- The S&P 500 rose while the Dow fell 0.8% on April 18, 2025.

- 52-week market divergence between Dow and S&P 500 occurred.

- UnitedHealth’s significant drop impacted the Dow heavily.

Major indices in the U.S. stock market displayed divergent behavior on April 18, 2025, with the S&P 500 gaining 0.6% while the Dow Jones fell by approximately 0.8%. This unusual market activity was notably influenced by UnitedHealth Group’s stock plummet.

The contrasts between major U.S. indices highlight differing sensitivities in index construction. UnitedHealth Group’s over 23% drop contributed to the Dow’s fall, with portfolio manager Brian Mulberry attributing substantial volatility to the Dow’s reliance on high-priced components. “One stock out of 30 [on the Dow] has a greater impact than one stock out of 500 [in the S&P 500 index],” Mulberry said. As the S&P 500 and Nasdaq showed resilience, a rare divergence between these indices emerged.

Dow Plummets by 0.8% Amid UnitedHealth’s 23% Stock Drop

UnitedHealth Group’s earnings miss and subsequent 23%+ stock price drop prompted significant market attention. The Dow’s construction amplifies single-stock moves, which highlights structural risks. UnitedHealth Group, led by CEO Andrew Witty, refrained from public comment on the plunge.

The Dow, S&P 500, and Nasdaq showed divergent behaviors, prompting scrutiny over index sensitivities. The Dow fell by 0.8%, driven by UnitedHealth, whereas the S&P 500 and Nasdaq saw slight gains. These swings are attributed to the Dow’s price-weighted nature.

Market participants responded to the Dow’s decline by pointing out its vulnerability to single-stock movements. Institutions like

were noted for maintaining broader market stability amid the volatility. No public statement was issued by UnitedHealth’s executives regarding the drop, although earnings calls cited unexpected Medicare expenses as a factor.

Bitcoin’s Dominance and Regulatory Considerations

Did you know? This event marks a historic divergence, with the Dow experiencing its first 1% drop while the S&P 500 ascended on April 18, 2025.

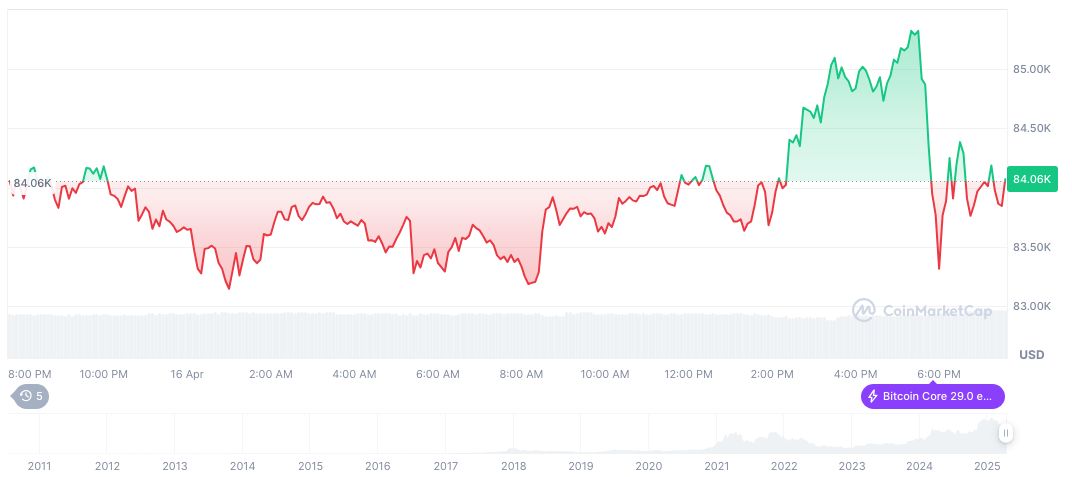

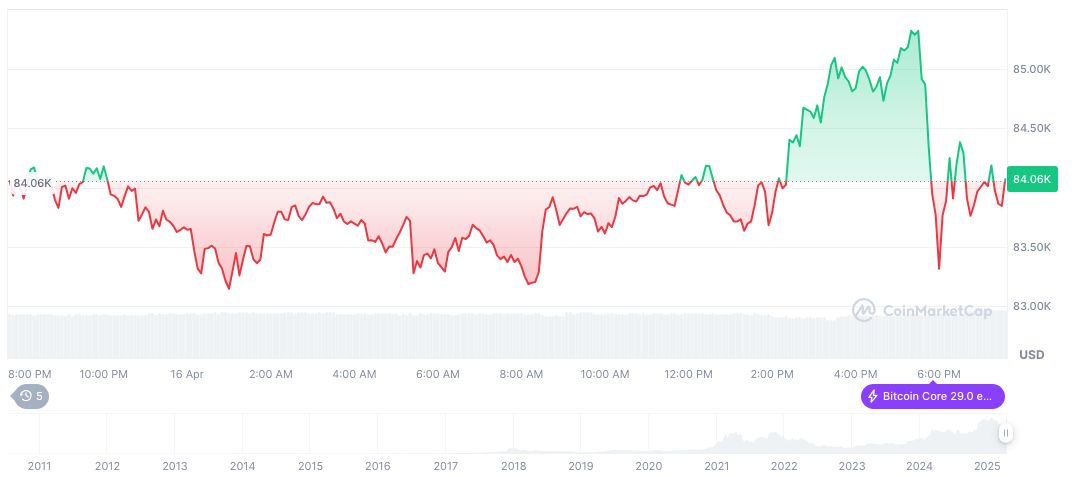

Bitcoin (BTC), trading at $84,876.61 with a market cap of $1.69 trillion, holds 62.97% market dominance. According to CoinMarketCap, its 90-day performance shows a decrease of 19.07%. The circulating supply is nearing its maximum with 19,852,681 BTC in circulation. The 24-hour trading volume of $25.39 billion has seen a 3.72% reduction.

The Coincu Research team highlights potential outcomes in financial and regulatory aspects from this event.

they point to increased structural risks and anticipate potential regulatory changes to address pricing discrepancies across indices. The day may see further analysis into how index constructions influence broader economic stability.

Source: https://coincu.com/332773-us-stock-market-mixed-results/