- FTX is set to repay major creditors starting May 30, potentially injecting billions into the crypto market.

- The SEC is unlikely to approve any pending crypto ETFs before August, delaying investor hopes yet again.

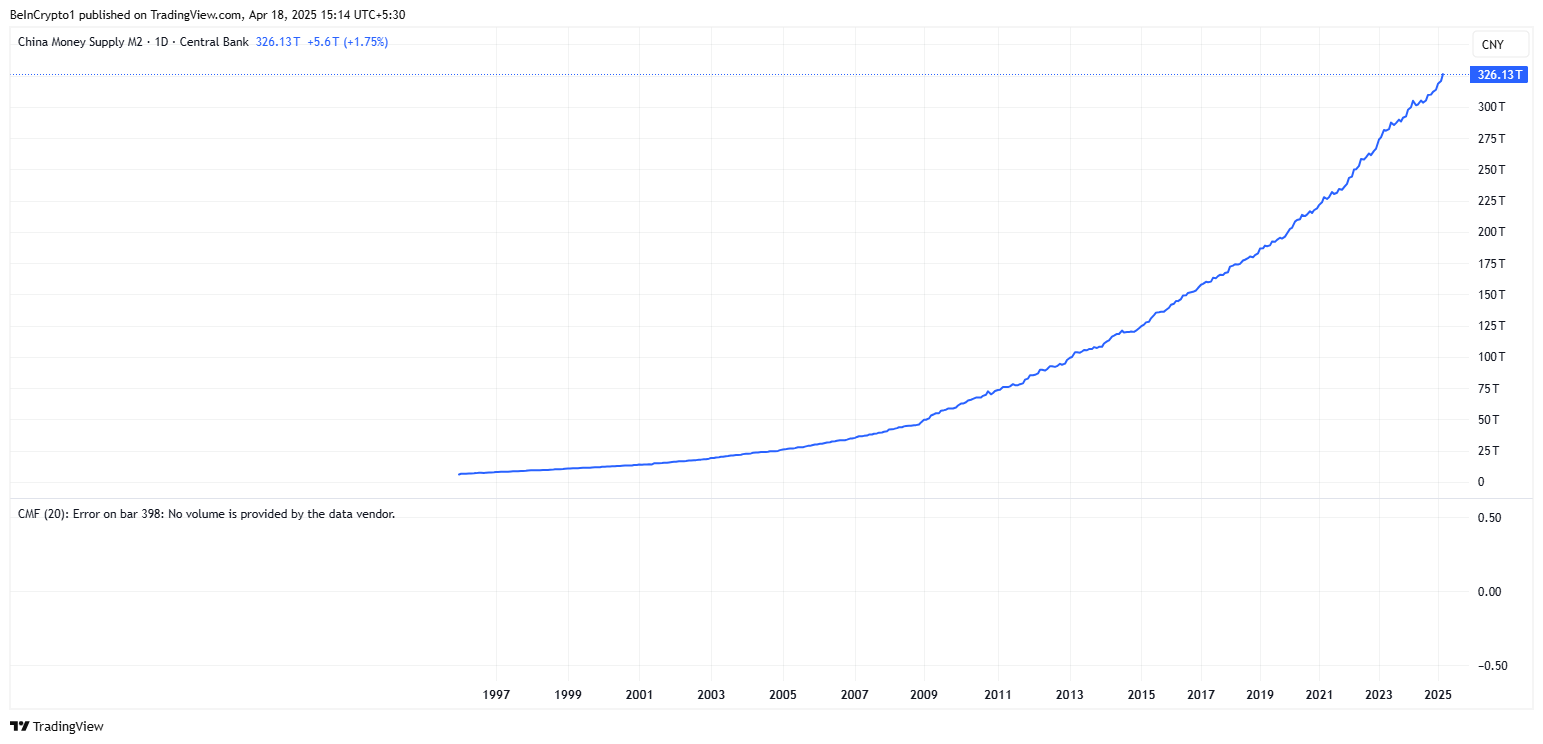

- China’s record-breaking M2 money supply surge could ignite a fresh wave of demand for risk assets like Bitcoin.

The crypto world is staring down May 30 when two major events scheduled for that day could significantly impact digital asset markets: the long-awaited FTX creditor repayments and looming decision deadlines for US regulators on crypto ETFs.

FTX Repayments: Injecting Liquidity or Dampening Sentiment?

Nearly 27 months after its catastrophic collapse in November 2022, FTX is finally preparing to repay creditors, with payments over $50,000 scheduled to begin May 30.

According to bankruptcy attorney Andrew Dietderich, the exchange—now led by CEO John Ray III—will draw from its $11.4 billion cash stockpile to begin disbursing funds.

A fresh injection of billions into the hands of crypto-native investors could stoke buying momentum—especially if those funds are reinvested into digital assets at a time when sentiment is cautiously bullish.

SEC ETF Decisions: Delays Still Expected

While the FTX news gives some reason for optimism, the SEC continues to stall progress on crypto ETFs. A Bloomberg-tracked list of applications shows more than 70 ETF filings across various assets including XRP, Solana, Litecoin, and Ethereum. Nearly all of these applications remain in review limbo.

The first key deadline round falls on May 30th – the same day FTX payments begin. However, analysts widely expect the SEC will again delay approvals, pushing major decisions possibly to August pending more regulatory clarity.

Related: Spotlight on XRP, Solana as 72 Crypto ETFs Seek SEC Approval This Year

With Paul Atkins now sworn in as the 34th SEC Chairman, optimism is bubbling. A known proponent of capital market efficiency, Atkins’ return could usher in a more crypto-forward era at the SEC, breaking from the restrictive stance of Gary Gensler’s leadership. That shift, however, may not show its teeth until later in the summer.

Macro Factor: China’s Record Money Supply

In a parallel macro narrative, China’s M2 money supply has soared to an all-time high of $44.7 trillion, signaling an ongoing global liquidity surge. Historically, such expansions correlate with rallies in risk-on assets like crypto.

Related: Bitcoin Dominance Reaches New Cycle Peak as Altcoins Fail to Keep Up

Analyst Kong Trading noted, “The money printers are back on. Risk assets are about to go parabolic.” The implication is clear: if liquidity is rising and repayment capital is reentering the market, a perfect storm could be brewing.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/all-eyes-on-may-30-ftx-repayments-could-mark-market-bottom-as-sec-stalls-etf-reviews/