- Stablecoin market surged past $230 billion, with RLUSD gaining momentum as a notable contender

- Regulatory clarity and institutional interest has fueled stablecoin growth too

The stablecoin sector is entering a phase of renewed momentum right now, one shaped by both regulatory pushes and a visible uptick in institutional confidence. While established giants like USDT and USDC have maintained their dominance, new entrants are quietly carving out a meaningful space in the market.

One such name has begun to turn heads – Ripple’s RLUSD. Against a backdrop of legislative possibilities and a shifting U.S. policy, the broader stablecoin ecosystem is beginning to look like one of crypto’s most resilient growth narratives.

Stablecoin market sees renewed capital inflows

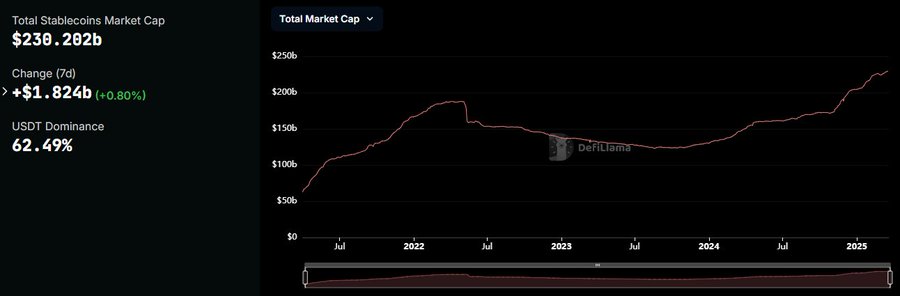

The total market cap for stablecoins officially surged past $230 billion recently, marking a strong return to growth after a prolonged lull.

This represented a 56% year-over-year hike. This hike also followed fresh interest from institutional players reallocating capital towards dollar-pegged assets.

Source: X

Notably, USDT dominance was strong at over 62%, although there were signs of mild diversification as new players gained traction. The latest uptick reflected a broader risk-on sentiment across digital assets. However, stablecoins’ stability and liquidity make them a favored entry point.

The sector saw a $1.8 billion net inflows last week, highlighting demand for reliable crypto-native dollar substitutes amid geopolitical and fiscal uncertainty.

Ripple’s RLUSD gains momentum

Ripple’s RLUSD stablecoin, launched to compete in the dollar-backed token market, is rapidly finding its footing too. The token’s circulating supply reached $160 million as of mid-March.

What stands out is RLUSD’s increasing adoption on the Ethereum mainnet – A strategic move signaling Ripple’s intent to bridge both institutional and DeFi markets. From January to March 2025, RLUSD supply growth has been steady, with noticeable spikes aligned with periods of market volatility.

This suggested that RLUSD is being tapped for liquidity and hedging purposes.

Source: IntoTheBlock

While still a fraction of USDT or USDC, RLUSD’s momentum is worth noting, especially given Ripple’s established infrastructure and recent regulatory wins in the U.S and U.K.

If growth continues at this pace, RLUSD could become a top-five stablecoin by year’s end.

Policy momentum, not immediate market action

The surge in stablecoin market capitalization – now over $230 billion – is rooted in more than just investor appetite. It’s increasingly tied to policy signals. On 20 March, President Donald Trump addressed the Digital Asset Summit with a clear call for Congress to pass “simple, common-sense rules for stablecoins and market structure.” He positioned stablecoins as a strategic pillar for reinforcing U.S. dollar dominance globally, urging swift legislation to prevent losing ground to competitors like China.

While no major institutional players have unveiled new offerings in direct response to the speech, the messaging has deepened market conviction. Regulatory clarity – once murky – is taking shape, and that alone is fueling optimism.

If these legislative intentions materialize, the ripple effects on issuance, adoption, and innovation could be far-reaching. For now, the tone from the top is bullish, and the market is listening.

Source: https://ambcrypto.com/ripple-heres-rlusds-role-in-stablecoins-230-billion-growth-story/