- Goldman Sachs to expand digital assets trading and tokenization.

- Seeking regulatory approvals for digital asset integration.

- Goldman plans to engage clients in crypto lending activities.

Mathew McDermott, global head of digital assets at Goldman Sachs, revealed plans to enhance the firm’s digital trading activities at TOKEN2049 on May 2. The bank seeks regulatory approvals as it explores tokenization and crypto lending.

The initiative marks a strategic expansion for Goldman Sachs as client interest in digital assets grows. This could potentially shift market dynamics, further institutionalizing the digital assets sector.

Goldman Sachs Targets Bitcoin, Ethereum in Tokenization Push

Goldman Sachs is planning a significant expansion in its digital asset trading operations. Led by Mathew McDermott, the initiative includes increased focus on crypto lending and tokenization. This move is driven by rising client interest in actively participating in digital asset transactions. Goldman aims to secure regulatory approvals to facilitate these changes. The institution has a history in secondary market transactions involving private equity and is now exploring new horizons with tokenization and collateral liquidity businesses.

The impact of this venture may be substantial. As Goldman Sachs rolls out its plans, the focus will mainly be on highly liquid assets, primarily Bitcoin (BTC) and Ethereum (ETH), as well as tokenized real-world assets. These adjustments are anticipated to appeal to institutional preferences, especially in money market fund tokenization.

There is noticeable anticipation from markets and industry figures. While no direct responses from crypto thought leaders are recorded, previous institutional moves, such as those by JPMorgan and Citi, have typically driven optimism and short-term price fluctuations in major digital assets. Raoul Pal, CEO of Real Vision, has noted, “Institutional adoption is the next major wave, and tokenization of real-world assets is a trillion-dollar opportunity.”

Institutional Moves Could Boost Crypto Market Cap Beyond $1.92 Trillion

Did you know? The tokenization of real-world assets, like that explored by Goldman Sachs, often piques institutional interest, potentially leading to substantial inflows in DeFi protocols that support such assets.

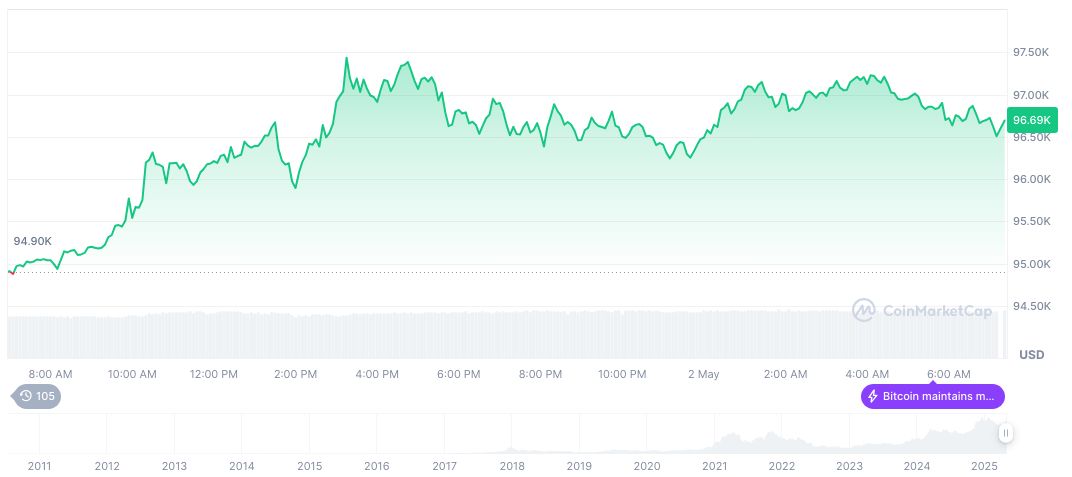

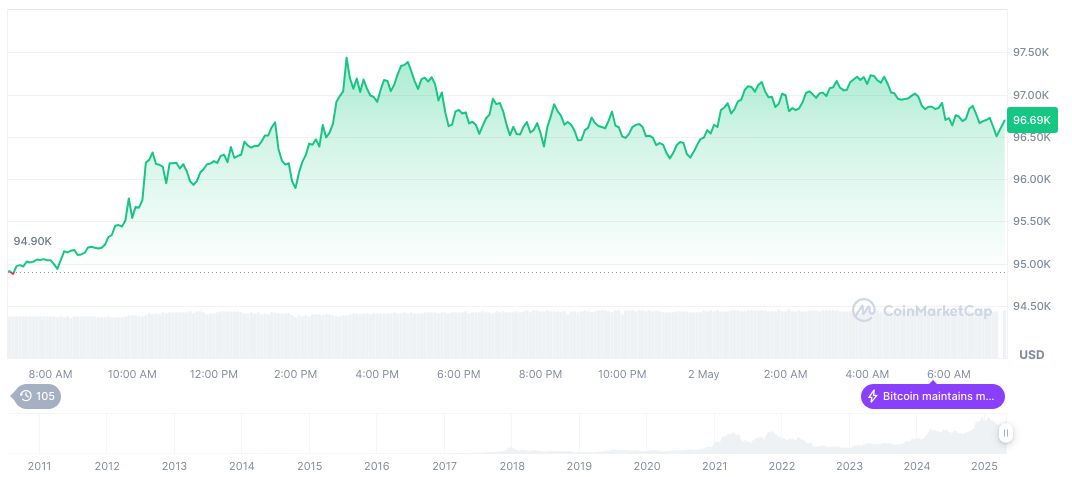

Bitcoin (BTC) is currently valued at $96,767.21, holding a market cap of $1.92 trillion according to CoinMarketCap. The asset’s influence is significant, comprising 63.81% of market dominance. Recent trading volumes reached $33.93 billion, reflecting a 17.09% increase. Over the past 30 days, BTC has ascended by 13.66%, despite a 90-day decline of 4.97%, based on May 2 data.

The Coincu research team suggests that with clearer regulations and technological advancements, the crypto landscape could witness broader institutional participation. This projection is reinforced by historical trends where institutional initiatives drive increased attention and engagement with digital assets from both market players and investors.

Source: https://coincu.com/335319-goldman-sachs-crypto-expansion/