- Nasdaq proposes categorization of digital assets to the SEC.

- Emphasizes cooperation between the SEC and CFTC for asset oversight.

- Aims to align U.S. market practices with global standards.

On April 25, 2025, Nasdaq submitted a proposal to the SEC to categorize digital assets, with the initiative led by John Zecca. The proposal calls for cooperation between governmental agencies in redefining asset classifications to align with evolving digital markets.

Nasdaq has urged the U.S. SEC’s Crypto Working Group to categorize digital assets into four distinct groups to reflect novel attributes. This proposal emphasizes aligning regulatory conditions with established financial practices. John Zecca highlighted Nasdaq’s position, stating the importance of integrating digital assets into existing frameworks given their global trading expertise.

Regulatory Reassignment Could Enhance Institutional Engagement

Regulatory changes suggested by Nasdaq focus on reassigning asset oversight between the SEC and CFTC, aiming to streamline regulatory processes. It suggests that while traditional securities-like tokens should fall under SEC jurisdiction, commodities align with CFTC standards. This classification seeks to lower operational hurdles and foster institutional engagement.

Responses from the crypto community remain understated as of now, with no significant comments from industry leaders. Due to the proposal’s potential market implications, the balanced reaction reflects the transitional nature of regulatory adoption. Nasdaq’s letter underscores the goal of fostering investor confidence by aligning platforms with industry best practices.

“Rather than building a new regulatory system from scratch, existing frameworks should be adjusted for digital assets.” — John Zecca, Chief Regulatory Officer, Nasdaq.

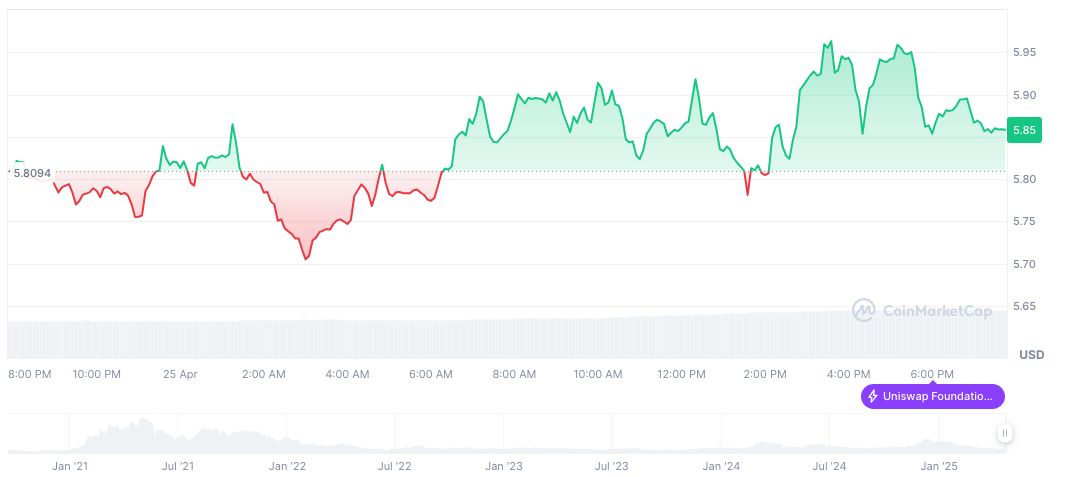

Market Data Overview

Did you know? Nasdaq’s proposal can influence similar regulatory frameworks adopted post-ETF approvals. These changes often lead to increased innovation and product diversification within financial markets.

Uniswap (UNI) is priced at $5.86, with a market cap at $3.69 billion and a trading volume of $208.43 million, according to CoinMarketCap. Despite a 1.01% 24-hour increase, it shows a 12.80% rise this week, countering a 30-day decline of 13.76%.

Coincu specialists note Nasdaq’s initiative may drive innovative solutions and regulatory cooperation. Successful implementation could align U.S. market practices with global standards, ensuring a cohesive digital asset market landscape. Such moves can potentially improve investor confidence and broaden institutional participation in tokenized products.

Source: https://coincu.com/334356-nasdaq-sec-crypto-classification/