- MicroStrategy’s rapid Bitcoin accumulation affects market liquidity.

- Annual deflation rate projected at -2.23%.

- Institutional activity challenges traditional market models.

Ki Young Ju, CEO of CryptoQuant, recently indicated that MicroStrategy’s Bitcoin acquisitions are surpassing mining rates, significantly impacting market liquidity.

The substantial Bitcoin acquisitions by MicroStrategy suggest a move towards deflationary tendencies, potentially disrupting conventional market models.

MicroStrategy’s Bitcoin Purchases Surpass Mining Output

CryptoQuant’s Ki Young Ju emphasizes Bitcoin’s emerging deflationary characteristics, citing MicroStrategy’s rapid and illiquid BTC purchases. The firm currently holds approximately 555,000 BTC, considerably shrinking its availability in the market. Bitcoin acquisitions by MicroStrategy outpace newly mined coins, potentially constraining market liquidity. Ju suggests an annual deflation rate of -2.23%, attributing further effects to other institutional stakeholders.

“The Bitcoin market has become much more diverse. ETFs, MicroStrategy (MSTR), institutional investors, and even government agencies are considering buying and selling Bitcoin.” – Ki Young Ju, CEO, CryptoQuant

Analysts speculate that this persistent acquisition could foster enhanced scarcity, impacting Bitcoin’s price dynamics and challenging historical trading models. Notably, supporters of this strategy argue it may enhance Bitcoin’s attractiveness as a long-term asset. Conversely, skeptics contend the implications on broader market stability remain uncertain.

Bitcoin Scarcity Drives Price and Regulatory Discussions

Did you know? MicroStrategy’s 555,000 BTC holdings now exceed new mining outputs, influencing supply dynamics akin to historical precedent with long-term institutional holding trends during previous bull cycles.

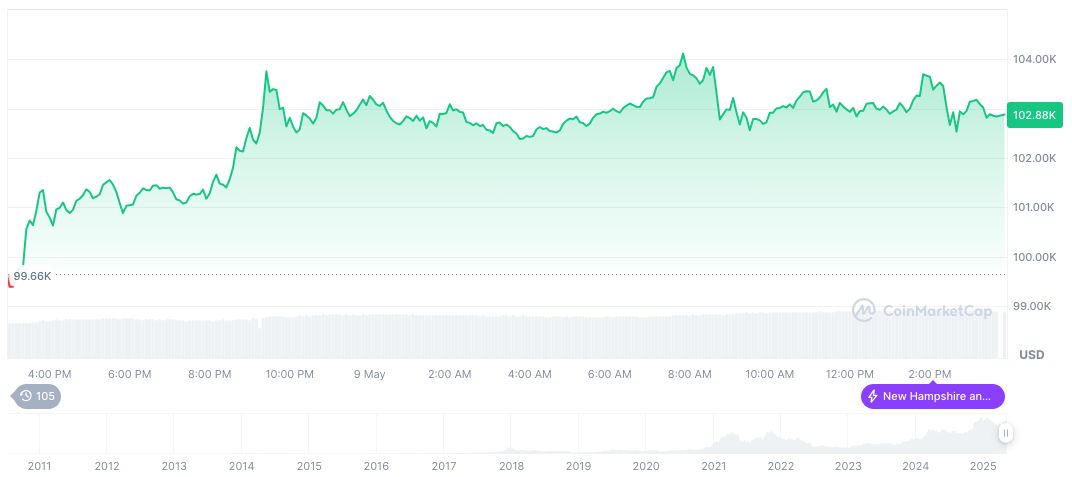

As of May 10, 2025, Bitcoin’s price sits at 103,576.63 USD with a market capitalization of 2,057,320,875,920.64 USD, maintaining a market dominance of 62.41%. The 24-hour trading volume decreased by -37.51% at approximately 45,806,246,934.15 USD. Over 90 days, Bitcoin experienced a price increase of 6.94%. This data, obtained from CoinMarketCap, reflects key fluctuations and supply influences shaping Bitcoin’s market position.

Insights from Coincu suggest that extended institutional control over Bitcoin supplies might pressure market liquidity, prompting potential consideration of regulatory intercessions to mitigate volatility. Analysts further propose examining alternative technological advancements that could adapt to or counterbalance prospective liquidity restrictions.

Source: https://coincu.com/336802-bitcoin-deflationary-trend-microstrategy/