- Mt Gox moved $1B worth of BTC to unmarked wallets.

- BTC price briefly stalled at $92K as the Mt. Gox move spooked traders.

Mt Gox, the defunct Japanese crypto exchange, moved $1 billion worth of Bitcoin [BTC] during the early Asian session on the 6th of March, sparking fears of a new FUD that could cap the recent recovery.

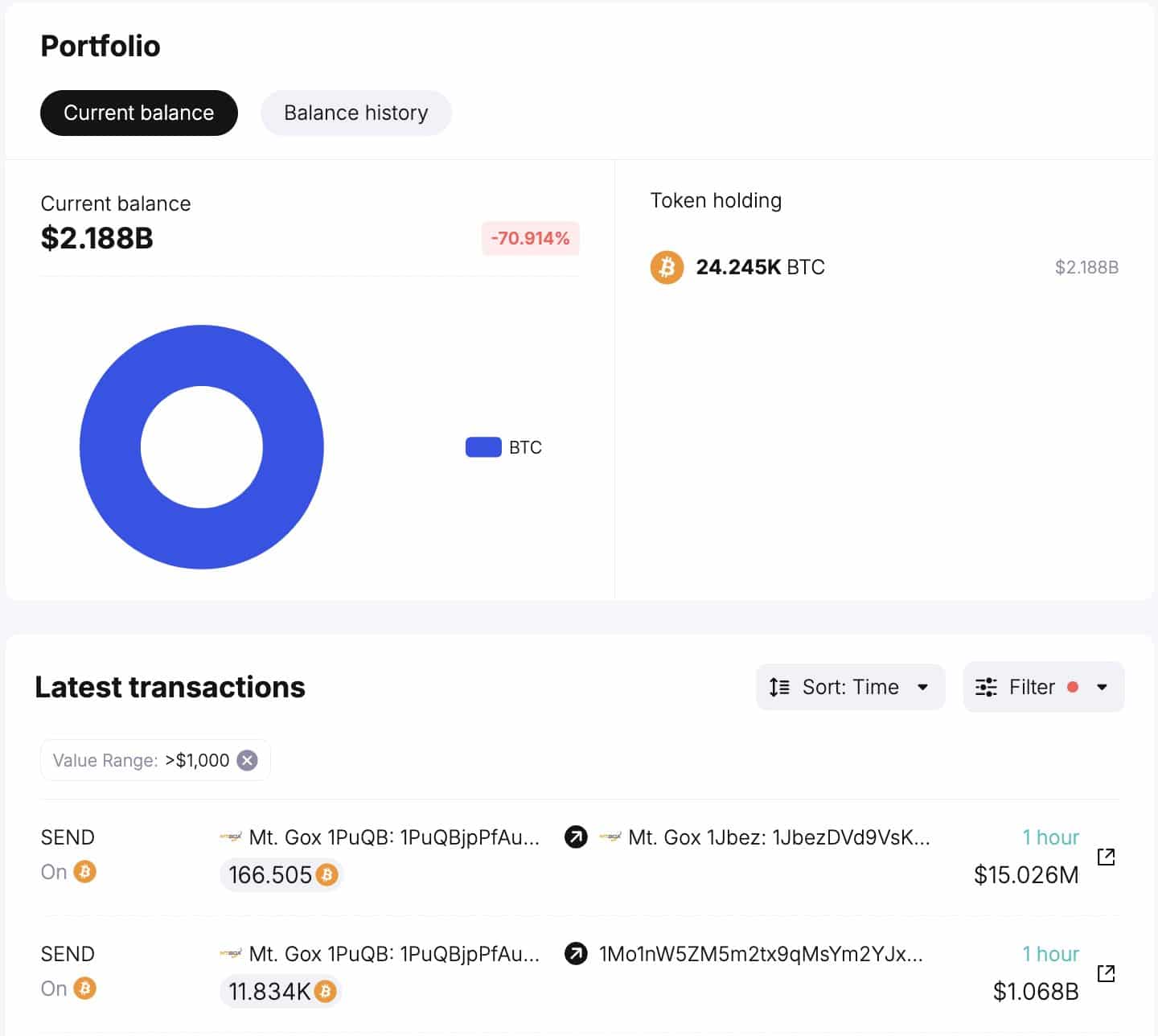

According to Arkham data, the exchange transferred 12000 BTC worth $1.09 billion, to two unmarked wallets. One of the wallets received $1.07 billion, while $15 million BTC was sent to another wallet.

Source: Arkham

Will it cap BTC recovery?

The transfer comes amid weak market sentiment and uncertainty linked to trade tariffs.

Before the news, BTC tapped $92.8K, a 13% jump from the new lows of $81K formed on the 4th of March. However, market watchers doubted the recovery extension due to Mt Gox’s move.

One user stated,

“Bitcoin bounced back to $92K after the recent dip, but trouble might be ahead… Mt. Gox just moved $1 BILLION in #BTC! If they sell, a massive dump could follow! Are we about to see a market shake-up?”

For its part, blockchain analytics firm SpotOnChain speculated that the BTC transfers could be internal and not designed for sell-offs.

The firm added that the defunct exchange still held +$2B BTC on the known wallet that made the transfers.

Source: SpotOnChain

In the past, such updates from Mt. Gox triggered sell-offs as traders and investors worried about a dumping spree.

At press time, BTC was slightly down to $90.9K from $92.8K, suggesting that the Mt. Gox update could be partly behind the stalling price.

However, according to a previous statement from the exchange, the next compensation stage was scheduled for October 2025. There was no communication for the latest transfer by Mt Gox by the time of going to press.

Meanwhile, the market focus will shift to Friday’s inaugural crypto summit amid speculation that President Trump could provide an update on Bitcoin’s strategic reserve.

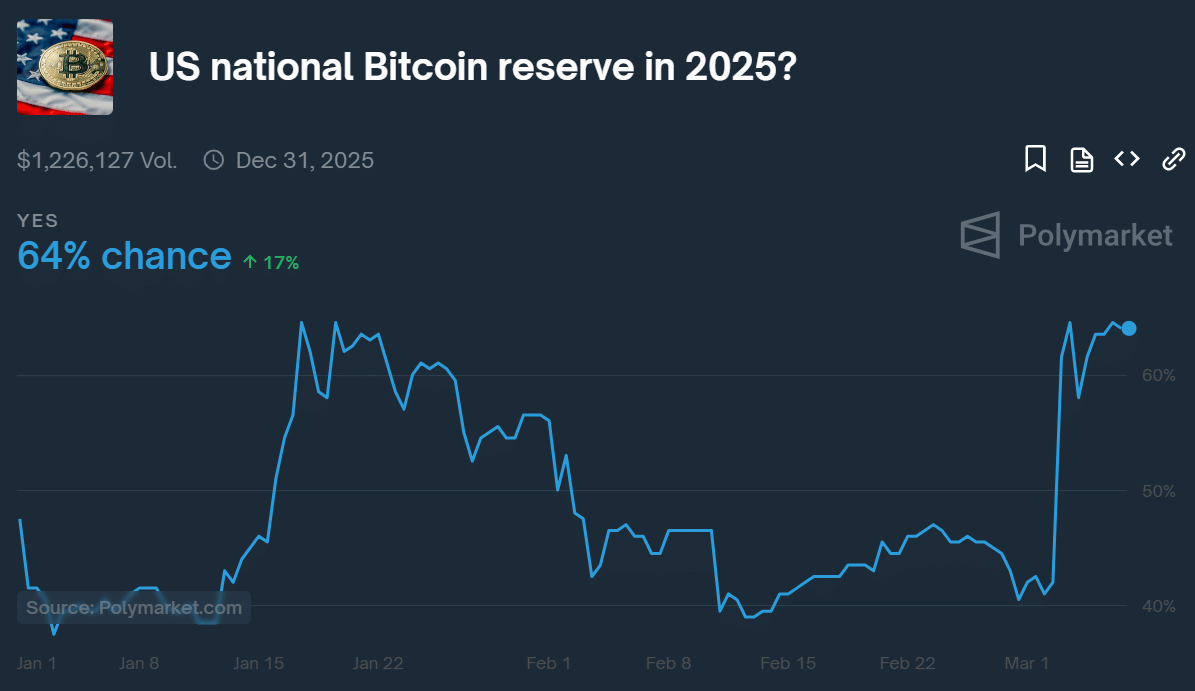

In March, Polymarket odds of a U.S. national BTC reserve jumped from 40% to over 60%. Simply put, the market was optimistic about a positive outcome. However, it remains to be seen whether the rumors will be validated at the summit.

Source: Polymarket

Source: https://ambcrypto.com/mt-gox-moves-1b-in-bitcoin-will-it-effect-btcs-recovery/