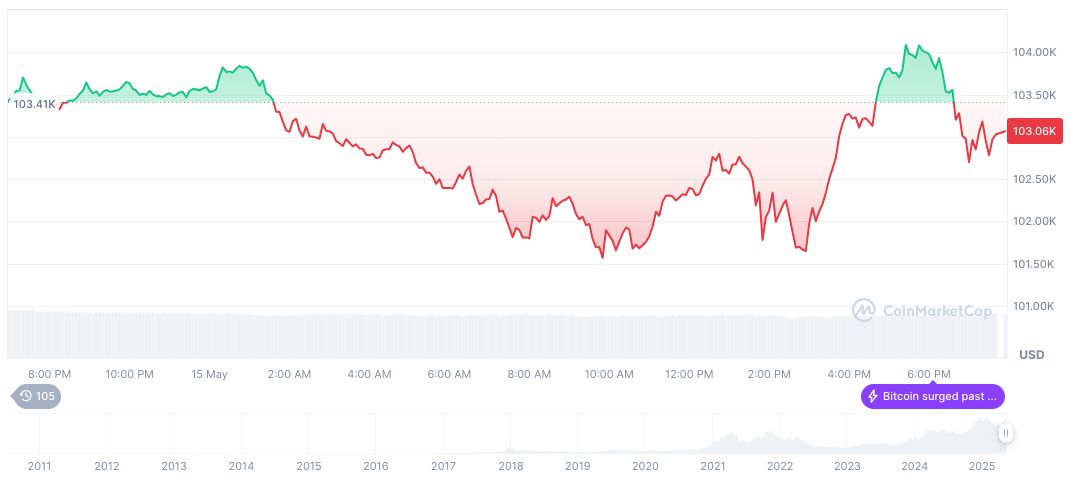

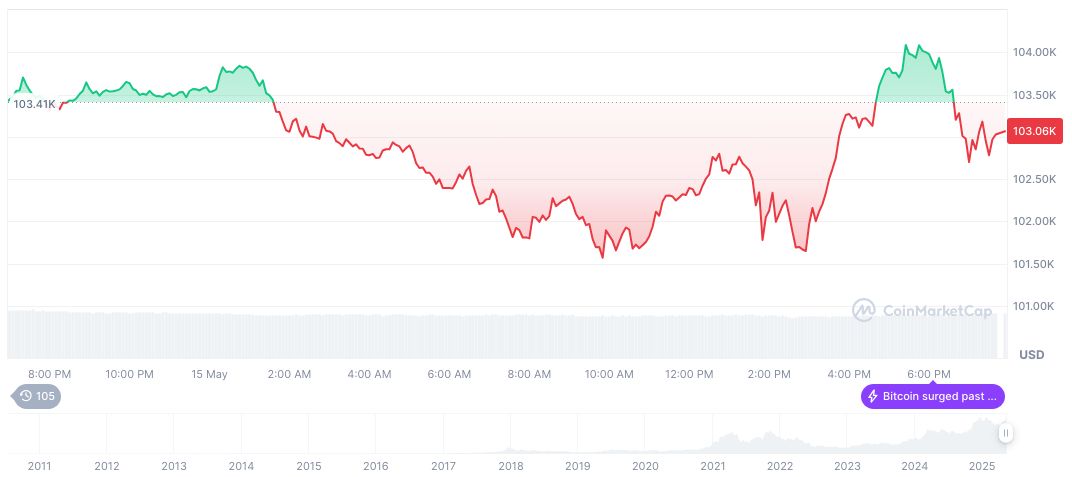

Bitcoin’s current market data reports its price at $103,991.33, reflecting a 1.37% increase over 24 hours, according to CoinMarketCap. The total market cap stands at formatNumber(2,065,817,948,259, 2), underscoring Bitcoin’s significant market dominance of 62%. Recent data indicates Bitcoin’s trading range has been volatile, with a remarkable 25.04% increase over 60 days.

The Coincu research team suggests that BlackRock’s strong ETF inflows could push Bitcoin towards more mainstream adoption. As regulatory bodies adapt to cryptocurrency, market dynamics may stabilize, enhancing Bitcoin’s financial and technological advancements in future markets.

Source: https://coincu.com/337890-blackrock-bitcoin-etf-surpasses-strategy/