- U.S. Bureau of Labor Statistics revises February-March job data lower.

- April jobs exceed expectations at 177,000 new positions.

- Crypto markets attentive to possible Federal Reserve policy changes.

On May 2, 2025, the U.S. Bureau of Labor Statistics revised February and March nonfarm payrolls upshots while April saw an unexpected increase in employment numbers, reported PANews.

The revisions indicate the U.S. economy added fewer jobs in early 2025 than previously reported, prompting interest in potential Federal Reserve policy adjustments.

April Job Gains Surpass Forecast Amid Data Revisions

The U.S. Bureau of Labor Statistics adjusted February and March nonfarm payroll figures downward by a total of 58,000. Meanwhile, April added 177,000 new jobs, surpassing the forecasted increase of 130,000.

The previous revisions depict a marginal lowering in job creation, influencing the early-year employment landscape. Elevated April figures introduce discussions on market stability amid Federal Reserve policy speculations.

Market analysts noted that the higher-than-expected April jobs figure results in a muted impact on immediate market sentiment. No substantial statements have surfaced from key blockchain leaders following these updates.

Crypto Market Projections Amid Economic Indicators

Did you know? Employment revisions in the past often impacted risk assets like Bitcoin, reflecting economic sentiment shifts. For context, in past economic surprises, BTC exhibited notable volatility linked to nonfarm payroll data deviations.

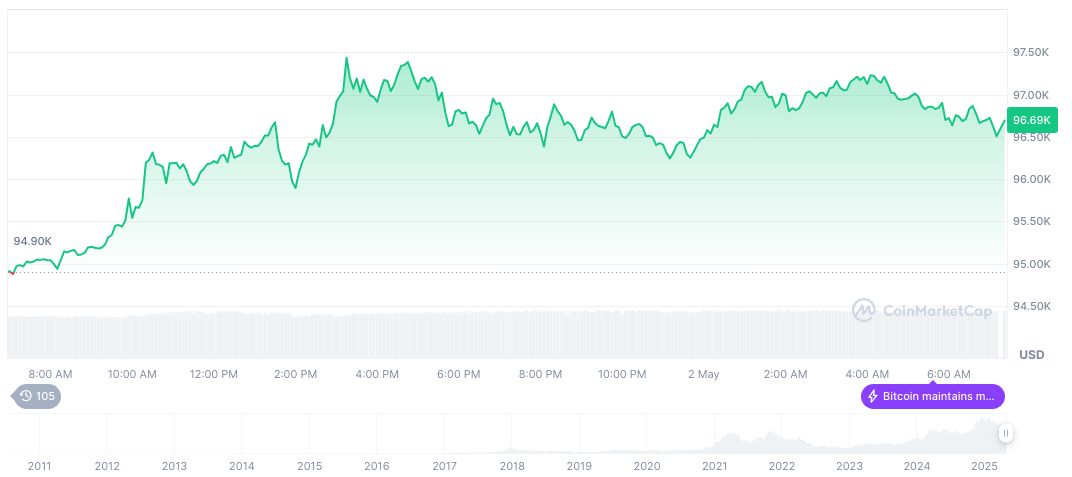

As of May 2, 2025, Bitcoin (BTC) was priced at $97,081.62 with a market cap of 1,927,945,322,022.98 billion and dominance of 63.93%, according to CoinMarketCap. Its 24-hour trading volume decreased by 5.81%, though BTC showed gains of 0.82% over the last 24 hours.

Analysts highlight that downward job data revisions can stimulate anticipations of loosened monetary policy potentially benefiting riskier assets like BTC, ETH, and DeFi protocols. “When employment prints softer than expected or is revised downward, it often raises expectations for looser U.S. monetary policy—a positive for crypto risk assets in the short term,” aligns with Employment Situation Summary elements that emphasize historical trends steering crypto markets.

Source: https://coincu.com/335349-us-nonfarm-payrolls-crypto-impact/