Today marks the official deadline for the U.S. Treasury Secretary to deliver an evaluation on the potential creation and management of a Strategic Bitcoin Reserve, as mandated by former President Donald Trump’s March 6 executive order.

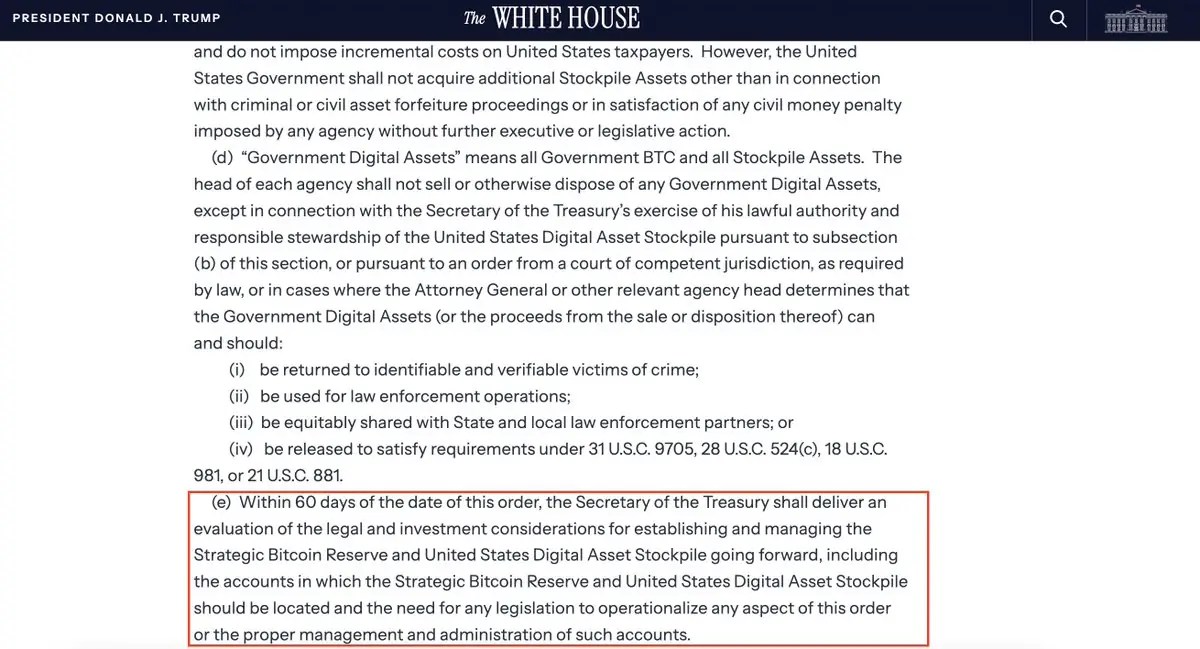

The mandate requires the Treasury to assess both the legal and investment considerations for establishing a government-managed reserve of BTC, as well as the infrastructure necessary to store and administer it through the United States Digital Asset Stockpile.

According to the executive order, the Treasury’s evaluation must include:

- Where and how the Strategic Bitcoin Reserve should be located and operated

- Whether any new legislation is needed to support its development

- Oversight and accountability for the management of digital assets by the federal government

The document defines “Government Digital Assets” as all government-held BTC and other digital assets obtained through enforcement or forfeiture, not through new purchases.

The initiative could represent the first major effort by the U.S. government to formally structure and safeguard Bitcoin holdings—potentially aligning the country’s fiscal tools with emerging digital asset strategies already being explored by other sovereign entities.

As of now, it remains unclear whether the Treasury will publish the evaluation publicly or keep it classified within internal government channels.

The crypto community is watching closely. Should the proposal move forward, it could mark a historic shift in how the U.S. government engages with Bitcoin—not as a regulatory threat, but as a strategic reserve asset.

Source: https://coindoo.com/may-5-deadline-looms-for-u-s-treasurys-strategic-bitcoin-reserve-evaluation/