- SEC has delayed its decision on the 21Shares Polkadot ETF application.

- This move is part of a broader pattern affecting cryptocurrency ETF applications.

- Market reactions include a decline in Polkadot’s price and investor confidence.

SEC Delays Continue to Sway Polkadot Market Confidence

The SEC has postponed its decision on the 21Shares Polkadot ETF application, citing the need for additional review. The application, submitted to list on the Nasdaq exchange, underscores significant institutional interest. Nasdaq and 21Shares await SEC’s verdict, with potential dates now set for June 2025.

This decision extends a pattern of cautious regulatory review by the SEC, similarly affecting other cryptocurrency ETFs such as those for Solana and Ripple. The decision delays may influence the broader crypto ETF market landscape by maintaining uncertainty. Open-ended review processes often lead to volatility in related cryptocurrency prices, mirroring prior ETF delays.

Reactions and Market Impact

Reactions have been mixed across the industry, with market experts noting the decline in Polkadot’s price as an immediate reaction. No formal statements have emerged from 21Shares or Nasdaq, though the impacts are evident in lowered investor confidence. Nasdaq remarked, “We remain hopeful for the SEC’s consideration of our filing for the 21Shares Polkadot ETF, recognizing the burgeoning interest in Polkadot.”

Did you know?

The SEC has historically postponed cryptocurrency ETF decisions, often leading to immediate market downturns, which is reflected in the ongoing SEC Rule Filing for NYSE Arca. This parallels previous actions with Bitcoin ETFs, highlighting ongoing caution in adopting new cryptocurrency-backed financial products.

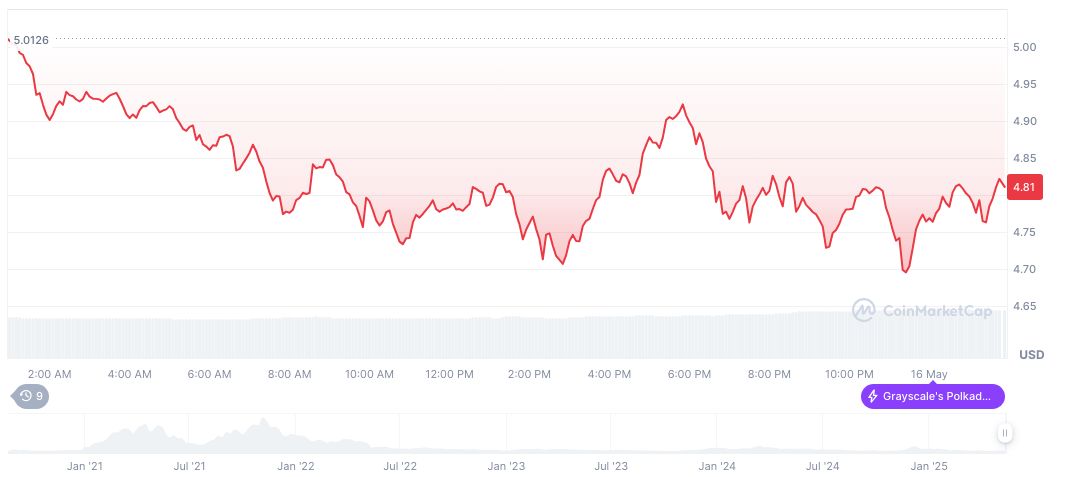

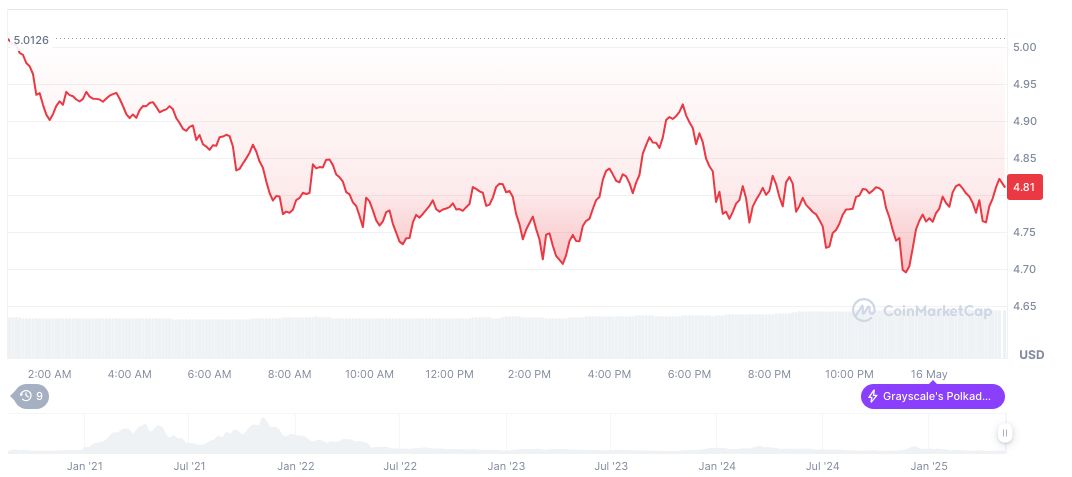

Polkadot’s price currently stands at $4.81, with a market cap nearing $7.59 billion, according to CoinMarketCap. Over the past 90 days, Polkadot has seen a price change of approximately -7.42%. Trading volume recently surged by 18.67%, reflecting increased market activity ahead of anticipated regulatory outcomes.

Historical Patterns: SEC Trends and Polkadot Analysis

Did you know? Insert a historical or comparative fact related to this topic.

Analyses from the Coincu research team emphasize continued regulatory hurdles that could prolong uncertainty. Historical trends indicate that SEC postponements often correlate with investor hesitancy, impacting not only Polkadot but also broader cryptocurrency market dynamics.

Source: https://coincu.com/337854-sec-delays-21shares-polkadot-etf/