- U.S. Senate rejects GENIUS Act, dampening financial innovation prospects.

- Treasury Secretary Bessent calls decision a “missed opportunity.”

- Lack of federal regulation might hinder U.S. global financial position.

The U.S. Senate’s rejection of the GENIUS Act has stirred significant conversations within financial circles about the future of financial innovation in the United States.

U.S. Treasury Secretary Scott Bessent remarked on May 9, 2025, that the Senate’s decision to reject the GENIUS Act was a missed chance for financial innovation. The decision raises concerns over the absence of unified regulations potentially driving digital asset innovation abroad, affecting U.S. economic competitiveness.

U.S. Senate’s Rejection Sparks Debate Over Financial Future

Secretary Scott Bessent, writing on platform X, described the rejection as a “missed generational opportunity” to fortify the U.S. dollar’s dominance. With fragmented state regulations, stablecoin development faces unpredictability, highlighting the financial innovation risks. Bessent emphasized that without a unified regulatory framework, the United States might lose its edge in global finance.

The lack of formal federal legislation introduces potential roadblocks for stablecoin innovation within the U.S. This fragmentation could spur innovators to explore regions with more proactive regulations, affecting the country’s standing in emerging digital asset markets. Key reactions to the news showed a divided sentiment among financial experts, with some seeing the decision as a “hindrance” to U.S. leadership in blockchain technology.

“America is the Schelling point of global finance. We have the world’s reserve currency, the deepest and most liquid markets, and the strongest property rights. For these reasons, the United States is the premier destination for international capital. And the administration’s goal is to make it even more appealing for investors like you.” – U.S. Treasury Press Release

Stablecoin Market Trends and Regulatory Implications

Did you know? Treasury officials have historically cautioned that fragmented state regulations might limit U.S. influence in the digital asset sector, similar to past stances on algorithmic stablecoins. This echoes broader concerns about maintaining competitive advantage.

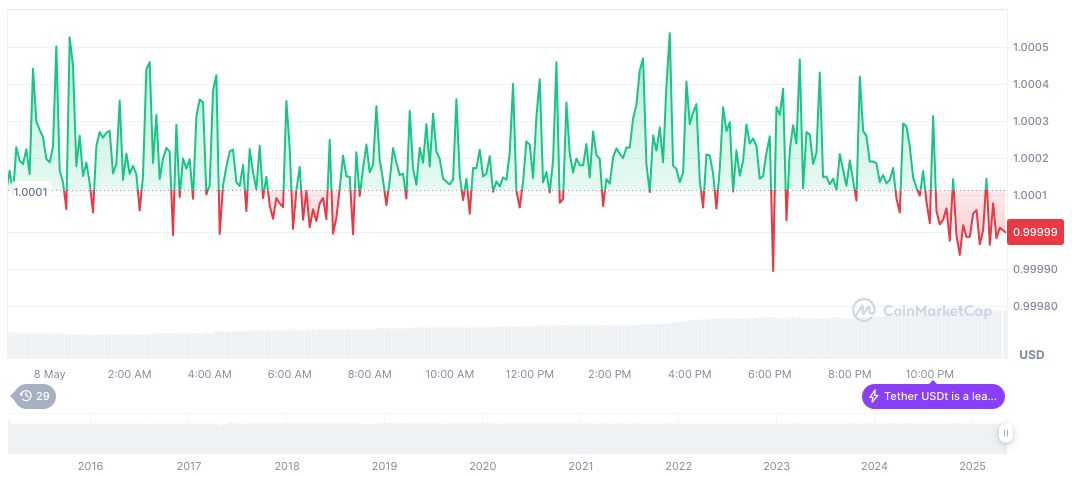

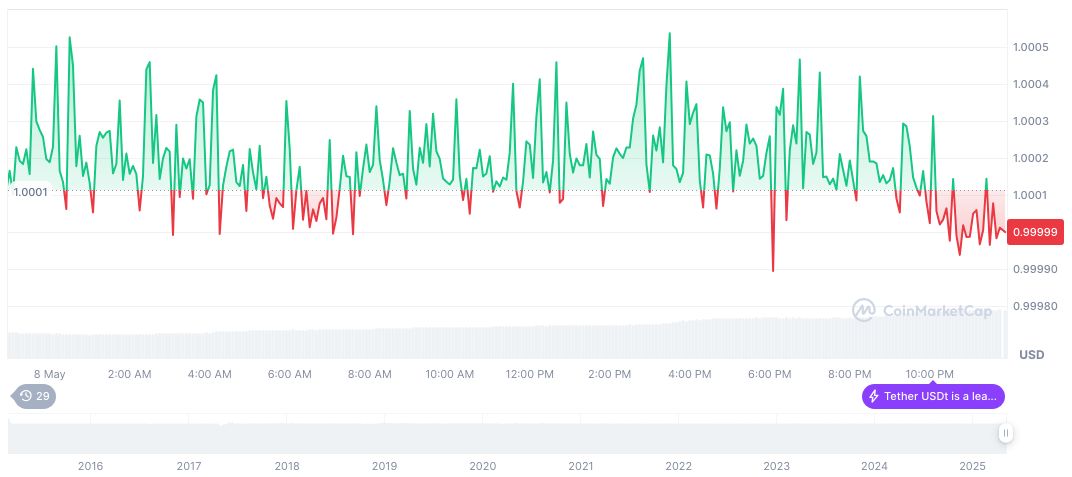

CoinMarketCap data reports that Tether USDt (USDT) currently holds a strong market capitalization of $149.71 billion, contributing 4.63% to market dominance. Its value remains stable at $1.00 with a minimal 0.03% decline over 24 hours. Trading volume over the last day registered at $113.33 billion, a substantial 68.80% increase, showing ongoing interest in stablecoin markets.

Analysis from Coincu posits that regulatory clarity could steer domestic innovation within the U.S., aligning technological growth with economic expansion models. Historical precedents indicate enhanced legal frameworks can provide stability necessary for burgeoning sectors like digital assets and blockchain technologies.

Source: https://coincu.com/336576-us-senate-genius-act-rejection/