- AVAX tested key $19 support, consolidating in a symmetrical triangle, signaling indecision.

- Bearish on-chain signals and high underwater investor percentages suggested a potential downside.

Avalanche [AVAX] is consolidating within a symmetrical triangle pattern on the 4-hour chart and testing a critical support level of $19.

This support has held firm in recent price action, which may indicate a potential rebound. AVAX is currently at a crucial level, trading at $19.56 with a slight 0.20% increase in the last 24 hours.

Will AVAX maintain its support, or will it fall further? Let’s find out.

What does the current price action reveal about AVAX?

At press time, AVAX’s price was testing a key $19 support level, which has acted as a reliable floor in previous price movements.

The symmetrical triangle pattern that is currently forming suggests a build-up of market indecision, where both buyers and sellers are waiting for the next move.

If AVAX can break above the upper boundary of the triangle, the price could experience a short-term rally. However, a failure to hold this support might push the price lower, potentially leading to a deeper correction.

Source: TradingView

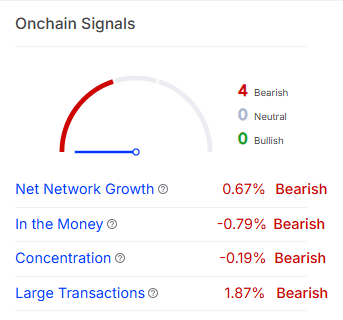

Are the on-chain signals pointing towards bullish or bearish sentiment?

Examining the on-chain signals for AVAX, the overall outlook appears more bearish than bullish. The net network growth stands at -0.67%, showing a slight decrease in network activity.

In addition, the “In the Money” metric has dropped by 0.79%, indicating that fewer investors are in profit.

Furthermore, the concentration metric is at -0.19%, signaling that there has been little change in the distribution of AVAX tokens.

Lastly, large transactions have decreased by 1.87%, suggesting a lack of significant bullish movement among large investors. All these on-chain signals point to a lack of strong bullish momentum at this time.

Source: IntoTheBlock

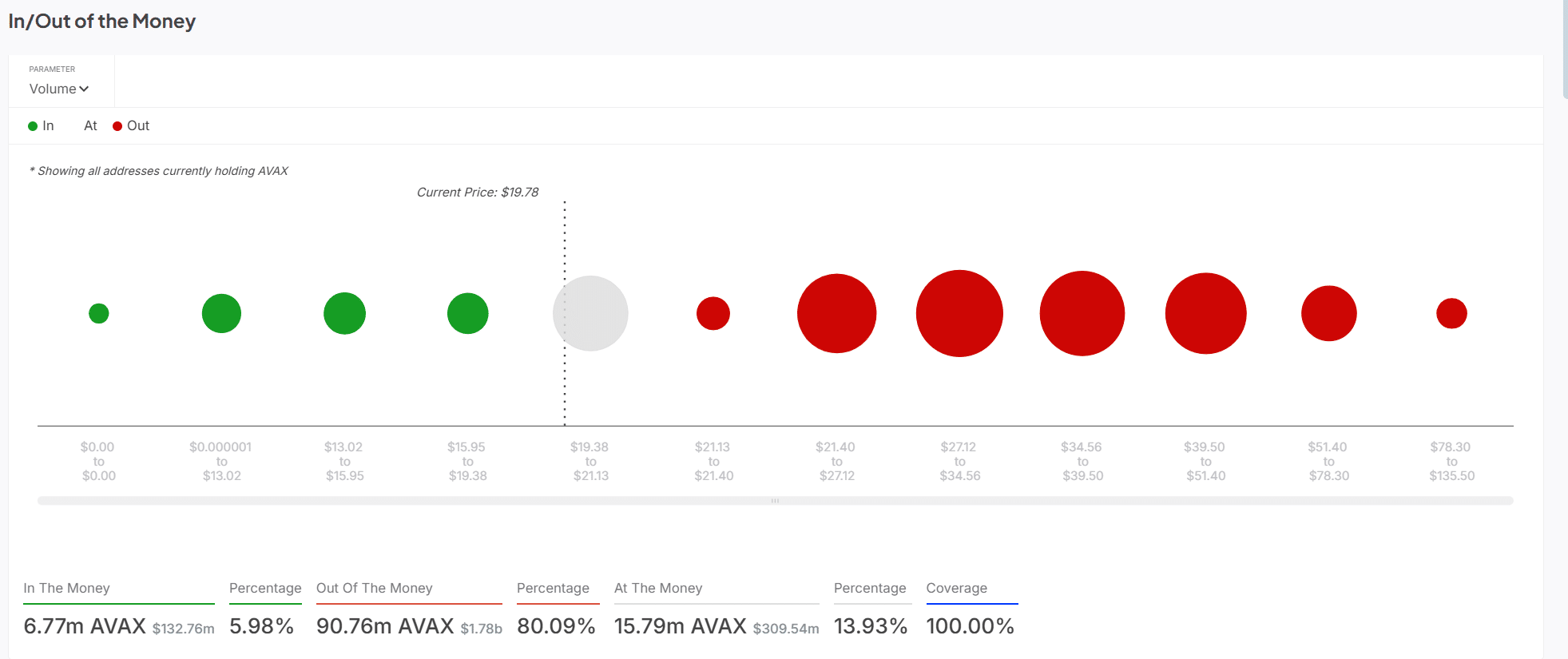

How does in/out of the money data influence its price action?

The in/out of the money chart further highlights the bearish sentiment around AVAX. At the time of writing, 80.09% of addresses holding AVAX are out of the money, with a significant portion of these investors holding losses. Only 5.98% of holders are in profit at the current price level.

This suggests that numerous investors are underwater and might be tempted to sell if the price falls below the $19 support.

Additionally, as the price struggles to stay above this level, more selling pressure could mount, further driving down the price of AVAX.

Source: IntoTheBlock

Can AVAX hold $19, or will it break lower?

AVAX is at a critical juncture, and the next few hours could determine whether it experiences a rebound or breaks lower.

With a symmetrical triangle pattern forming and on-chain signals leaning bearish, the risk of a breakdown seems higher.

Given the overwhelming number of investors who are out of the money and the lack of bullish on-chain momentum, AVAX may struggle to maintain its $19 support.

Therefore, if the price fails to hold this key level, AVAX is likely to face further downside movement soon.

Source: https://ambcrypto.com/avalanche-fights-to-stay-above-19-avax-can-hold-only-if/