- TeraWulf reports a $61.4 million loss in Q1 2025.

- Bitcoin halving impacts mining profitability.

- Severe New York weather affects operations.

TeraWulf has reported a significant financial loss of $61.4 million for the first quarter of 2025. This financial downturn is attributed to the recent Bitcoin halving and adverse weather conditions that affected operations in New York.

TeraWulf Reports $61.4 Million Loss Amid Rising Costs TeraWulf’s financial report reveals its net loss for Q1 2025 surged to $61.4 million, up from $9.6 million in 2024. The company reported revenue of $34.4 million with costs rising to $24.5 million, constituting 71.4% of total revenue. Bitcoin halving and increased network difficulty were cited as primary causes. Additionally, severe weather in New York impacted mining operations, exacerbating financial strain. CEO Paul Prager emphasized the challenges posed by these conditions without further public commentary or social media engagement from the company’s leadership.

Economic Pressures from Bitcoin Halving and Market Trends

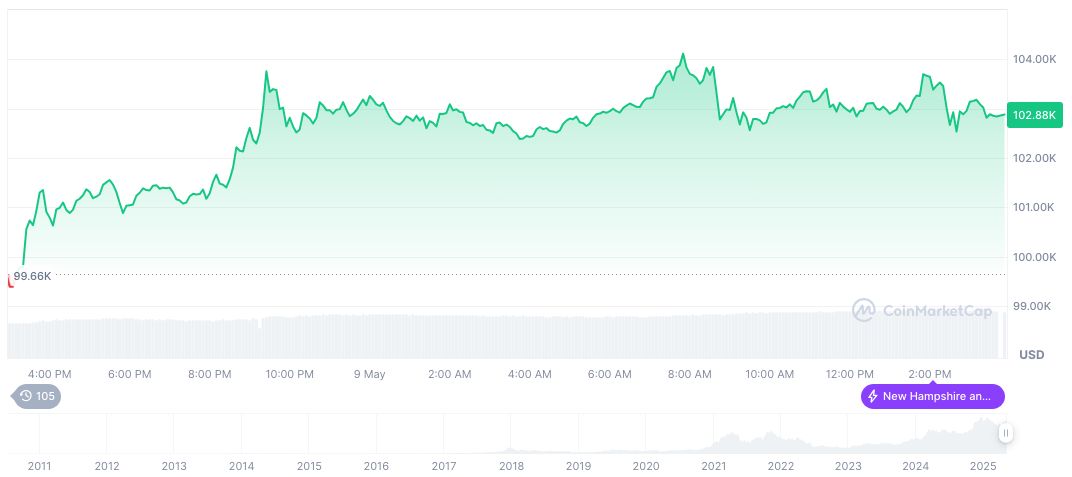

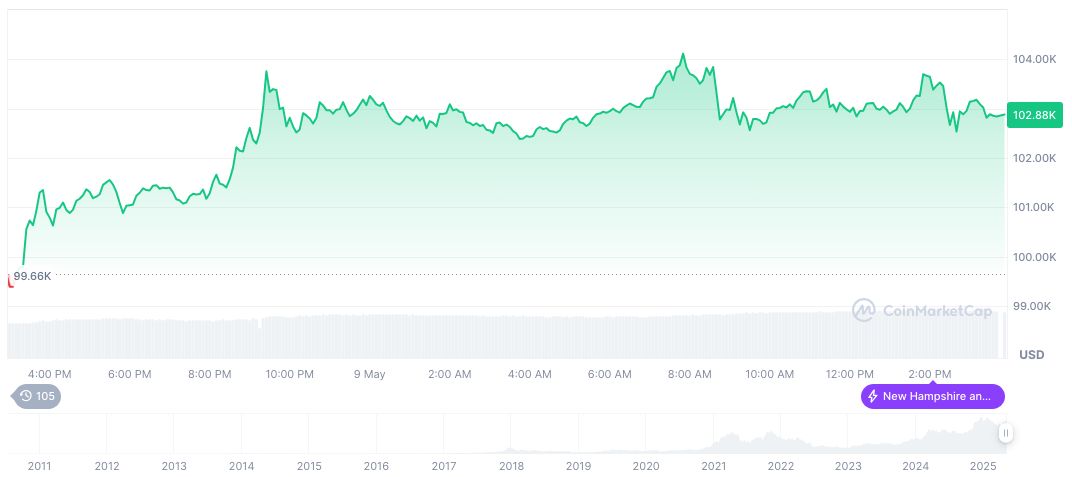

Bitcoin currently trades at $103,821.66, with a market cap of $2,062,177,693,352 and a dominance of 62.54%. According to CoinMarketCap, its 24-hour volume dropped 17.57% to $54,785,394,471. Recent changes show a 26.58% 30-day increase, presenting a fluctuating trend since the halving.

Insights from the Coincu research team suggest that Bitcoin halvings typically tighten miner margins, aligning with increased cost pressures and regulatory scrutiny in environmentally sensitive locations. The team anticipates potential strategic shifts in mining operations to balance economic and environmental demands better.

Paul Prager, Co-Founder, Chairman & Chief Executive Officer, TeraWulf, explained, “Our highly qualified board brings a diverse range of insights and backgrounds to support the Company’s ambitions; including deep industry knowledge in bitcoin mining, capital allocation experience to support organic and inorganic growth, management and financial expertise, and digital innovation leadership.”

Insights

Did you know? Historically, Bitcoin halvings result in decreased miner revenue, similar to TeraWulf’s experience, with miners often seeing reduced profit margins until prices adjust or operations become more efficient.

For more detailed information on TeraWulf’s leadership, you can view Management Team Information. Additionally, the Board of Directors Overview provides insights into the strategic direction influenced by their leadership capabilities.

Insights from the Coincu research team suggest that Bitcoin halvings typically tighten miner margins, aligning with increased cost pressures and regulatory scrutiny in environmentally sensitive locations. The team anticipates potential strategic shifts in mining operations to balance economic and environmental demands better.

Source: https://coincu.com/336774-terawulf-financial-loss-bitcoin-halving/