XRP and Solana (SOL) are emerging as leading candidates for spot exchange-traded fund (ETF) approvals in the United States. According to a recent report by Kaiko analysts, these two assets stand out due to their high liquidity, with the Ripple-related token potentially taking the lead in market readiness.

XRP And SOL Emerge As Top Candidates For ETF Approval

The US Securities and Exchange Commission (SEC) is on the brink of a significant transition with the confirmation of incoming Chair Paul Atkins by the Senate last week.

As a former SEC Commissioner, Atkins inherits a complex portfolio that includes the pressing issue of cryptocurrency regulation. Although crypto currently represents a small fraction of overall market activity, looming deadlines for various ETF applications could push digital assets to the forefront of his agenda, the report notes.

A wave of asset managers has recently filed for crypto-related ETFs, and with these deadlines approaching, Atkins has the opportunity to reshape the SEC’s narrative on cryptocurrency, diverging from the cautious stance of previous leadership.

XRP and SOL have emerged as two of the most favored assets for ETF applications, largely due to their liquidity. A highly liquid spot market is crucial for the efficient structuring of financial products.

According to Kaiko Indices, both tokens exhibit the highest average 1% market depth among vetted exchanges, with XRP’s market depth significantly increasing since late 2024, surpassing SOL and doubling Cardano’s (ADA) depth.

While Bitcoin’s (BTC) ETF approval was propelled by Grayscale’s legal actions, which highlighted inconsistencies in the SEC’s previous narratives, XRP’s situation is markedly different.

Key Date Approaches

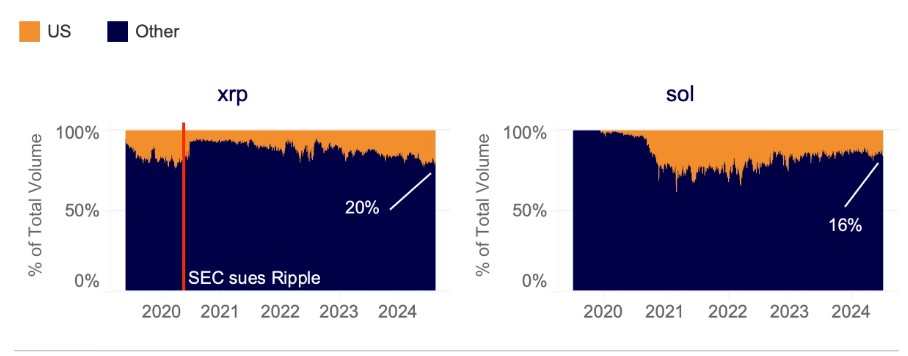

Currently, XRP lacks an active futures market, and its trading volume is concentrated offshore. However, Kaiko highlights XRP’s share of spot volume on US exchanges has recently surged to its highest levels since the SEC’s lawsuit in 2021, which led to widespread delistings of the asset.

In contrast, Solana has experienced a decline in its US market share, dropping to approximately 16% from the 25-30% range it maintained throughout much of 2022.

This shift in market dynamics, coupled with the recent launch of a 2x XRP ETF, positions XRP favorably in the race for ETF approval.

The SEC acknowledged the token’s spot ETF applications as of late February, alongside other tokens. A crucial date to watch is May 22, when the SEC is expected to respond to Grayscale’s XRP spot filing.

This comes at a time when the market is exhibiting mixed signals, particularly in the options market on Deribit, where bearish sentiment prevails. The implied volatility smile for the upcoming April 18 expiration indicates strong demand for downside protection.

As of now, XRP trades at $2.085, recording a surge of nearly 20% in the weekly time frame.

Featured image from DALL-E, chart from TradingVeiw.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Source: https://bitcoinist.com/race-for-etf-approval-xrp-gains-edge-over-others/