- Goldman Sachs revises Fed rate cut forecast due to employment data.

- Impacts investor sentiment, potentially benefiting cryptocurrency markets.

- Interest rate cuts historically correlate with crypto market inflow increases.

Goldman Sachs anticipates the Federal Reserve will proceed with a rate cut in July, not June, following robust employment data.

The revision by Goldman Sachs could reshape investment strategies as lower rates have historically supported risk assets, including cryptocurrencies.

Goldman Sachs Adjusts Rate Cut to July After Job Data

Goldman Sachs, a leading investment bank, revised its forecast from June to July for the Federal Reserve’s next interest rate cut following strong U.S. non-farm payrolls data. The updated projection signifies how employment statistics can recalibrate financial expectations globally. The Federal Reserve’s rate cuts are closely watched, as they significantly impact financial markets, including the crypto sector. A dovish stance typically results in inflows to risk-on assets like cryptocurrencies.

Market anticipations are adjusting due to this change, potentially driving investments into Bitcoin and Ethereum as investors search for higher returns amid falling yields. Historical trends suggest that such rate cut expectations can boost market liquidity. The absence of public statements from Goldman Sachs executives illustrates the firm’s preference for institutional disclosures rather than social media communication.

_As of now, there are no official direct quotes from executives at Goldman Sachs or policymakers at the Federal Reserve regarding the anticipated shift in the rate cut timeline._

Crypto Markets Poised for Growth Amid Rate Cut Expectations

Did you know? Rate cuts in 2019–2020 coincided with increased inflows and higher spot volumes in the cryptocurrency market, illustrating historical patterns of investment behavior shifting towards higher-risk assets like BTC and ETH.

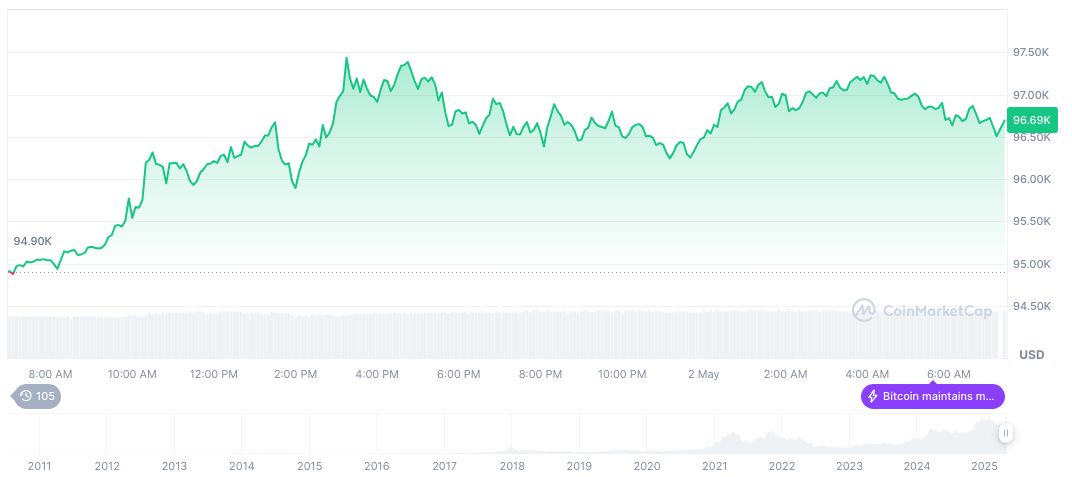

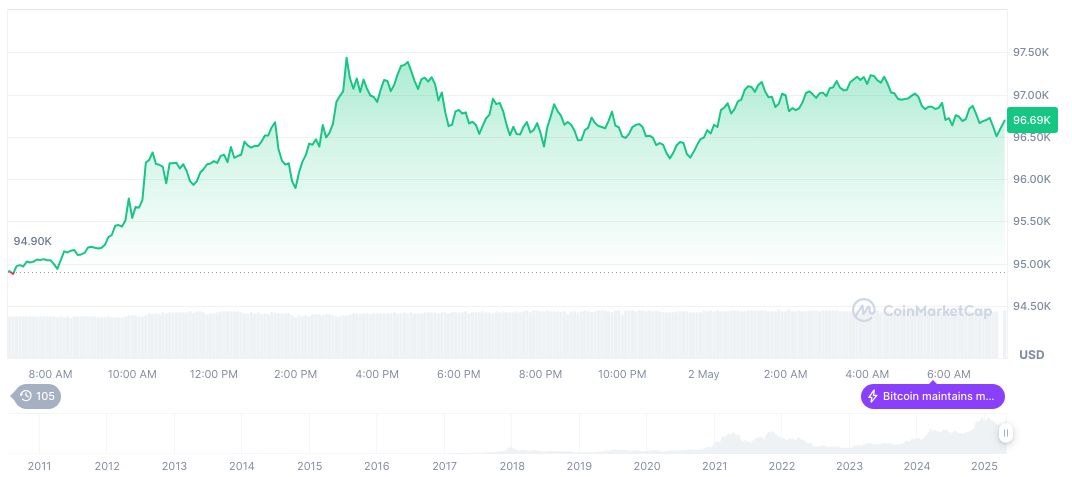

Bitcoin (BTC) remains a dominant force in the market with a capitalization of approximately $1.94 trillion, constituting 63.91% of total market dominance. Recent data from CoinMarketCap reveals Bitcoin’s trading volume dropped by 5.84% over the past 24 hours to $28.24 billion, with its price seeing slight upticks of 0.41% within the same duration, maintaining a 7-day increase of 2.30%.

The Coincu research team highlights that anticipated Fed actions typically enhance liquidity within crypto markets. Rate adjustments have historically provided boosts for both BTC and ETH as investors allocate funds to higher-yield options during comparative datapoints of lower federal rates.

Source: https://coincu.com/335371-goldman-sachs-fed-rate-cut-july/