- New dual governance framework introduced for stETH holders.

- Timelock and exit features aim to mitigate governance risks.

- Strategic improvements to align incentives and enhance security.

Lido DAO has introduced a dual governance framework involving a dynamic, time-limited lock mechanism that will enable stETH holders to safeguard their assets during contentious governance periods. This strategic improvement draws participation from within Lido’s DAO and is articulated by Lead Smart Contract Developer, Sam Kozin.

Under the DAO’s current multichain governance system, LDO holders have incentives related to other chains, which are not necessarily aligned with those of Ethereum network participants. Dual governance will introduce a dispute and resolution mechanism for misaligned incentives between stakers and LDO holders.

Lido’s Dual Governance Boosts Security for stETH Holders

The rollout includes timelock and exit features that prioritize the protection of staked funds, aiming to mitigate risks associated with Lido DAO’s multichain governance. By providing an exit route unaffected by governance, the protocol seeks to align stETH holder incentives towards greater security.

Learn more about this mechanism on the Lido Finance update on governance and protocol matters.

“Under the DAO’s current multichain governance system, LDO holders have incentives related to other chains, which are ‘not necessarily aligned with those of Ethereum network participants.’ … [Dual governance] will introduce ‘a dispute and resolution mechanism for misaligned incentives between stakers and LDO holders.’” – Sam Kozin

stETH Sees 40.20% Gain as Lido Enhances Governance

Did you know? The dual governance mechanism, while novel for Lido, resembles “rage quit” features used in smaller DAOs to safeguard user interests during disputes.

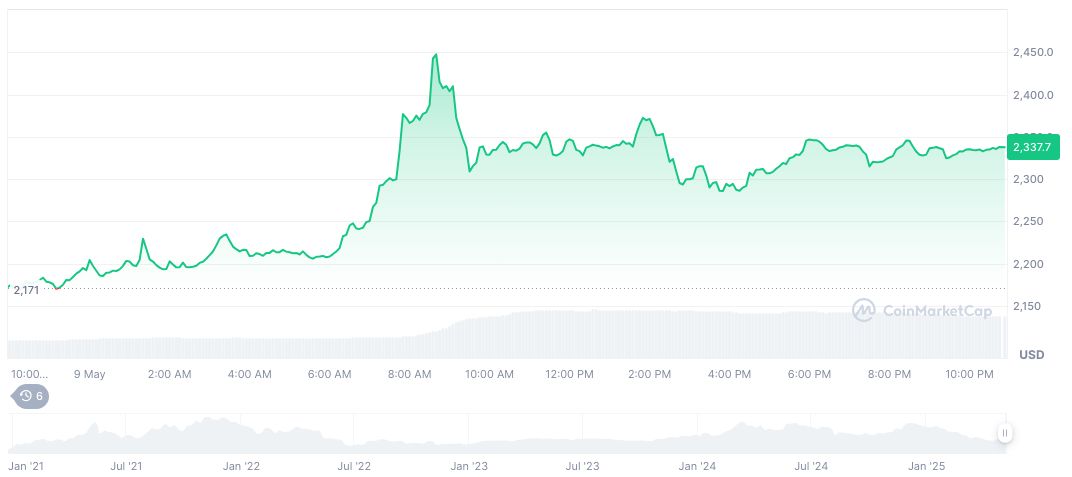

Based on data from CoinMarketCap, Lido Staked ETH (stETH) is priced at $2,338.56 with a market cap of $21.45 billion. The 24-hour trading volume saw an increase of 125.10%, reflecting market interest. Over the past 30 days, stETH has appreciated by 40.20%, showcasing a strong market presence.

Insights from Coincu research team suggest that this innovation could bolster staker confidence in Lido, potentially influencing adoption among liquid staking platforms. If successful, this governance model might inspire parallel mechanisms, shaping Ethereum’s future decentralization strategies.

Source: https://coincu.com/336715-lido-dual-governance-ethereum/