- Futu Securities plans to support USDT, USDC deposits for stock investments.

- Crypto investment in stocks features simple functionality.

- Internet brokers explore stablecoin integration countdown.

Futu Securities is reportedly testing a new feature that would allow stablecoin deposits in its trading platform for stock investments. This potential update could bridge cryptocurrency and traditional stock trading, impacting the brokerage market.

Futu Securities might introduce a feature to enable deposits in USDT and USDC stablecoins. Initial reports suggest that these changes are being internally tested. The broker’s existing accounts will incorporate a cryptocurrency section, facilitating direct investment in U.S. stocks, Hong Kong stocks, and Japanese stocks. This marks a significant move towards integrating cryptocurrencies with mainstream financial markets. Daniel Tse, Managing Director of Futu Securities, noted, “Futu is fully confident in the future of Hong Kong’s Web 3.0 market. As the most popular digitalized brokerage in Hong Kong, we have a broad user base and the opportunity to make significant achievements in this field.”

Futu’s Stablecoin Feature: A Shift Towards Digital Asset Integration

The anticipated change aims to enable seamless investment in stocks using stablecoins, highlighting a possible shift in investment strategies. Such an adaptation may influence how investors manage their portfolios. Industry insiders have noted the potential growth in brokerages incorporating similar features. Key players are closely observing these developments to gauge the technology’s impact on traditional financial markets.

The Coincu research team suggests that integrating stablecoins with stock investing could reshape financial landscapes, bringing changes in regulatory stances and technological progress. They assert that such developments enhance the adaptation and adoption of cryptocurrencies in established markets. As Futu continues to expand its offerings, the focus remains on harnessing new technologies and exploring digital currency trading products.

Industry insiders have noted the potential growth in brokerages incorporating similar features. Key players are closely observing these developments to gauge the technology’s impact on traditional financial markets.

Historical Context, Price Data, and Expert Analysis

Did you know? In 2014, stablecoins represented a nascent idea. Today, their integration with traditional financial systems indicates significant market evolution.

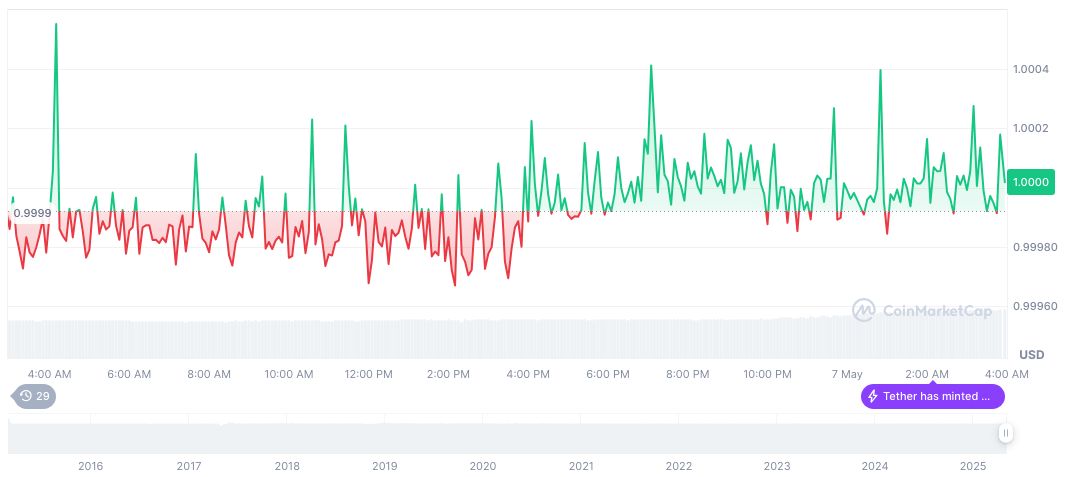

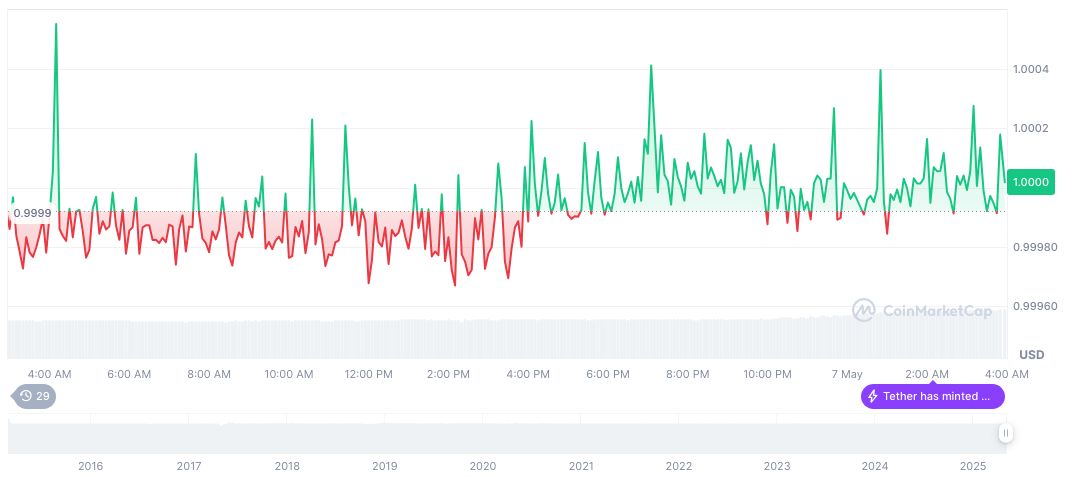

CoinMarketCap data reveals that Tether (USDT) holds a market cap of $149.43 billion and trades at $1.00. The 24-hour trading volume stands at $62.46 billion, marking a 25.85% increase. Tether’s market dominance is 5.01%, with price fluctuations of 0.01% over 24 hours and 0.07% over 30 days.

The Coincu research team suggests that integrating stablecoins with stock investing could reshape financial landscapes, bringing changes in regulatory stances and technological progress. They assert that such developments enhance the adaptation and adoption of cryptocurrencies in established markets. As Futu continues to expand its offerings, the focus remains on harnessing new technologies and exploring digital currency trading products.

Source: https://coincu.com/336067-futu-securities-stablecoin-deposits/