- Binance will adjust collateral ratios and leverage tiers on May 9.

- Affects several perpetual contracts and trading strategies.

- Traders advised to review portfolios to prevent potential liquidation.

Binance announced upcoming changes slated for May 9, 2025, affecting collateral ratios and leverage tiers of select tokens. The adjustments will occur at 06:00 UTC for collateral ratios and continue for various perpetual contracts shortly after.

Binance’s May 9 Revisions: Key Contract Changes Binance has confirmed updates to the collateralization ratio for assets including EOS on May 9, 2025, starting at 06:00 UTC. Simultaneously, leverage and margin tier modifications for several USDⓈ-M Perpetual Contracts such as SXPUSDT and EGLDUSDT will be implemented to manage trading conditions better.

Binance’s May 9 Revisions: Key Contract Changes

These changes are significant because they will influence the Unified Maintenance Margin Ratio, potentially affecting existing trades and futures strategies. Binance has advised users to monitor portfolios to mitigate liquidation risks under the new parameters.

The collateral ratio directly affects the Unified Maintenance Margin Ratio (uniMMR), which determines liquidation thresholds.

— Binance Announcement Team, Official Announcement, Binance

Historical Impact: Binance’s Approach to Market Volatility Market responses have varied across different spheres. Some experts highlight the importance of Binance’s strategic adaptations in response to market volatility, while others advise traders to reassess holdings. These updates continue Binance’s history of periodic financial recalibrations aligning with global trading dynamics.

Market Data and Trading Volume

Did you know? Binance’s regular updates to collateral ratios suggest an ongoing risk management strategy. Historically, these occur about every 1-2 weeks, consistently adjusting to shifting market conditions.

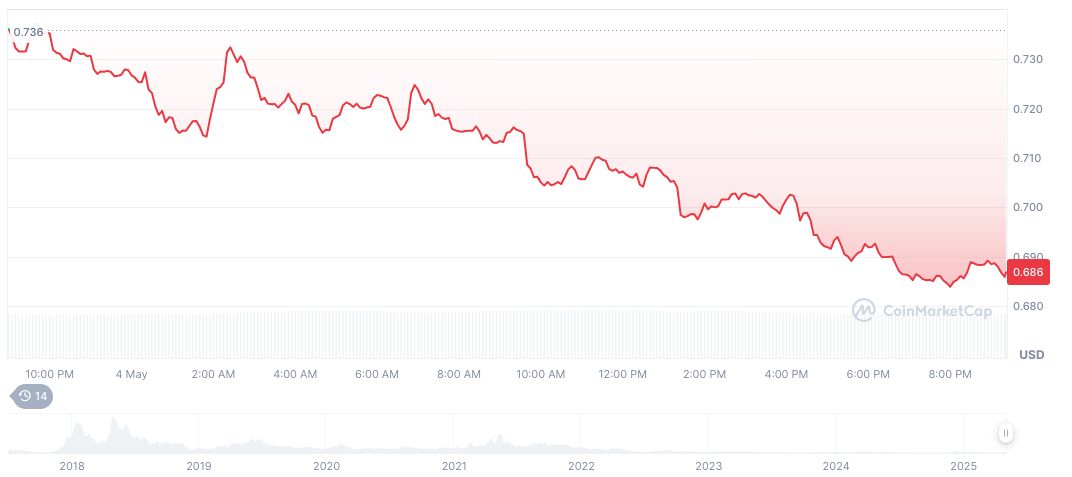

EOS currently trades at $0.69 with a market capitalization of formatNumber(1072472175, 2). Despite a 6.25% decrease in the past 24 hours, EOS has seen a 22.82% increase over 60 days. The trading volume, however, decreased by 13.28% in the last 24 hours, reflecting variable interest among traders, according to CoinMarketCap.

The Coincu research team notes that Binance’s adjustments symbolize a proactively managed ecosystem, balancing liquidity with security needs. Historically, Binance’s recalibrations facilitate market stability amid volatility, demonstrating meticulous planning from a regulatory and technological perspective.

Source: https://coincu.com/335683-binance-collateral-ratios-update/