- VanEck files S-1 for Binance Coin ETF with SEC, marking a U.S. milestone.

- Changpeng Zhao shares filing news, increasing market visibility.

- BNB trading volume surges 40% after filing announcement.

VanEck officially submitted the S-1 form for a Binance Coin ETF to the U.S. Securities and Exchange Commission (SEC) on May 5, 2025.

The filing reflects VanEck’s strategic move to provide U.S. investors with exposure to Binance Coin. Following the announcement, Binance Coin’s trading volume soared by 40%, indicating strong market interest.

VanEck’s ETF Filing and Market Surge Highlights

VanEck, a leading investment firm, has initiated the process for a U.S.-based ETF targeting Binance Coin. The filing with the SEC marks a step towards expanding regulated cryptocurrency investment options in the United States. Previously, VanEck successfully launched spot Bitcoin and Ethereum ETFs.

With this new filing, VanEck aims to tap into U.S. investors wishing to invest in Binance Coin through a regulated vehicle. This ETF could enhance BNB’s accessibility and regulation compliance, akin to other cryptocurrency ETFs introduced earlier. Market reactions reveal a heightened trading interest, with BNB’s volume increasing significantly post-filing.

Binance CEO Changpeng Zhao acknowledged the news via Twitter, contributing to the filing’s visibility.

Historical ETF Success and BNB Market Data Insight

Did you know? The introduction of Bitcoin and Ethereum ETFs by VanEck in previous years sparked increased institutional interest, leading cryptocurrency ETFs to become a crucial pathway for regulated investment.

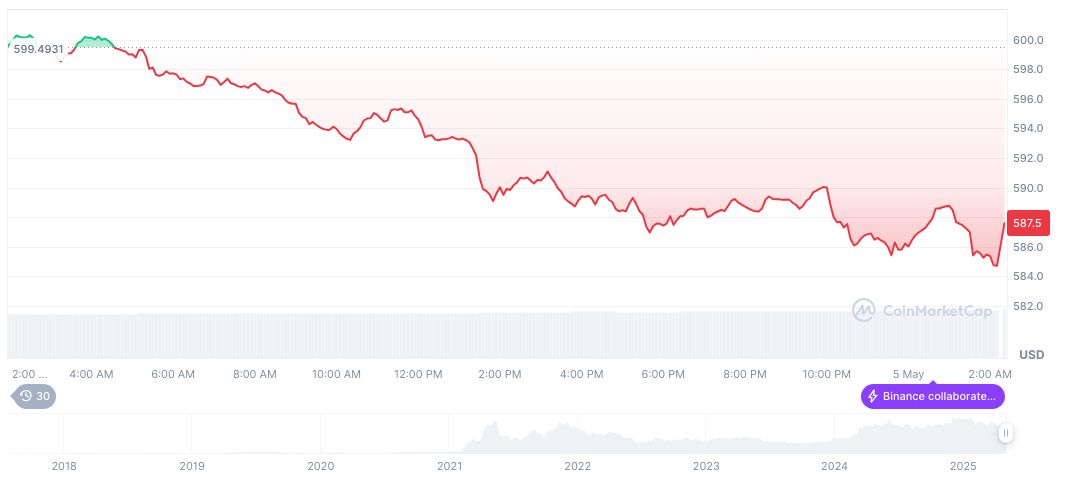

According to CoinMarketCap, BNB is priced at $592.67, with a market capitalization exceeding $83.50 billion, reflecting a 2.83% market dominance. Trading volume over 24 hours is approximately $1.39 billion, showing an 11.70% change. In the last 90 days, BNB’s price shifted up by 2.40%, yet it remains 0.10% lower over the past 24 hours.

Coincu’s research team highlights potential regulatory effects of the filing. Should the SEC approve the ETF, this could set a precedent, likely encouraging further cryptocurrency ETF applications. Historical trends suggest regulated access might reduce volatility, enhancing investor confidence.

Source: https://coincu.com/335766-vaneck-bnb-etf-filing-sec/