- Next Technology’s Bitcoin holdings increase significantly to impact stock prices.

- The stock price surged by 740% post-announcement.

- Q1 revenue hit $1.934 billion driven by digital asset gains.

Next Technology Holding Inc saw its stock rise by 740% to $2.7 last Friday afternoon, following a notable increase in its Bitcoin holdings during Q1, significantly impacting market activities.

The surge in Bitcoin holdings, primarily driven by stock issuance and warrants, brings broader implications for institutional Bitcoin use and market dynamics, affecting both company valuations and overall cryptocurrency adoption trends.

Bitcoin Holdings Jump to 5,833 BTC, Driving Stock Surge

Next Technology Holding Inc dramatically increased its Bitcoin reserves, growing from 833 BTC at the end of 2024 to 5,833 BTC by March 31, 2025. This expansion, primarily financed via stock issuance and warrants, underlines the company’s strategic commitment to Bitcoin investments. The company’s business focus spans software development and Bitcoin ventures, which saw material growth in contrast to previous quarters.

The stock price soared by 740% to $2.7, driven by confidence in the firm’s augmented Bitcoin strategy and substantial unrealized digital asset gains reported in Q1. This aligns with industry trends favoring digital assets as strategic reserves, following regulatory shifts in fair value accounting standards. The company’s first-quarter net revenue reached $1.934 billion, with most gains attributed to its digital assets, reinforcing its successful market positioning.

“Unfortunately, no official statements or comments from the executives of Next Technology Holding have been made available,” indicating the absence of direct quotes during this significant acquisition period.

Public reactions to the company’s financials and stock performance remain optimistic, aligning with a broader institutional shift toward Bitcoin incorporation.

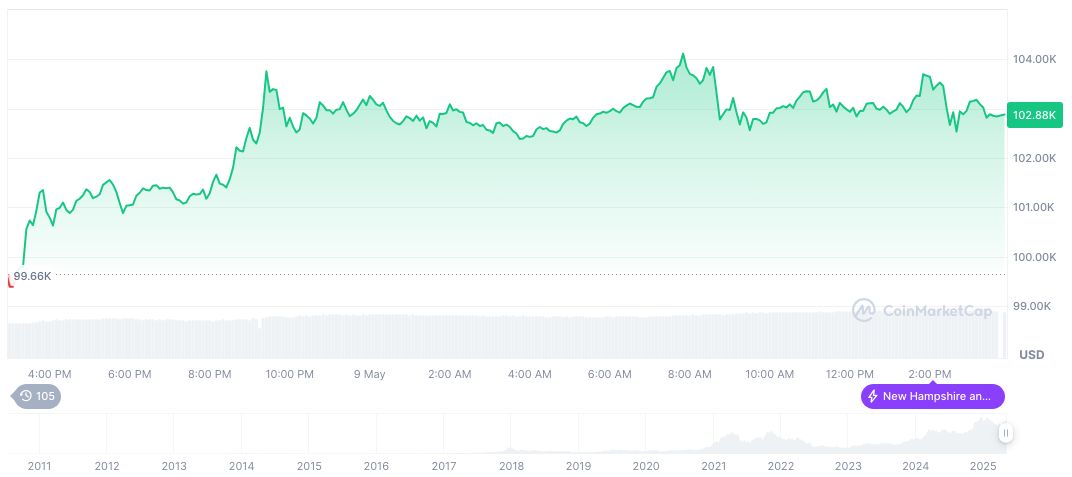

Bitcoin Market Dynamics: Price Reaches $102,987.75

Did you know? The integration of Bitcoin in corporate treasuries is reshaping financial strategies across various industries.

Bitcoin (BTC) has sustained upward momentum, reaching $102,987.75, bolstered by a market cap of 2.05 trillion. In the past 24 hours, BTC gained 6.56% with a trading volume of 57.37 billion, according to CoinMarketCap. This follows a 24.88% increase over 30 days, reflecting persistent demand.

Insights from Coincu research indicate that the integration of Bitcoin in corporate treasuries, expedited by regulatory clarity and accounting standard evolutions, potentially reshapes corporate financial strategies. Companies like Next Technology Holding pivoting to Bitcoin substantiate its appeal as a robust asset class, aligning with wider market adaptations.

Source: https://coincu.com/336737-next-technology-bitcoin-holdings-surge/