- Google will align crypto ads with MiCA by 2025.

- Impacts on cryptocurrency exchanges and wallet providers.

- Potential consolidation of larger crypto players in the market.

Solid Intel recently reported that Google will align its cryptocurrency advertising standards in Europe with the Markets in Crypto-Assets Regulation (MiCA). This enforcement is set to commence on April 23, 2025.

This alignment with MiCA marks a significant shift in regulatory compliance for firms operating within Europe’s crypto market.

MiCA Impact: Compliance Costs and Market Consolidation

Solid Intel’s report reveals that Google plans to enforce advertising standards compliant with MiCA starting April 2025. This development chiefly impacts cryptocurrency exchanges, wallet providers, and other crypto entities in the European Union. These firms are required to meet new licensing conditions set by MiCA.

Implications for smaller exchanges include facing notable financial challenges, given the licensing fees demanded by MiCA, which range between €15,000 and €150,000. This switch potentially raises operational costs, altering financial strategies within the industry. New compliance measures could be more difficult for smaller crypto players to absorb seamlessly.

Market reactions indicate a mix of support and concern. Regulatory alignment is welcomed by those seeking stability, but many worry about possible exclusion of smaller projects. Hon Ng, Bitget’s Chief Legal Officer, expressed concerns that although this move enhances investor protection, it might be overly restrictive. “These measures enhance investor protection but might be overly restrictive without flexible implementations, potentially stifling smaller players,” said Ng.

Historical Context, Price Data, and Expert Analysis

Did you know? Although MiCA aims at stabilizing the crypto market, past regulations in traditional finance have often restricted smaller entities, suggesting similar outcomes might occur here. Regulatory shifts have historically limited diversity, favoring more established players.

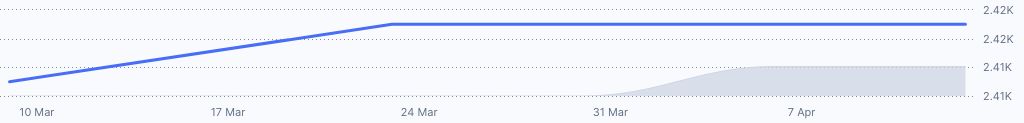

Based on recent data from CoinMarketCap, Maecenas (ART) shows a fully diluted market cap of $60,468.08 with no reported activity in market cap, trading volume, or circulating supply. Over the past 60 days, ART has risen by 25.32%. These figures provide a snapshot of current market conditions for this cryptocurrency asset.

Experts at Coincu assess that Google’s alignment with MiCA could lead to significant regulatory changes, potentially consolidating larger crypto players within the market. Data supports the premise of possible market shifts, potentially evolving the European crypto arena as regulatory uniformity strengthens investor confidence.

Source: https://coincu.com/332099-mica-europe-crypto-ad-rules/