- BTC could surge to over $100K in 2025 and double to +$200K in 2026, per analysts.

- Price models and prediction sites aligned with these projections despite ongoing tariff woes.

Renowned macro analyst Lyn Alden projected that Bitcoin [BTC] could rally above $100K in 2025 and double in value within a year. That suggested a potential price target of $200K in 2026.

Alden’s modest surge above $100K was based on ongoing tariff wars.

However, she noted that BTC could rally harder and higher if a massive liquidity unlock happens, especially if the Fed intervenes in the U.S. bond markets.

More room for BTC growth?

Additionally, Alden expected more BTC growth, citing the MVRV valuation metric. The metric was yet to flash the multi-year cycle top signals above 3.

The recent local top and the early 2024 peak were overheated levels around the MVRV score of 2, but didn’t suggest a cycle top.

Source: CryptoQuant

Her outlook was similar to that of Bernstein analysts, who maintained that BTC could tap $200K before the end of 2025.

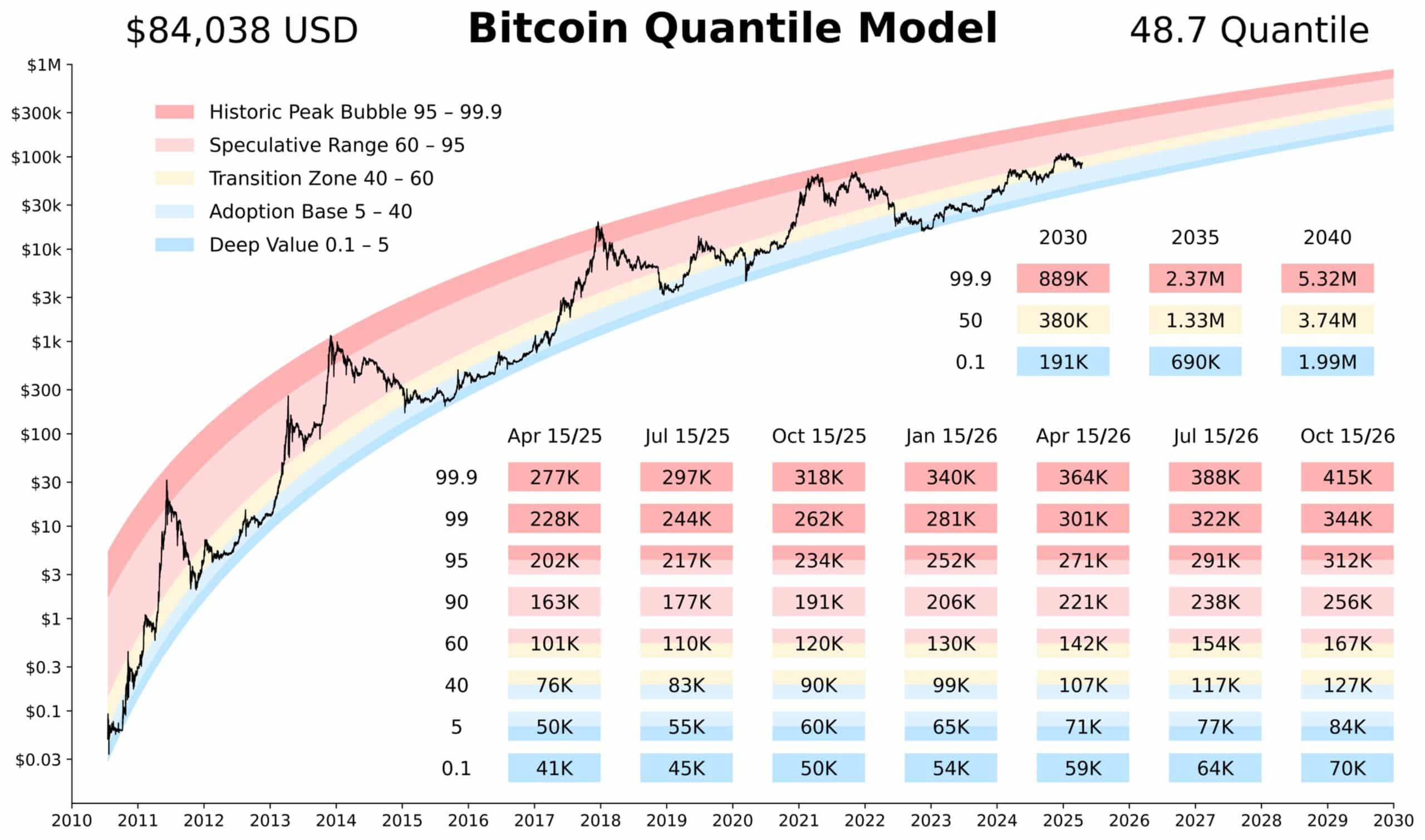

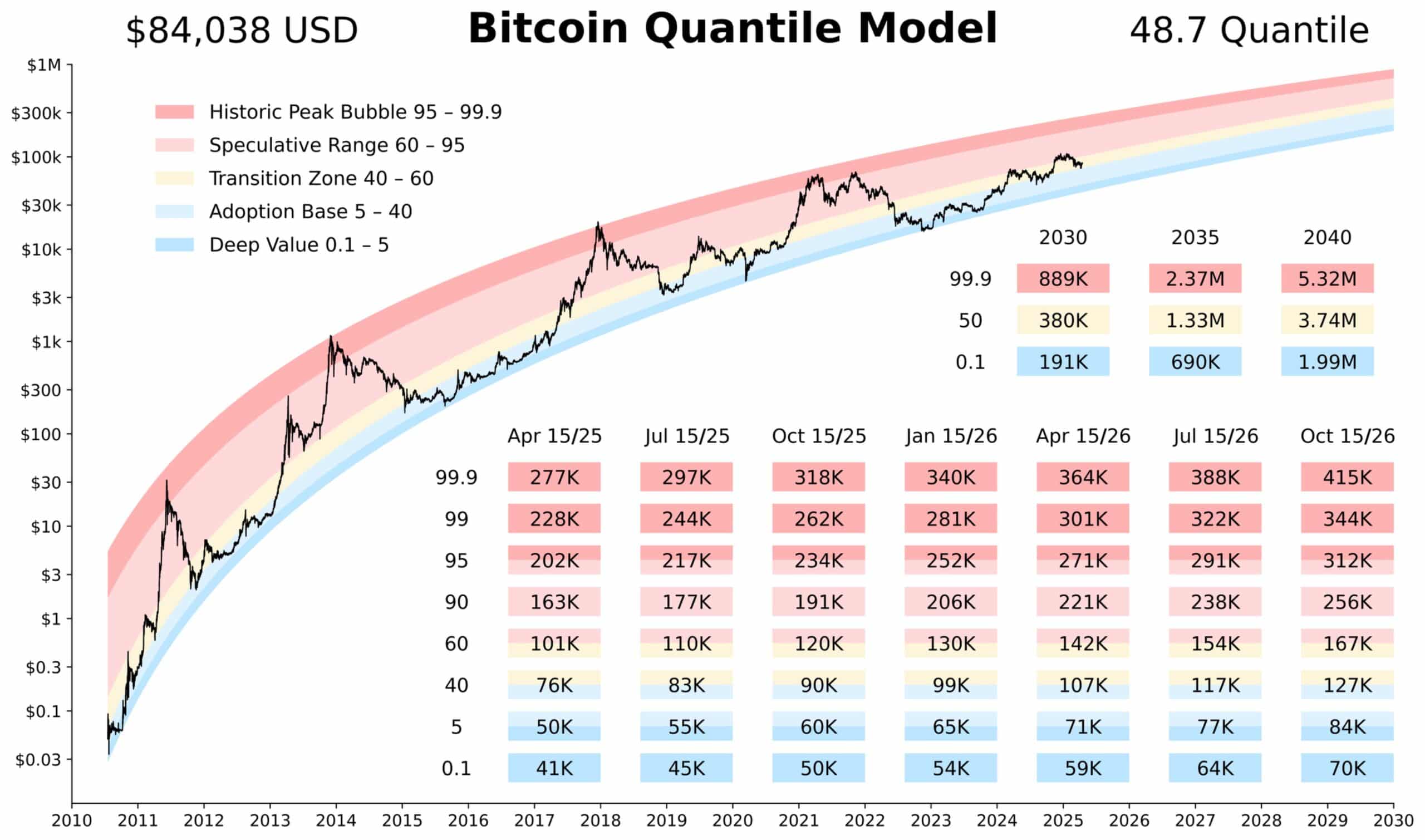

Key price models like the Bitcoin Quantile Model somewhat validated these projections.

Source: X

For his part, Dr. Sina, co-founder of 21st Capital, expected BTC to top out between $200K-$300K, if past historical cycle trends repeat. Citing the BTC Quantile Model, he stated,

“Even if we only get to the 95th quantile this cycle, it is a 3x from here.”

The model uses past data to pick probability zones for BTC price, with a 95th quantile common with cycle peaks.

Simply put, Dr. Sina’s 3x upside meant that he expected BTC to tap $250K this cycle. This also aligned with Charles Hoskinson’s recent prediction.

On the prediction site Polymarket, the largest volume ($1.3M) was parked at a $110K price target with a 52% chance of hitting that level.

Source: Polymarket

The next top volumes were at $200K and $150K, with lower odds of 13% and 22%. Simply put, Polymarket reiterated Alden and Dr. Sina’s projections.

However, Options traders expected BTC to exceed $100K in the second half of 2025. But for the $150K and $250K targets, the odds ranged from 10% to 15% in late 2025 or early 2026.

Source: Deribit

In other words, the market was confident BTC would reclaim $100K this year but was slightly optimistic for $150K and $200K levels in 2026.

However, the market must survive the tariff uncertainty in the mid-term for such prospects to be possible.

Source: https://ambcrypto.com/bitcoin-might-cross-100k-in-2025-but-thats-just-the-start-analyst/