- Integration of Cryptocurrency Deposits: Futu Securities launches cryptocurrency deposit services for BTC, ETH, and USDT.

- Investment Expansion: Enhances investment into U.S., Hong Kong, and Japanese stock markets.

- Market Dynamics: Fosters cryptocurrency and traditional market convergence.

Futu Securities has officially launched cryptocurrency deposit services in Hong Kong, allowing investors to deposit Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) to invest in U.S., Hong Kong, and Japanese stock markets.

This development marks a significant step in bridging traditional and cryptocurrency markets, potentially increasing investor diversification and market fluidity.

Futu Integrates BTC, ETH, USDT Deposits for Global Access

Futu Securities, through its platform Futu NiuNiu, launched deposit services for BTC, ETH, and USDT, highlighting its strategy to integrate digital currencies with traditional finance. The Coincu Research Team emphasizes the potential to “fundamentally transform financial markets, potentially influencing regulatory approaches and accelerating technological advancement in the sector.” Currently testing USDC deposits for further expansion, this move could enhance cryptocurrency market adoption by traditional investors.

The launch signifies a new era for investors, offering an opportunity to diversify portfolios by combining traditional and cryptocurrency assets seamlessly. This integration could fuel capital movement between digital and traditional markets, impacting investor strategies.

Positive Reception and Implications for Financial Regulation

Did you know? The integration of cryptocurrency deposits by traditional financial institutions could reshape the investment landscape significantly.

Industry analysis indicates positive reception, with Daniel Tse, Managing Director, Futu Securities, stating, “Futu is fully confident in the future of Hong Kong’s Web 3.0 market. As the most popular digitalized brokerage in Hong Kong, we have a broad user base and the opportunity to make significant achievements in this field.” Futu’s advancement showcases an alignment with broader industry trends towards cryptocurrency adoption.

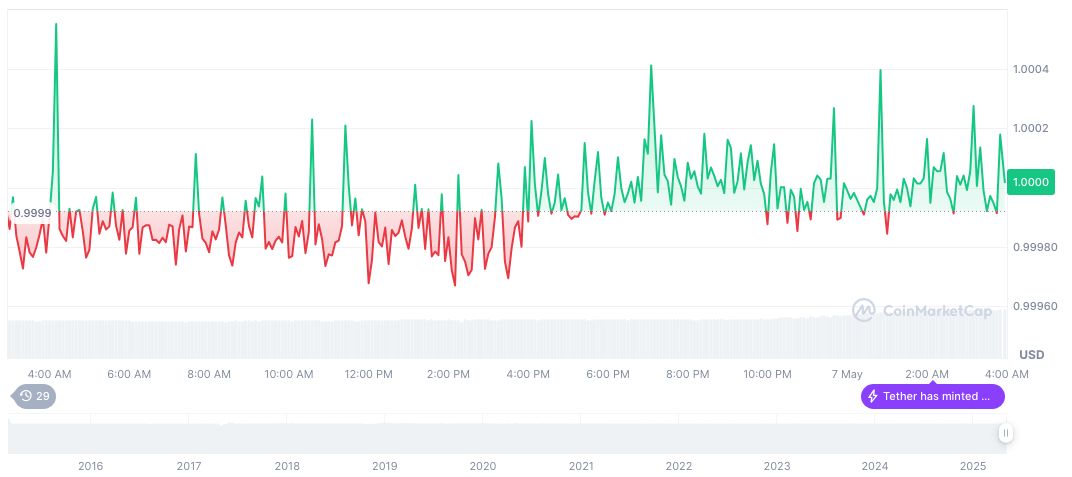

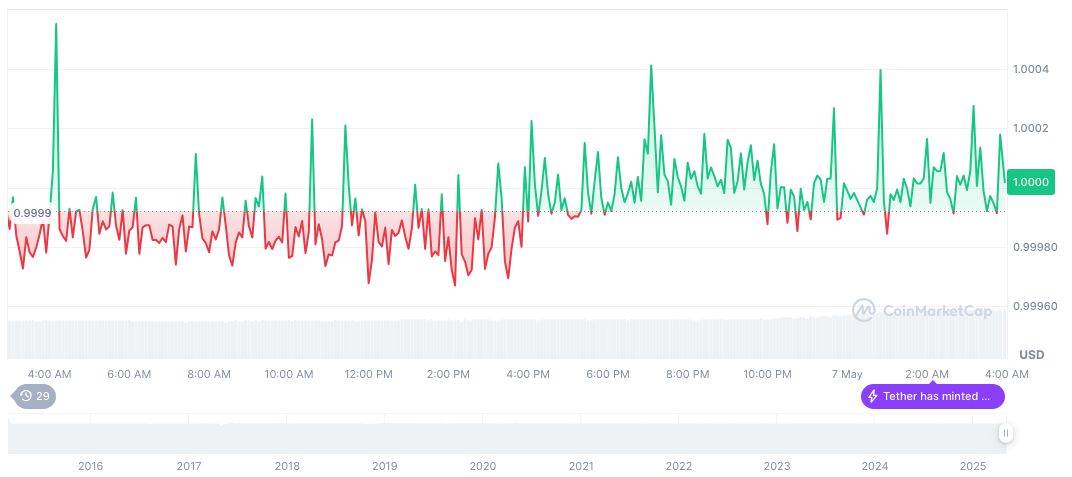

Tether (USDT) trades consistently at $1.00, with a market cap of $149.43 billion and a 24-hour trading volume of 62,417,172,734. Despite minor fluctuations, USDT maintains stability, reflecting its role as a key stablecoin.

Coincu researchers suggest that such integrations could reshape financial markets by influencing regulatory frameworks and advancing technology. Stablecoin investments may drive regulatory changes, while experts predict increased adoption, pointing to expanding digital currency usage within traditional financial systems.

Source: https://coincu.com/336146-futu-securities-crypto-deposits-launch/