Over the past week, the crypto market has collectively declined, with Bitcoin’s price briefly falling below the $80,000 mark. The industry has been buzzing with voices claiming, “The bull market is over, the bear market is here.”

However, whether it’s a bull market or a bear market, the inherent volatility of the entire market means there are always potential opportunities. Although market corrections can be anxiety-inducing, they are some of the best opportunities for investors to start positioning themselves and achieving long-term profits.

If you are a long-term investor looking to profit through market cycles, mining is undoubtedly an investment option worth considering. In different market cycles, mining returns are relatively stable, especially during bear markets, where lower market participation costs often lead to greater profit potential.

Of course, as more investors realize the potential of mining, the mining process has evolved from its early days. In this process, mining pools play a crucial role as platforms that help miners earn mining profits.

What are Mining Pools?

Currently, the total Bitcoin network hashrate is 800 EH/s. Suppose you own an Antminer S21 XP with a hashrate of 270 TH/s. The hashrate of this miner accounts for 0.000034% of the total network hashrate.

Solo mining will either result in successfully mining a block and receiving at least 3.125 BTC or nothing at all. From a probability perspective, it’s likely that when your miner is retired, you will fall into the “zero earnings” category.

Given the current Bitcoin network mining difficulty, solo mining is like searching for a coin in a vast swimming pool all by yourself—you might spend the whole day and still find nothing.

But if you and a group of friends work together, the chances of finding the coin increase dramatically, and everyone shares the rewards based on their contributions.

Bitcoin mining pools are like “mining clubs” where people come together to pool their hashrate and mine Bitcoin. This greatly increases the probability of finding blocks compared to solo mining.

After mining Bitcoin, the pool will fairly distribute the rewards according to each participant’s contribution in terms of hashrate. This way, whether it’s a bull or bear market, miners can maintain relatively stable income without always feeling like lone wolves unable to find that elusive “coin.”

How to Choose a Bitcoin Mining Pool?

This article will offer methods for choosing mining pools from both macro and micro perspectives. First, from a macro perspective, three key factors should be considered: the pool’s hashrate, overall scale, and market reputation.

01 Mining Pool’s Hashrate

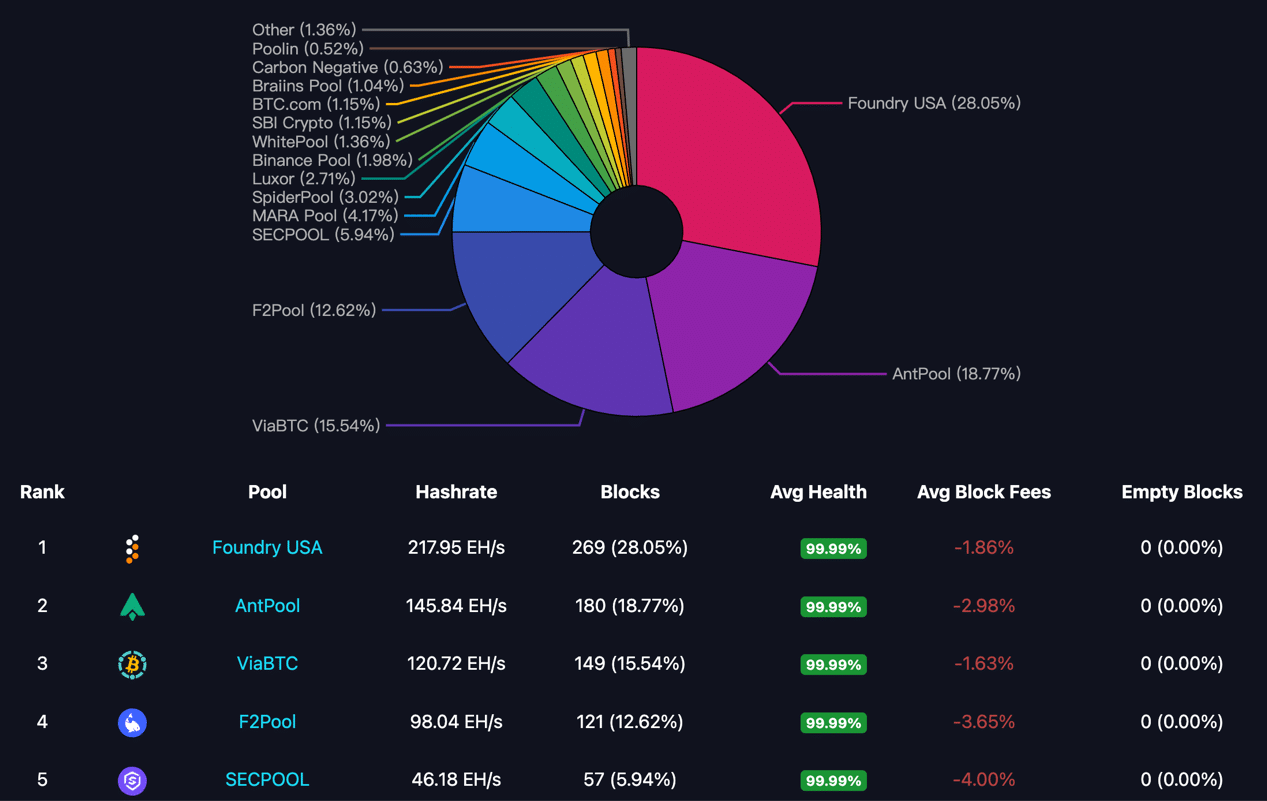

In theory, the larger the hashrate of a mining pool, the higher the probability of mining a block. Large mining pools typically offer a more stable block generation rate. MempoolSpace is a tool that allows you to view the macro indicators of various mining pools.

For example, data shows that in the past week, the mining pool with the highest hashrate was Foundry USA, with a hashrate of 218 EH/s, having mined 269 blocks. The second place went to AntPool, with a hashrate of 145.8 EH/s and 180 blocks mined.

The third place was ViaBTC, with a hashrate of 120.7 EH/s and 149 blocks mined. This data further confirms the theory that “the larger the hashrate, the higher the probability of mining a block.”

02 Mining Pool’s Overall Scale

This refers to the size of the mining pool’s team. The team size is often proportional to the pool’s financial strength and operational capability. Well-funded mining pools can maintain stable operations even in extreme market conditions, ensuring that miners’ earnings are unaffected.

At the same time, larger mining pools tend to invest more in security measures, thus enhancing the pool’s ability to resist risks and protect miners’ crypto assets.

As a user, you can usually search for a mining pool’s name and find information about the team size through its official channels, such as its website or whitepaper. However, not all mining pools disclose this information publicly, as some pools may hide it for reasons related to business competition or privacy protection.

03 Mining Pool’s Market Reputation

The long-term stability, block generation ability, and the quality of support and services provided by mining pools will accumulate a reputation within the industry. Reputable mining pools can offer miners a more reliable mining environment, ensuring stable earnings.

Miners can check out user reviews through forums, social media, and mining communities, or refer to third-party, neutral industry reports to learn more about different mining pools.

In general, from a macro perspective, choosing a mining pool with a high industry ranking and strong overall strength is typically a safer choice. This selection method is suitable for miners who prioritize stability and long-term operational capability and have fewer concerns about rate discounts.

Of course, if you are a miner who focuses more on cost-effectiveness, you can approach the decision from a micro perspective, focusing on payout methods, fee structures, and service response times to find the pool that best meets your needs.

01 Payout Methods

The payout method offered by a mining pool directly affects the stability of a miner’s income. Common payout methods include:

- PPS (Pay Per Share): Pays miners a fixed coinbase reward based on the proportion of hashrate they contribute.

- PPS+ (Pay Per Share Plus): An enhanced payment method developed by ViaBTC based on traditional PPS. In this method, miners receive coinbase rewards calculated via PPS and transaction fee earnings calculated via PPLNS.

- FPPS (Full Pay Per Share): An extension of PPS that includes transaction fee earnings. Both coinbase rewards and transaction fees are settled using the PPS method.

- PPLNS (Pay Per Last N Shares): Rewards miners based on the last N shares of work submitted. Earnings depend on the actual number of blocks mined by the pool on a given day.

- SOLO: Operates like independent mining. Miners keep the full block reward (after deducting the mining fees) if they successfully mine a block.

02 Fee Structures

To maintain normal operations, mining pools usually charge a service fee, which directly impacts the miner’s net income. Pools charge different fees depending on the payout method, generally ranging from 1% to 4%.

For example, if a pool has a 2% fee, for every 1 BTC you mine, 0.02 BTC will be deducted by the pool, and the remaining will be your actual earnings. In pools with the same hashrate and block generation frequency, a lower fee means a higher net income.

One thing to note is that different pools use different fee models. Some pools may appear to have a low fee on the surface, but due to different payout methods, the final earnings may not be the highest. Therefore, miners need to consider their own needs and choose the most suitable fee structure.

03 Service Response Times

During the mining process, technical issues or other unexpected situations may arise. Whether a mining pool provides timely and professional customer support is also an important factor when choosing a pool. Especially for home miners, many technical problems can be difficult to solve on their own. Choosing a pool with fast customer support can help miners resolve issues quickly and avoid income losses due to unresolved problems.

Remember, smart miners should compare multiple factors across different mining pools, and ideally test a portion of their hash power for a period to ensure the pool they choose offers the best net earnings.

About ViaBTC

Founded in May 2016, ViaBTC has provided mining services to over one million users across 150+ countries and regions, supporting more than twenty types of cryptocurrencies, including BTC, LTC/DOGE, and KAS. With total mining output surpassing several billion dollars, ViaBTC ranks among the top three BTC mining pools and is the number one LTC mining pool globally.

As a pioneer in the cryptocurrency industry, ViaBTC is committed to a user-first philosophy, offering a secure, stable, and efficient mining experience to global users through robust technology, reliable products, comprehensive tools, and efficient customer support.

Disclaimer: This is a paid post and should not be treated as news/advice.

Source: https://ambcrypto.com/bitcoin-mining-pools-in-2025-a-must-read-guide-for-miners/