- Core Scientific reports $580.7M Q1 2025 profit after strategic pivot.

- Profit boosted by non-cash factors despite revenue drop.

- Strategic shift to AI infrastructure aids growth potential.

Core Scientific reported a net profit of $580.7 million for the first quarter of 2025. The Nasdaq-listed Bitcoin mining company, despite a drop in revenue to $79.5 million, continues to transform its business operations in Dallas.

The significant profit boost is attributed to adjustments in non-cash income following its bankruptcy reorganization. Market responses showed both optimism and skepticism, noting Core Scientific’s strategic shift toward expanding high-performance computing and AI sectors.

Core Scientific’s Profit Surges Over 170% Despite Revenue Drop

Core Scientific’s latest earnings report reveals a major stride with net profits more than doubling compared to the previous year. Primarily attributed to non-cash income adjustments, the earnings reflect the company’s strategic financial maneuvers. Revenue decline delineates an active change in operations. Despite the reduced revenue, the company remains committed to diversifying its business, focusing on AI infrastructure through partnerships like the one with CoreWeave.

With the Bitcoin halving event affecting rewards, Core Scientific has identified alternative income opportunities. Lower power usage and cost reductions contributed to propelling the financial metrics amid the mining industry’s constraints. Market reactions were mixed, with analysts pointing out the strategic pivot’s potential long-term benefits. The stock market showed optimism though concerns about revenue figures lingered.

“Our pivot into high-performance computing services marks an important strategic transformation to adapt to the evolving landscape post-Bitcoin halving.” — Mike Levitt, CEO, Core Scientific

Bitcoin’s Volatility and Core Scientific’s Shift to AI

Did you know? In the first quarter of 2025, Core Scientific’s profit soared over 170% beyond prior analyst projections despite a revenue shortfall. The company’s pivot towards AI highlights a notable industry shift.

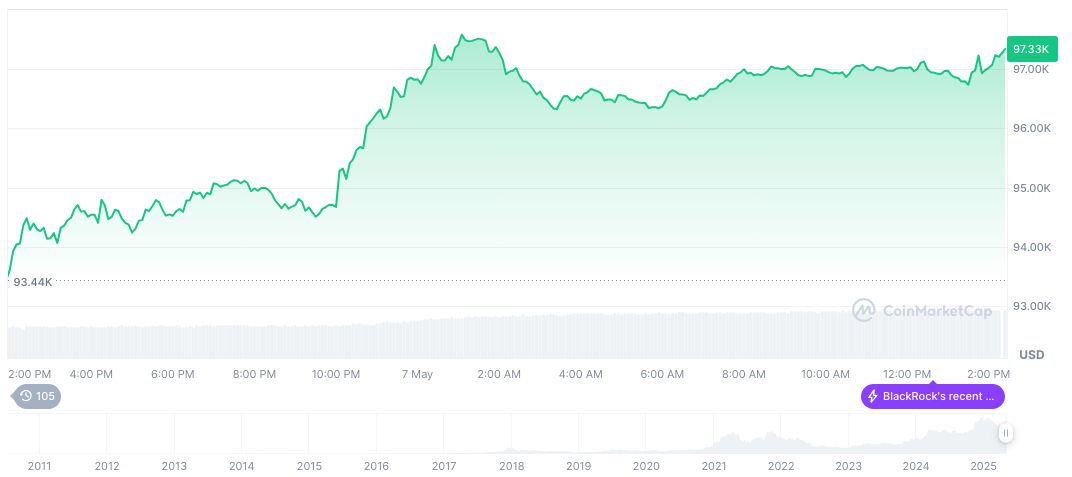

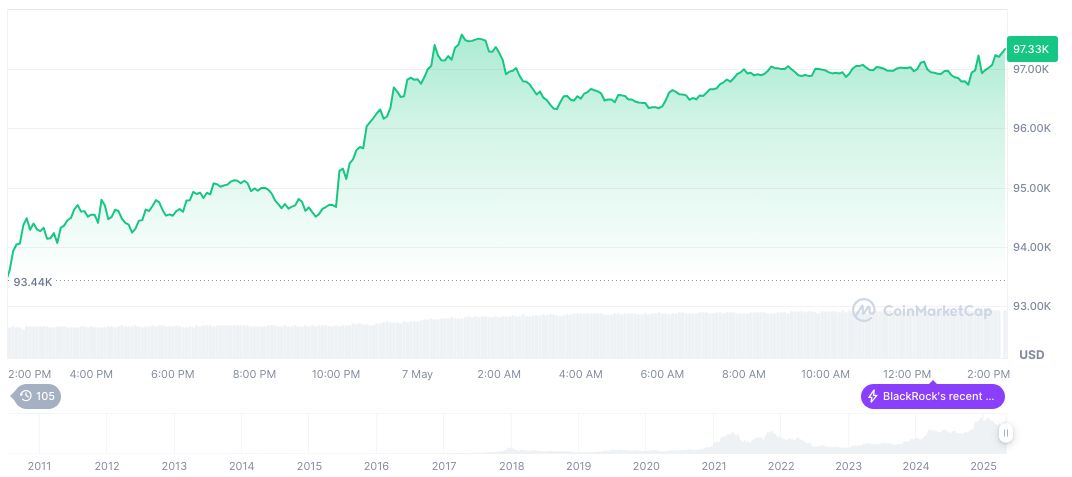

Bitcoin’s current standing shows a price of $99,298.28 with a market cap of $1.97 trillion, according to CoinMarketCap. Recent dynamics saw a significant 25.13% rise in a 30-day period, reflecting volatility and investor interest ahead of regulatory updates.

Experts from the Coincu research team attribute Core Scientific’s performance to strategic diversification amid challenging market conditions. Focusing on AI infrastructure, the company adapts to market changes, potentially stabilizing financial outcomes and leading in tech-driven developments over traditional mining operations.

Source: https://coincu.com/336321-core-scientific-q1-2025-results/