| Key Points: – Crypto market slumps as Trump escalates tariffs on Chinese goods, shaking investor confidence in crypto markets. |

Crypto markets have been on a rocky path in recent weeks, shaken by renewed geopolitical tensions and wavering investor sentiment.

The latest blow came from the White House, where President Donald Trump’s decision to escalate tariffs on Chinese imports has added further strain to an already jittery global financial landscape.

Crypto Markets Slide Amid Rising US-China Trade Tensions

Earlier this week, Trump announced a sharp increase in tariffs on Chinese goods, raising them to 125% and now the number has increased to 145%. Although he later eased tariff threats against most other countries, the tough stance on China remains a focal point of economic uncertainty. Posting on his Truth Social platform, the president reaffirmed his administration’s commitment to a more aggressive trade strategy with Beijing.

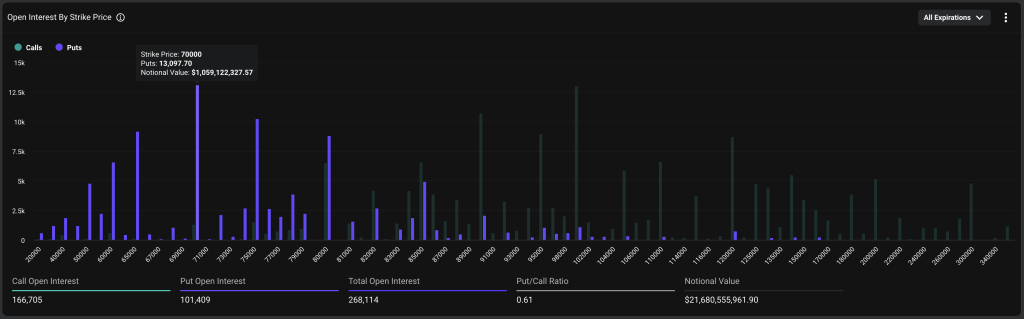

Despite a modest rebound midweek, options market data suggests traders remain cautious. On Deribit, a leading crypto derivatives exchange, $70,000 Bitcoin put options — essentially bets that the price will fall — were among the most traded for April. Bullish sentiment, represented by call options, has been far less dominant, reflecting broader market hesitance.

For much of 2025, Bitcoin has fluctuated between $80,000 and $90,000, maintaining a relatively stable range following its record-setting surge earlier in the year. However, this period of relative calm now appears to be under threat from both macroeconomic headwinds and declining risk appetite across asset classes.

Bitcoin’s strong performance following Trump’s election victory in November 2024 gave investors reason for optimism. But by the time he returned to the Oval Office in January, much of that momentum had faded. The renewed trade tensions and faltering traditional markets have since compounded the challenges facing the crypto sector.

Fragile Sentiment Threatens Hopes for Crypto Bull Run

Crypto market, often seen as a barometer for risk appetite, has responded with heightened volatility. Bitcoin, the largest cryptocurrency by market capitalization, briefly fell below $75,000 — a five-month low. Though it has since recovered slightly, the price remains more than 25% below its all-time high of over $108,000, recorded just before Trump’s second inauguration in January.

Ethereum, the second-largest cryptocurrency, has faced even sharper losses. Over the past week, its price has dropped by as much as 13.5%, coming dangerously close to the $1,400 level — a price not seen since March 2023. The $1,500 mark has emerged as a tentative support level, but sentiment remains fragile.

The broader slump in traditional financial markets has also weighed heavily on cryptocurrencies. With equities under pressure and bond yields rising, riskier investments like digital currencies have seen a pullback. Analysts say that while hopes for a renewed “bull run” in crypto market still linger, they are increasingly fragile in light of the current global economic climate.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/331446-crypto-market-still-grappling-with-trumps-tariff/