According To Google Finance today, gold has just shattered its all-time high, soaring past the $3,300 mark – and it’s got the entire market talking. The sharp upward movement has energized investors, especially gold enthusiasts.

But while gold is grabbing headlines, Bitcoin is quietly slipping. Peter Schiff, a well-known advocate for gold, has used this moment to question Bitcoin’s future, even urging investors to sell all their Bitcoin holdings.

Are we heading for trouble? Let’s break it down.

Gold Is Breaking Records!

Gold recently surged past $3,300, a major milestone in its ongoing rally. At the beginning of April, gold was priced at $3,114.04, but there was some fluctuation early in the month. Between April 3 and 7, the price dropped from $3,131.08 to $2,980.78. This dip coincided with global market uncertainty caused by U.S. President Donald Trump’s aggressive tariff policy and a 90-day pause for non-retaliating countries.

On April 8, gold’s market experienced a key moment as buyers and sellers fought it out, forming a long-legged Doji candlestick pattern on the daily chart. This pattern indicated indecision, but soon after, the market made a clear move.

Starting April 9, the trend shifted, and gold began to climb steadily. Between April 9 and 11, gold’s price jumped by over 8.52%, signaling a strong bullish momentum. As of today, gold sits at $3,296.74, and the market looks set for further growth.

Meanwhile, Bitcoin is struggling. The cryptocurrency has dropped below $83,380, losing over 2.6% in just the past 24 hours. Compared to its peak earlier in the month, Bitcoin is down by 5.87% and 23.53% below its all-time high of $109,000.

A Tough Start to 2025

The first quarter of 2025 has been tough for Bitcoin, with a drop of at least 11.7%. This is a stark contrast to the same period last year when Bitcoin saw a 68.7% rise.

Pick Gold, Ditch Your Bitcoin!

Peter Schiff, a prominent critic of Bitcoin, has advised investors to sell their Bitcoin holdings and turn to gold instead.

As Schiff suggests, gold mining stocks have seen impressive growth. According to Yahoo Finance, companies involved in gold exploration, mining, and processing have experienced an average increase of 16.69% over the last 30 days.

The sector’s year-to-date (YTD) return stands at an impressive +47.16%, and its one-year return is +60.29%. Over the last three and five years, returns have been equally strong, at +26.77% and +73.77%, respectively.

Key gold sector companies are showing remarkable performance. For example, Newmont Corporation has a YTD increase of +46.64%, while AngloGold Ashanti has surged by +89.90%. Other notable companies include Royal Gold Inc (+40.31%), Seabridge Gold Inc (+9.20%), and Idaho Strategic Resources Inc (+78.41%).

Schiff Mocks MicroStrategy and Saylor

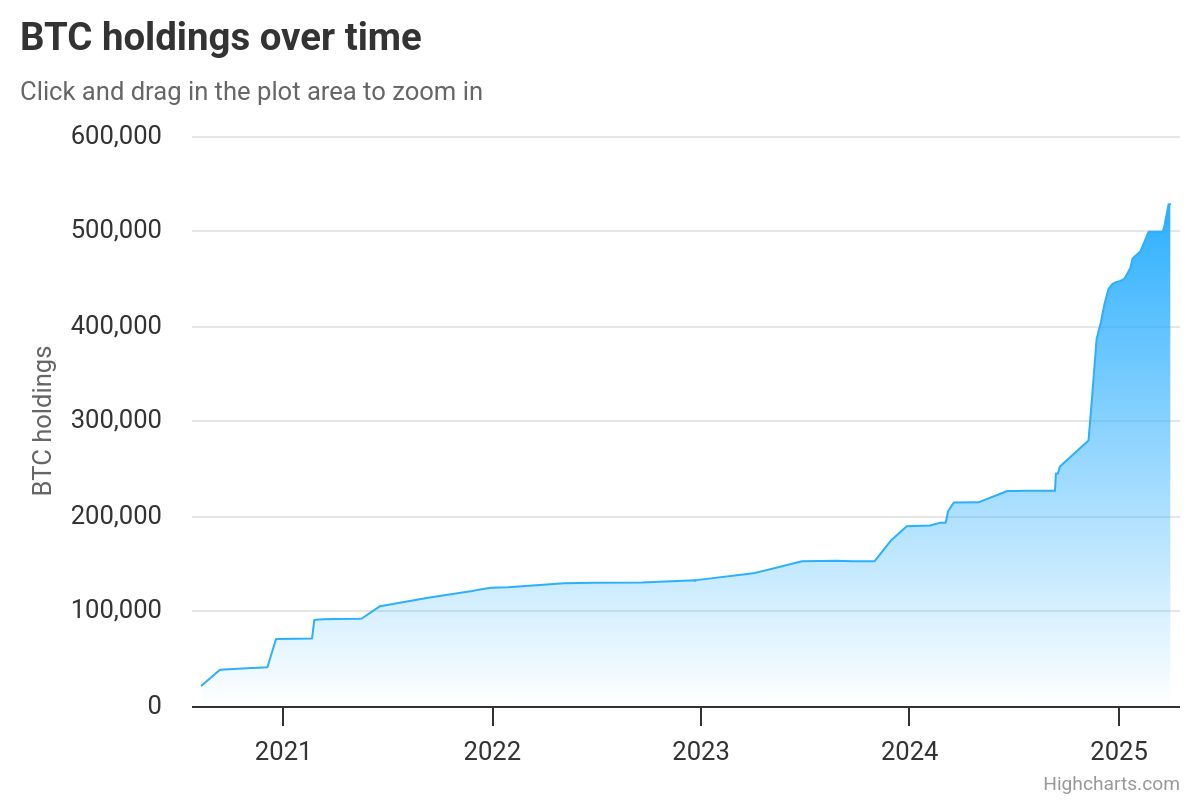

Back in December 2024, Michael J. Saylor, co-founder of Strategy, urged major U.S. tech companies like Microsoft to adopt an aggressive Bitcoin accumulation strategy. Strategy, with 528,185 BTC tokens worth over $44 billion, holds the largest Bitcoin position among public companies.

Despite this, Peter Schiff has strongly criticized Strategy’s Bitcoin-focused strategy and even predicted Bitcoin could drop as low as $10,000. However, Strategy’s stock has outperformed U.S. tech stocks.

According to Yahoo Finance, Strategy’s stock has surged by 147.78% in the past year, with a YTD growth of 7.29%. In contrast, the broader U.S. tech sector has gained only 6.82% over the past year and has a YTD decline of -14.56%.

As gold continues to break new records and Bitcoin faces challenges, the battle between these two assets is heating up. Investors are closely watching the market, with many turning to gold as a safer option given Bitcoin’s volatility.

Whether this trend will continue remains to be seen, but for now, gold is enjoying its golden moment.

Source: https://coinpedia.org/news/gold-price-hit-all-time-high-of-3300-while-bitcoin-price-drops-to-83k/