- Several governments are interested in establishing cryptocurrency reserves.

- Binance assists and advises these governments, signifying a strategic shift.

- The U.S. is spearheading efforts to create a strategic Bitcoin reserve.

The interest from several governments follows statements from industry leaders, such as Binance’s Founder, Changpeng Zhao, who confirmed the U.S.’s plans to create a strategic Bitcoin reserve. U.S. Senator Cynthia Lummis has also proposed policies that support these strategies, indicating significant alignment among governmental bodies for Bitcoin integration.

The Coincu research team notes that this governmental interest in crypto reserves could signal a paradigm shift in global finance, potentially influencing regulatory approaches and future technological integration. The adoption of such reserves might inspire further cryptographic scrutiny and demand.

Key Developments, Impact, and Reactions

Multiple governments and sovereign wealth funds have sought Binance’s guidance on forming cryptocurrency reserves, as revealed in an interview with CEO Richard Teng. The U.S. is notably advanced in considering strategic Bitcoin reserves. This involvement underscores the growing interest and potential national strategies for managing crypto assets.

Binance’s CEO Richard Teng confirmed that several governments are interested in establishing cryptocurrency reserves, mainly focusing on Bitcoin (BTC) formation. Binance already advises on crypto strategies and regulations, illustrating the company’s proactive engagement with global authorities. “We have already received quite a few suggestions from some governments and sovereign wealth funds about establishing their own crypto reserves,” said Richard Teng, CEO of Binance. These discussions suggest a strategic shift in how nations consider crypto assets as tools for economic strategy rather than just investments. This move potentially reinforces Bitcoin’s position as a key financial reserve tool for sovereign entities.

The interest from several governments follows statements from industry leaders, such as Binance’s Founder, Changpeng Zhao, who confirmed the U.S.’s plans to create a strategic Bitcoin reserve. U.S. Senator Cynthia Lummis has also proposed policies that support these strategies, indicating significant alignment among governmental bodies for Bitcoin integration.

Bitcoin’s Role in Global Financial Strategies

Did you know? The U.S. is considering a Bitcoin reserve strategy, following El Salvador’s lead in 2021, but on a much larger scale.

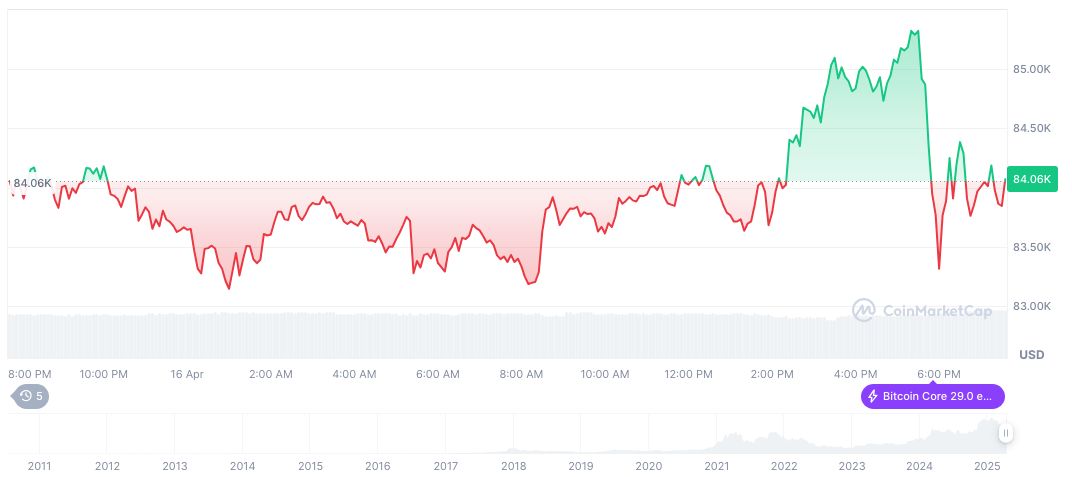

As of April 17, 2025, Bitcoin’s price stands at $84,149.60, with a market cap of $1.67 trillion, dominating 62.85% of the market. Despite a current 24-hour trading volume dip of 5.61%, Bitcoin’s price has increased 4.50% over the past 24 hours, per CoinMarketCap. However, it still shows negative growth over 60 and 90 days, at -13.09% and -17.97% respectively.

The Coincu research team notes that this governmental interest in crypto reserves could signal a paradigm shift in global finance, potentially influencing regulatory approaches and future technological integration. The adoption of such reserves might inspire further cryptographic scrutiny and demand.

Source: https://coincu.com/332740-binance-advises-crypto-reserves/