- Main event: CEO warnings about potential economic impacts from tariffs emerge.

- Summary: CEOs warn investment banks of tariff impacts in 2 months.

- Market impact: Anticipation for volatility leads to increased derivatives trading.

Charles Gasparino from Fox Business shared that multiple CEOs have warned investment banks about the impending impacts of tariffs, emerging as a critical issue likely to unfold within the next 6 to 8 weeks.

This warning highlights the potential for significant economic realignment, prompting heightened vigilance in financial markets and increased activity in cryptocurrency derivatives trading.

CEOs Warn Banks: Tariffs Could Shift Crypto Markets

Charles Gasparino, a prominent figure in financial journalism, conveyed through his social media presence that investment banks have been alerted by CEOs regarding the imminent effects of tariffs. This warning underlined a period of 6 to 8 weeks as vital to determine potential consequences. Multiple industry leaders are anticipating changes that may affect the economy, prompting cautious yet proactive stances from key market players.

Tariff concerns have stirred significant attention in cryptocurrency markets, particularly as past experiences have shown potential macroeconomic upheaval can influence digital asset valuations. Firms are now closely monitoring possible ramifications, with market strategies being adjusted to brace for volatility. Such market shifts hint at the importance of strategic positioning in response to unfolding macroeconomic dynamics.

Multiple CEOs have told their investment banks that the impact of tariffs will become apparent in the next 6 to 8 weeks. The outcome is currently unpredictable, but the next approximately two months will be a critical period that will determine whether there will be an economic slowdown or inflation issues. The true unknown is how long the economic shock, if it indeed occurs, will last, as the situation is still developing.

Crypto Derivatives Surge Amid Tariff Alert

Did you know? During past upheavals like the 2018–2019 US-China trade war, Bitcoin and Ethereum exhibited heightened volatility as they were perceived as alternative safe havens during times of economic uncertainty.

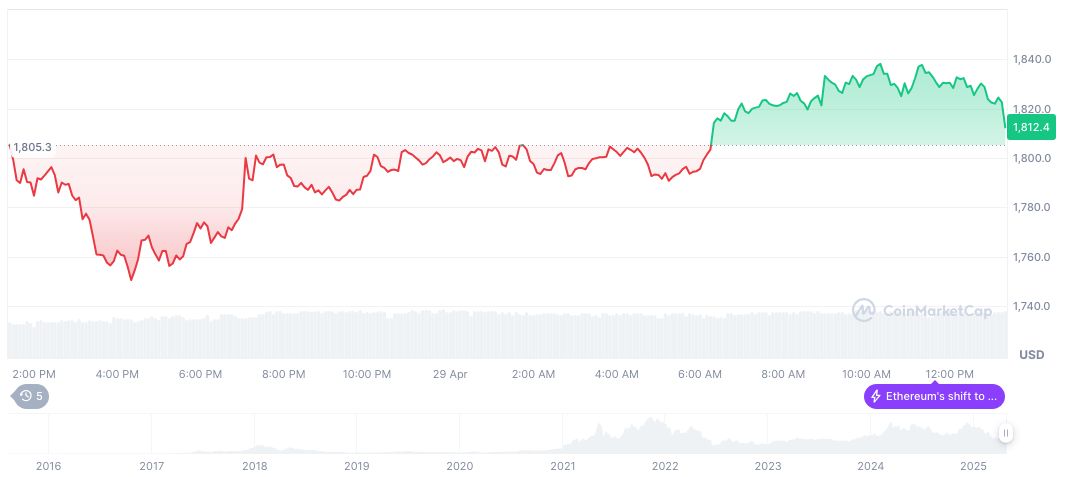

Ethereum (ETH) currently trades at $1,824.09, with a substantial market cap of $220.22 billion and a 24-hour trading volume of $16.09 billion, indicating a 3.06% rise in the past day, according to CoinMarketCap. Despite a historical decrease of 41.59% over 90 days, Ethereum’s consistent market dominance of 7.38% demonstrates its integral role in the cryptocurrency landscape as crucial discussions around tariffs unfold.

The Coincu research team indicates that, historically, macroeconomic pressures like tariffs could either elevate or devalue Bitcoin and Ethereum depending on traders’ risk appetites. As developers and financial experts focus on technological resilience, cryptocurrency’s underlying technology might gradually steer towards increased stability amid anticipated macroeconomic shifts.

Source: https://coincu.com/334906-crypto-markets-tariff-volatility-2/