- Ethereum whales have accumulated 1.10 million ETH in 48 hours, sparking market speculation

- Despite whale buying, Ethereum remains in a downtrend

Ethereum’s [ETH] big players are making quick moves! In the past 48 hours, whale wallets have accumulated a staggering 1.10 million ETH, sparking speculation across the market.

Are these high-net-worth investors positioning ahead of a major catalyst, or is this just another calculated play in an increasingly volatile landscape?

Ethereum’s price action remains in a tug-of-war, while Bitcoin’s dominance strongly influences the overall market sentiment.

The significant accumulation by whales raises the question: Could they have insights or information unavailable to the broader market?

Ethereum whales: Quiet accumulation or major move?

The recent acquisition of 1.10 million ETH by whale investors underscores a significant shift in Ethereum’s market dynamics.

As of March 2025, Ethereum’s circulating supply is about 120 million ETH. This purchase represents nearly 0.92% of the total supply, making it a significant accumulation.

Source: X

This pattern of whale accumulation is not an isolated event. In January 2025, large holders acquired over 330,000 ETH—worth more than $1 billion—in just one week.

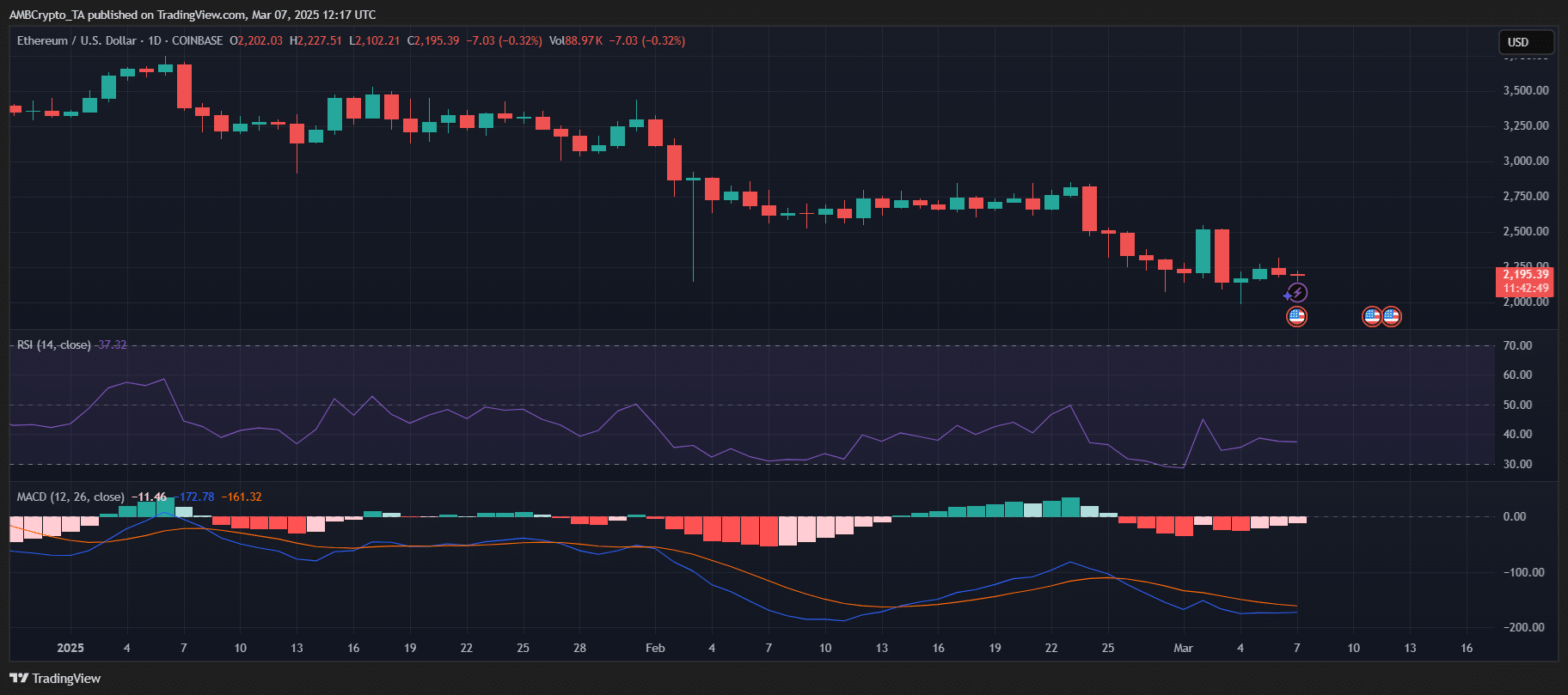

The recent accumulation coincides with Ethereum’s sluggish price performance, as ETH struggles to gain momentum in early 2025.

Despite the absence of a clear breakout, whales are positioning aggressively, possibly anticipating a market shift before it becomes apparent to others.

What’s causing this spike in whale transactions?

In recent months, Ethereum has experienced notable whale accumulation, with major investors collectively purchasing substantial amounts of ETH. This trend is particularly significant given Ethereum’s current circulating supply of approximately 120 million ETH.

Such large-scale acquisitions by whale wallets reflect strong bullish sentiment among major investors, demonstrating confidence in Ethereum’s long-term potential.

This accumulation continues despite Ethereum’s underperformance compared to Bitcoin in recent months.

The surge in whale activity coincides with key developments in the crypto space. On March 2nd, President Donald Trump announced a U.S. strategic crypto reserve, expressing his “love” for Ethereum, which boosted investor interest.

The upcoming White House Crypto Summit on the 7th of March has further heightened market activity, as stakeholders anticipate potential regulatory support.

Ethereum’s dominance in the stablecoin market, holding 56% of total stablecoin value, reinforces its importance as a cornerstone asset.

Source: https://ambcrypto.com/1-10m-ethereum-scooped-up-by-whales-what-do-they-know-that-we-dont/