- Xinbi Co. Ltd associated with an $8.40 billion USDT scam.

- Platform engaged in “pig butchering” and laundering activities.

- Industry faces increased regulatory focus and scrutiny.

Xinbi Co. Ltd, registered in Colorado, is associated with the illegal Telegram-based marketplace, “Xinbi Guarantee.” This platform facilitates scams, primarily using USDT, and was last updated to “delinquent” in January 2025.

The case underscores persistent risk in stablecoin transactions and regulatory challenges. Despite official warnings, the platform maintains substantial influence in illegal crypto activities.

Xinbi Co. Ltd Faces $8.4 Billion USDT Scam Allegations

Xinbi Co. Ltd’s involvement with “Xinbi Guarantee” as a platform for illegal activities has drawn attention. Registered in 2022, the company, marked as “delinquent” by Colorado authorities, is associated with $8.40 billion in mainly USDT transactions. This platform facilitates technology, personal data, and money laundering services known as “pig butchering” scams.

The impact concerns the criminal use of stablecoins for laundering activities. The platform is the second-largest illegal online marketplace with $1 billion in the fourth quarter of 2024 alone. Despite its claims as an “investment and capital guarantee group,” its primary role supports significant financial crimes via digital assets. Analysis of trends in crypto-related criminal activities further illustrates the scale of operations like Xinbi.

Market sentiment reflects caution regarding stablecoin miscues on platforms like Telegram. Blockchain security firm Elliptic highlights Xinbi’s scale, comparable to major illegal markets historically. Regulatory authorities continue to monitor, but federal actions remain unannounced, maintaining industry uncertainty.

Regulatory Challenges and Crypto Market Reactions

Did you know? The scale of Xinbi Guarantee’s illicit activities makes it one of the largest crypto-related crime hubs alongside historical operations like Hydra, emphasizing recurring laundering trends.

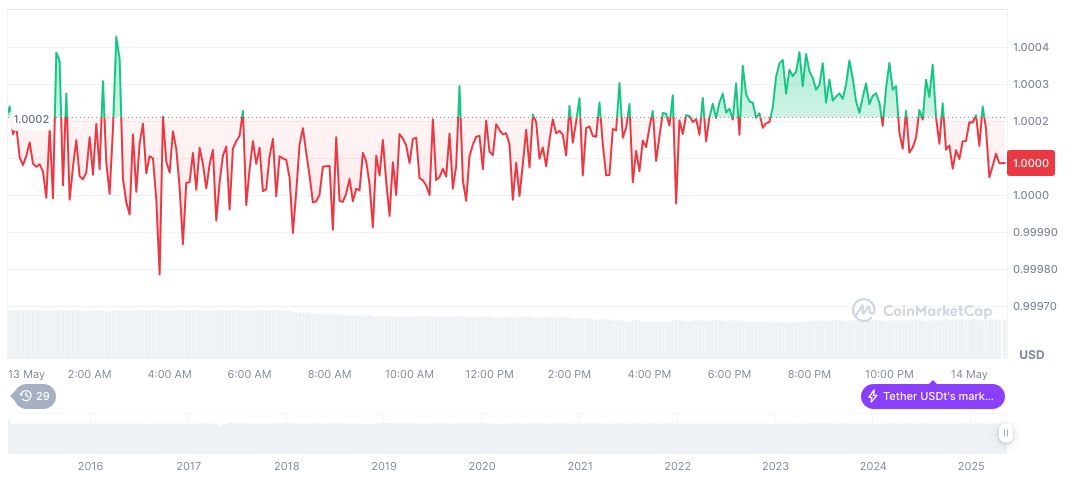

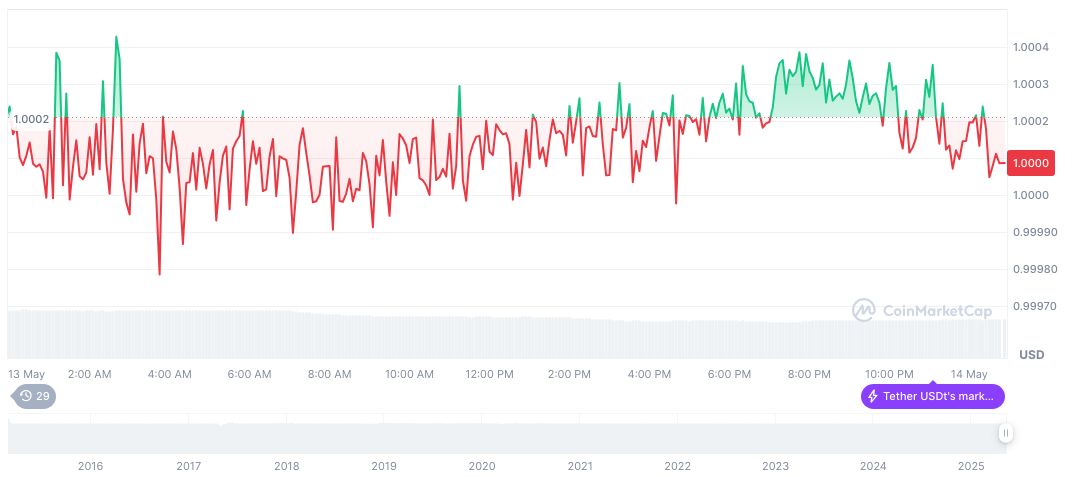

CoinMarketCap shows Tether USDt, trading at $1.00, experiences minor fluctuations with a 24-hour volume of $104.39 billion, reflecting a recent -0.02% price change. Its market cap stands at $150.32 billion, with a 4.46% dominance, capturing a stable demand despite broader market tensions.

The Coincu research team foresees increased regulatory focus on stablecoins like USDT and platforms facilitating financial crimes. Emerging technological solutions and tightened compliance protocols could shape a stricter financial environment, urging market participants toward better risk management strategies.

Source: https://coincu.com/337524-xinbi-colorado-violations-marketplace/