- US GDP falls 0.3%, spurring Bitcoin interest amid economic shifts.

- Potential dovish Fed stance supports Bitcoin market.

- Institutional investors eye alternative risk assets, influencing price trends.

The United States experienced a 0.3% contraction in GDP during the first quarter of 2025. Analysts suggest the decline could prompt the Federal Reserve to adopt a more accommodative policy. This situation presents an opportunity for Bitcoin and similar risk assets. The response from investors highlights the potential market shift influenced by macroeconomic changes.

US GDP Decline and Federal Reserve Policy Shift Likelihood

The U.S. GDP’s decline marks its first negative growth since 2022. According to The Block, analysts like BRN’s Valentin Fournier note that the resulting economic slowdown and cooling inflation may encourage the Federal Reserve to consider a more accommodative monetary stance. Such a policy shift could enhance liquidity for risky assets like Bitcoin, aligning with its current bullish trend. Reactions from the market suggest this economic environment may lead to a significant redistribution of institutional capital.

Key Points:

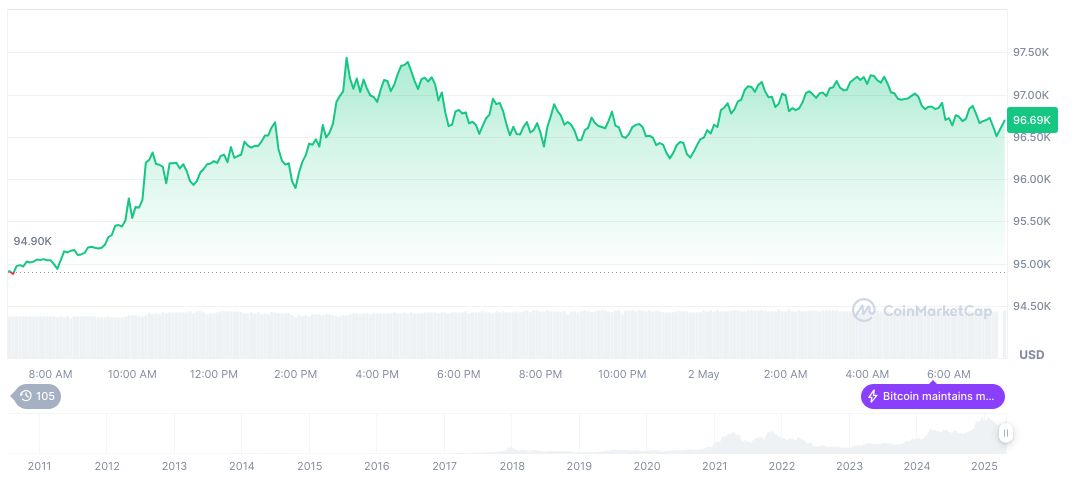

Bitcoin (BTC) currently trades at $96,875.44, with a market cap of $1.92 trillion, commanding a 63.84% dominance per CoinMarketCap data. Recent price movements include a 0.88% increase in the last 24 hours and a 3.46% rise over seven days, despite broader economic challenges. Analysts from the Coincu research team anticipate that a dovish Fed could further fuel Bitcoin’s appeal, with investors seeking alternatives to traditional stock markets amid economic uncertainties. The ongoing trend highlights the strategic shifts occurring within financial markets. Digital asset investment products’ outflows could be indicative of investors looking for safer alternatives in volatile conditions.

David Hernandez, Investment Expert, 21Shares, stated, “Bitcoin is more durable compared to stock rates and that this may revive institutional demand.”

David Hernandez, Investment Expert, 21Shares, stated, “Bitcoin is more durable compared to stock rates and that this may revive institutional demand.”

Bitcoin’s Market Position Amidst Economic Uncertainties

Did you know? Historically, recession fears have shifted capital to Bitcoin, mirroring similar market actions seen in 2022 during economic downturns.

Bitcoin (BTC) currently trades at $96,875.44, with a market cap of $1.92 trillion, commanding a 63.84% dominance per CoinMarketCap data. Recent price movements include a 0.88% increase in the last 24 hours and a 3.46% rise over seven days, despite broader economic challenges.

Analysts from the Coincu research team anticipate that a dovish Fed could further fuel Bitcoin’s appeal, with investors seeking alternatives to traditional stock markets amid economic uncertainties.

Source: https://coincu.com/335326-us-gdp-impact-bitcoin-growth/