Research outline

Research overview

February 2025 was a month of sharp market shifts, challenging the resilience of cryptocurrencies amid macroeconomic uncertainty, regulatory shifts, and security breaches. Following January’s bullish momentum, investor sentiment weakened as Bitcoin fell below $90K, Ethereum struggled with ETF-driven outflows, and institutional participation declined.

The month was defined by:

- Macroeconomic pressures shaping investor sentiment: Inflationary concerns, with U.S. inflation hitting 3.3% YoY, delayed expected Federal Reserve rate cuts. Trump’s 25% tariff announcement on Canada & Mexico fueled global financial uncertainty, impacting risk-on assets like crypto.

- A shift in institutional behavior: While ETF inflows remained positive in early February, net flows turned negative mid-month, resulting in a sharp decline in total assets under management across crypto investment products.

- Security vulnerabilities rattling markets: The Bybit hack ($1.4B stolen) marked the largest security breach in crypto history, triggering panic across centralized exchanges. Simultaneously, DeFi platforms saw renewed scrutiny after the Infini Protocol exploit ($50M) raised concerns over insider risks.

- Altcoin market seesaws between gains and corrections: AI and tokenized asset sectors saw continued investor interest, but an early altcoin rally was erased by late-month sell-offs. Solana, Dogecoin, and Cardano all suffered steep declines.

- NFT & metaverse recalibration: The market saw a downturn in NFT trading volume, yet an increase in unique user engagement suggested a shift toward more organic adoption beyond speculative trading. Meanwhile, Meta’s $50M investment in Horizon Worlds reinforced long-term institutional interest in the metaverse.

- Regulatory discussions take center stage: The SEC’s Crypto Task Force (led by Hester Peirce) signaled intent for clearer policies, while institutional players watched the SAB 121 rollback as a potential catalyst for U.S. banks exploring crypto custody.

- The Trump effect on Bitcoin’s future: AMBCrypto’s investor survey revealed mixed sentiment on Trump’s pro-Bitcoin stance, with expectations of potential regulatory shifts but lingering skepticism about real policy implementation.

Thematic market shifts

- From stability to uncertainty: Institutional optimism from January faded as macro risks and security vulnerabilities shaped investor behavior.

- Diverging retail & institutional trends: Retail traders remained more active during market dips, while hedge funds and institutional investors took a cautious stance or pulled back exposure mid-month.

- Security breaches redefine trust in crypto: The Bybit hack accelerated industry-wide discussions on exchange security frameworks and risk mitigation in centralized platforms.

- Macroeconomic headwinds vs. crypto adoption: External financial pressures, including inflation concerns and trade policies, played a greater role in crypto’s February downturn.

- DeFi and RWAs hold strong despite market turmoil: While the market saw turbulence, real-world asset (RWA) tokenization and DeFi engagement remained resilient, signaling long-term growth potential.

- Trump’s Bitcoin stance: A catalyst or campaign rhetoric? While excitement around Trump’s pro-Bitcoin rhetoric continued, investors remained divided on whether his stance would translate into tangible regulatory action.

Looking ahead

As the market moves into March 2025, investors will be watching:

- Bitcoin’s attempt to reclaim the $100K level, following February’s sharp correction.

- Ethereum’s upcoming Pectra upgrade, which could influence network development and institutional interest.

- The industry’s security response post-Bybit hack, as stakeholders push for stronger risk mitigation.

- Regulatory clarity on ETFs and crypto policies, especially as institutional players assess long-term commitments.

Despite February’s setbacks, the market remains dynamic—balancing near-term caution with long-term potential for growth and innovation.

Key takeaways

Trump’s Bitcoin stance: Market impact or political hype?

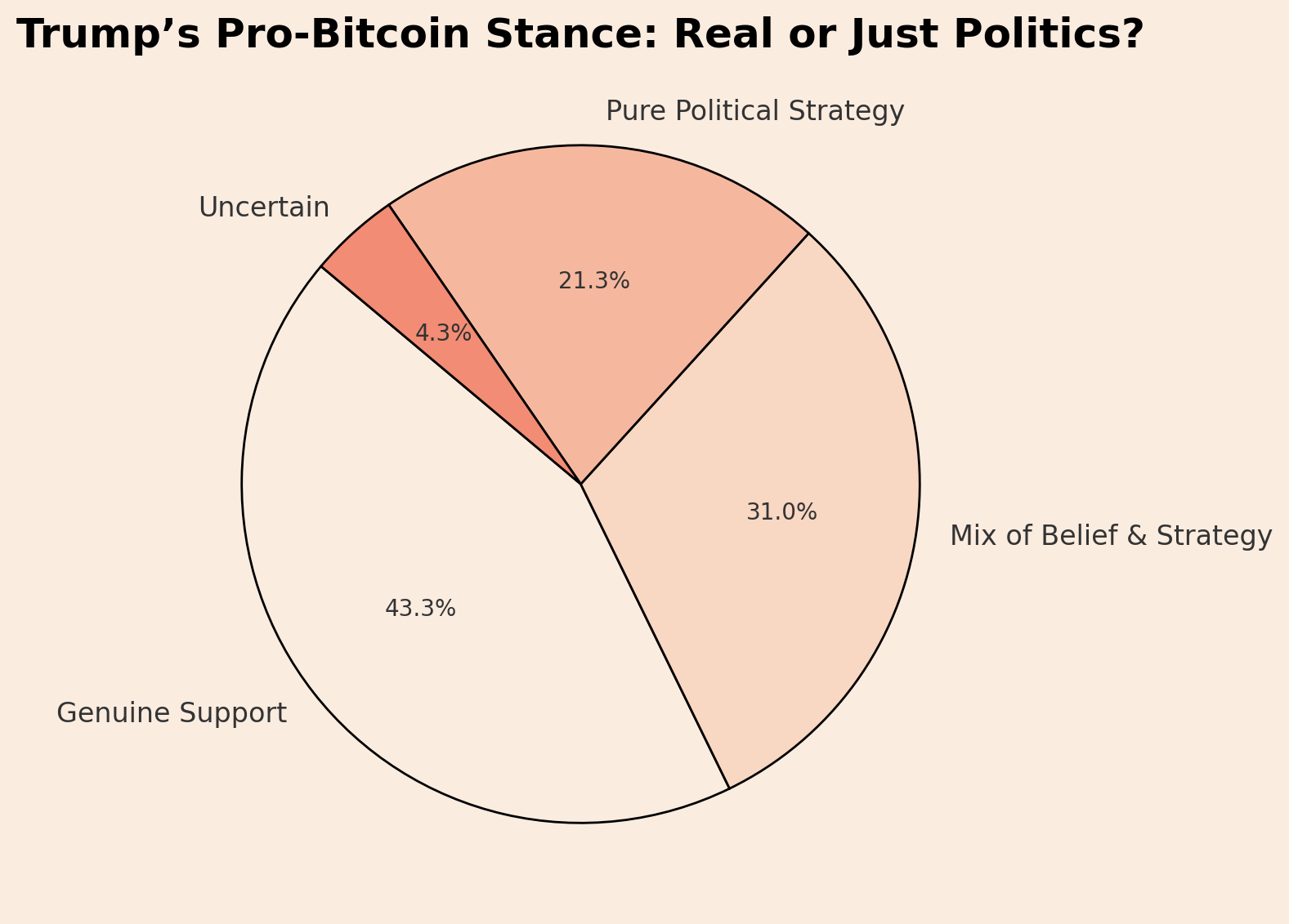

- AMBCrypto’s survey of 4K+ investors revealed mixed opinions on Trump’s pro-Bitcoin stance:

- 43.3% believe he genuinely supports Bitcoin.

- 31% see it as a mix of political strategy and belief.

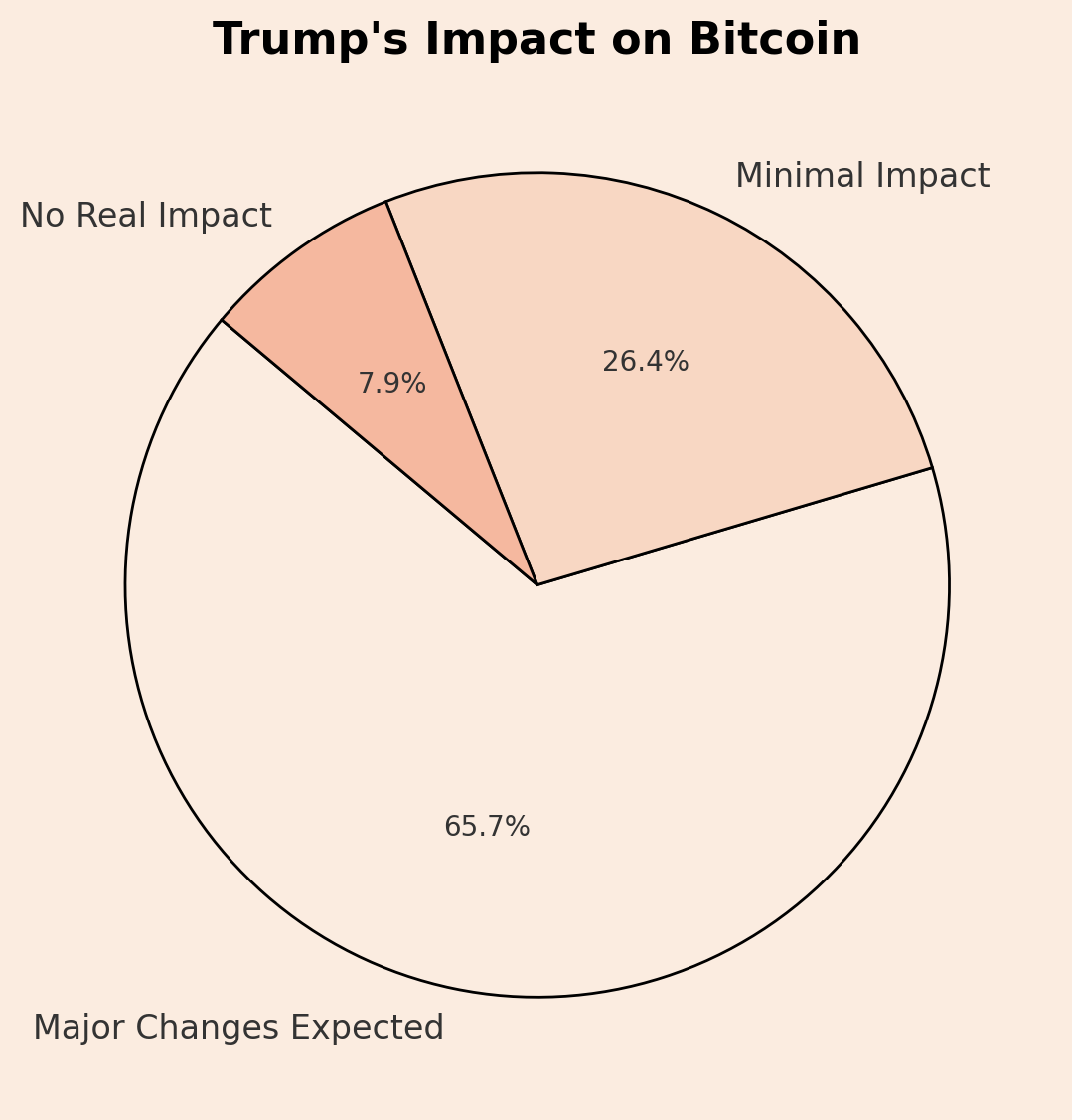

- 65.7% expect Trump’s policies to drive major changes in crypto adoption.

- Discussions on a U.S. Bitcoin reserve surfaced, though still in early stages.

Bitcoin’s volatility: ETF outflows & macro pressures weigh on price

- BTC slipped below $90K for the first time since November 2024, with a mid-month liquidation event exceeding $1.5B.

- ETF flows turned negative: Grayscale Bitcoin Trust (GBTC) outflows continued, weakening BTC’s support.

- BlackRock’s iShares Bitcoin Trust (IBIT) maintained $60B+ in AUM, leading ETF inflows.

- The Crypto Fear & Greed Index dropped to 21 (“Fear”), signaling a sentiment shift.

Ethereum struggles amid ETF uncertainty & market sell-off

- ETH’s price plunged from $3,500 to $2,337, closing the month at $2,413.

- Ethereum ETFs saw daily outflows exceeding 16,000 ETH, reducing institutional exposure.

- 30M+ ETH staked remained a positive metric, reinforcing network security despite price volatility.

Altcoins: Early rally meets harsh reality

- AI & tokenized asset sectors remained resilient, with Fetch.ai & Render Network leading AI token performance.

- Story (IP) surged +205%, Sonic (S) +60%, and Maker (MKR) +58% in early February.

- The late-month correction saw SOL, ADA, DOGE falling ~20%, wiping out gains from January’s rally.

NFT & metaverse: Market cooldown, but utility projects gain traction

- NFT sales volume declined 41.46% MoM to $542.6M, with transactions falling 20.7%.

- DMarket ($40M in volume) led the NFT market, reinforcing the shift toward gaming-related assets over traditional PFP collections.

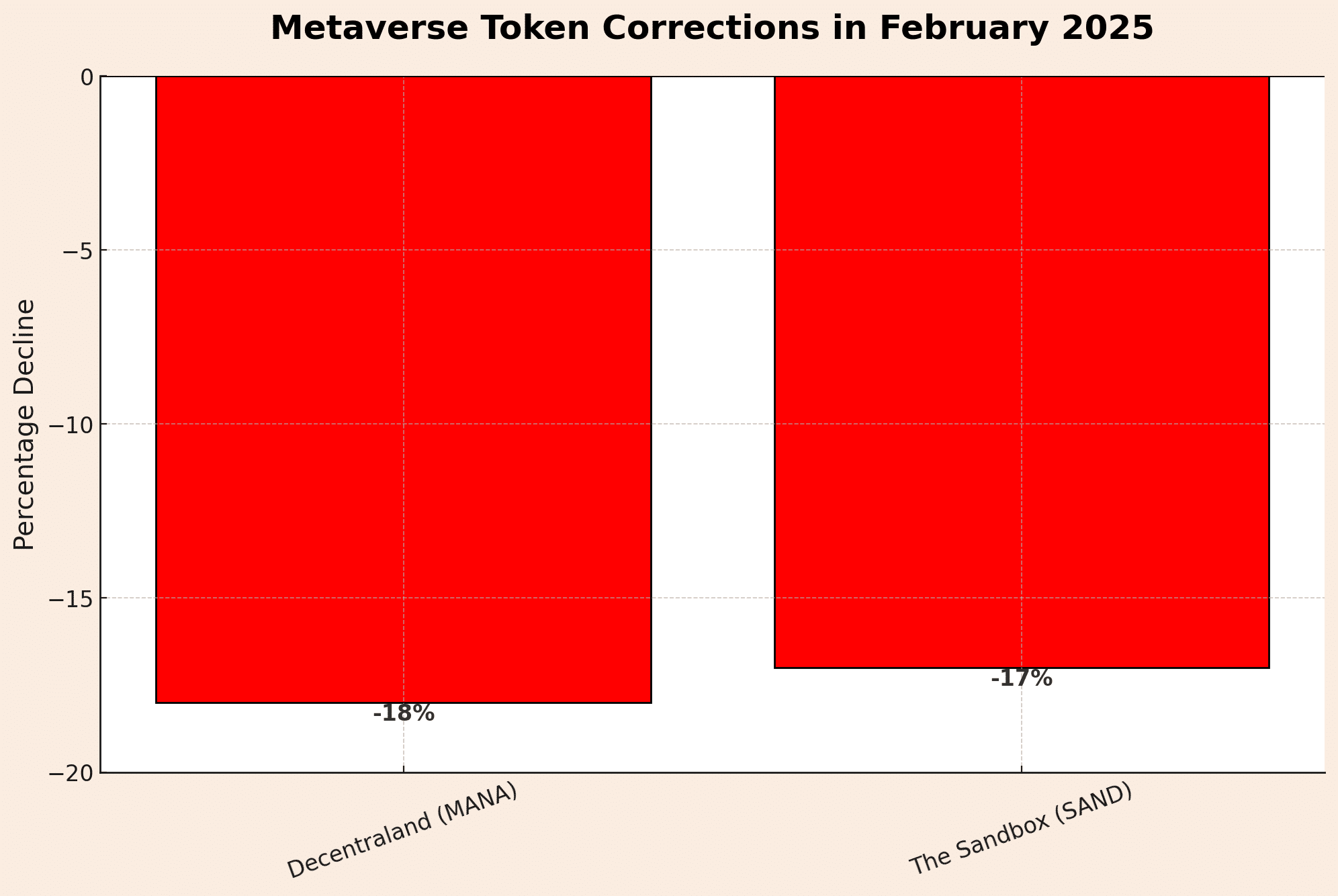

- Metaverse tokens (MANA, SAND) dropped 15–20%, but Meta’s $50M investment in Horizon Worlds signaled long-term corporate confidence.

Institutional investment & regulatory landscape: Mixed trends

- Early February saw $1.9B inflows into BTC & ETH ETFs, but net inflows into crypto investment products dropped sharply from $52B to $26.5B by month-end.

- No new ETF approvals, but Solana, Cardano, & XRP ETF filings gained traction.

- The SEC’s Crypto Task Force (led by Hester Peirce) pledged regulatory clarity, while SAB 121 rescission enabled banks to explore crypto custody.

February 2025: A record-breaking month for crypto exploits

- The Bybit hack ($1.4B stolen) became the largest in crypto history, triggering a broader market downturn.

- Infini DeFi ($50M exploit) underscored insider risks, raising concerns about protocol security.

- Over $1.5B in total crypto hacks made February one of the worst months for security breaches.

AMBCrypto’s survey: 4K+ investors shed light on Trump’s pro-Bitcoin stance

Donald Trump’s recent pro-Bitcoin rhetoric has stirred debates across the cryptocurrency community. While some see it as a genuine shift in policy that could favor Bitcoin adoption, others believe it’s merely a political move designed to rally support. AMBCrypto’s latest survey explores whether Trump’s stance is just hype or if it could truly reshape the crypto market.

Trump’s Bitcoin stance: Genuine support or political strategy?

Trump’s pro-Bitcoin stance: Real or just politics?

Opinions on Trump’s Bitcoin stance are split, though a majority believe there’s at least some sincerity behind it. The survey found that 43.3% of respondents believe Trump genuinely supports Bitcoin, while 31% think it’s a mix of genuine belief and political maneuvering. Meanwhile, 21.3% dismissed it as a pure political strategy, and 4.3% remained uncertain.

This diversity in sentiment highlights the ongoing skepticism surrounding politicians’ involvement in crypto. While some view Trump as a potential catalyst for Bitcoin adoption, others remain wary of overpromised narratives.

Can Trump drive Bitcoin’s growth?

Trump’s impact on Bitcoin

When asked about the potential impact of Trump actively championing Bitcoin, most respondents expressed optimism. A significant 65.7% anticipate major changes, believing that Trump’s policies could accelerate crypto adoption and market growth. However, 26.4% expect only minimal impact, arguing that crypto’s trajectory is independent of political influence. A smaller group (7.9%) believes there would be no real impact at all.

This suggests that while Trump’s stance might fuel excitement, many investors are cautiously watching whether his rhetoric translates into actual policy changes.

What kind of crypto policies could Trump introduce?

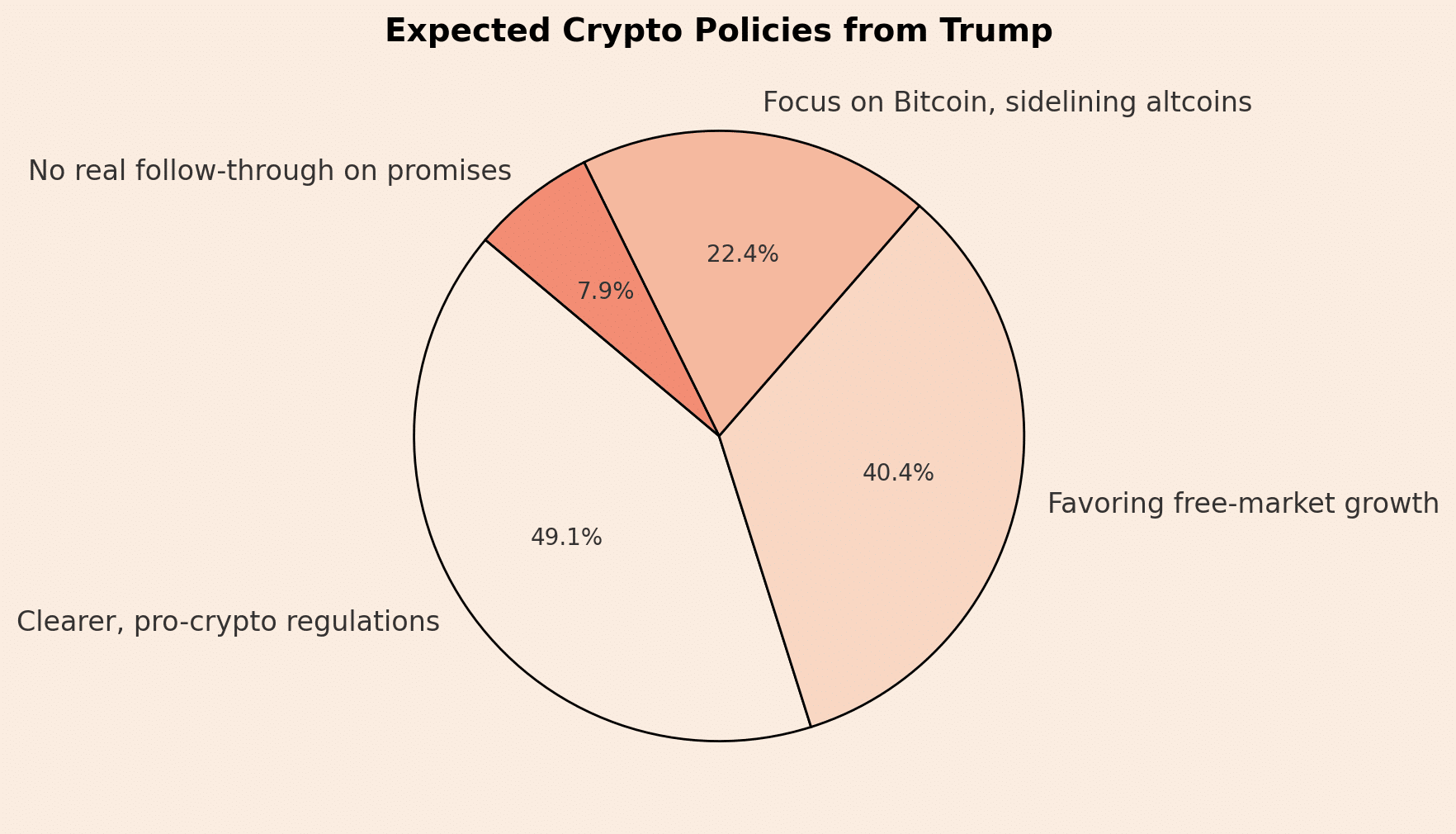

Expected crypto policies from Trump

Survey participants largely expect a crypto-friendly approach under a Trump administration. Nearly 49.1% foresee clearer, pro-crypto regulations that could bring legitimacy to the industry. Meanwhile, 40.4% believe Trump would favor a free-market approach with minimal regulatory interference.

Interestingly, 22.4% think Trump would focus primarily on Bitcoin while being less supportive of altcoins. However, 7.9% remain skeptical, predicting that despite his pro-Bitcoin stance, there may be little real follow-through on regulatory reforms.

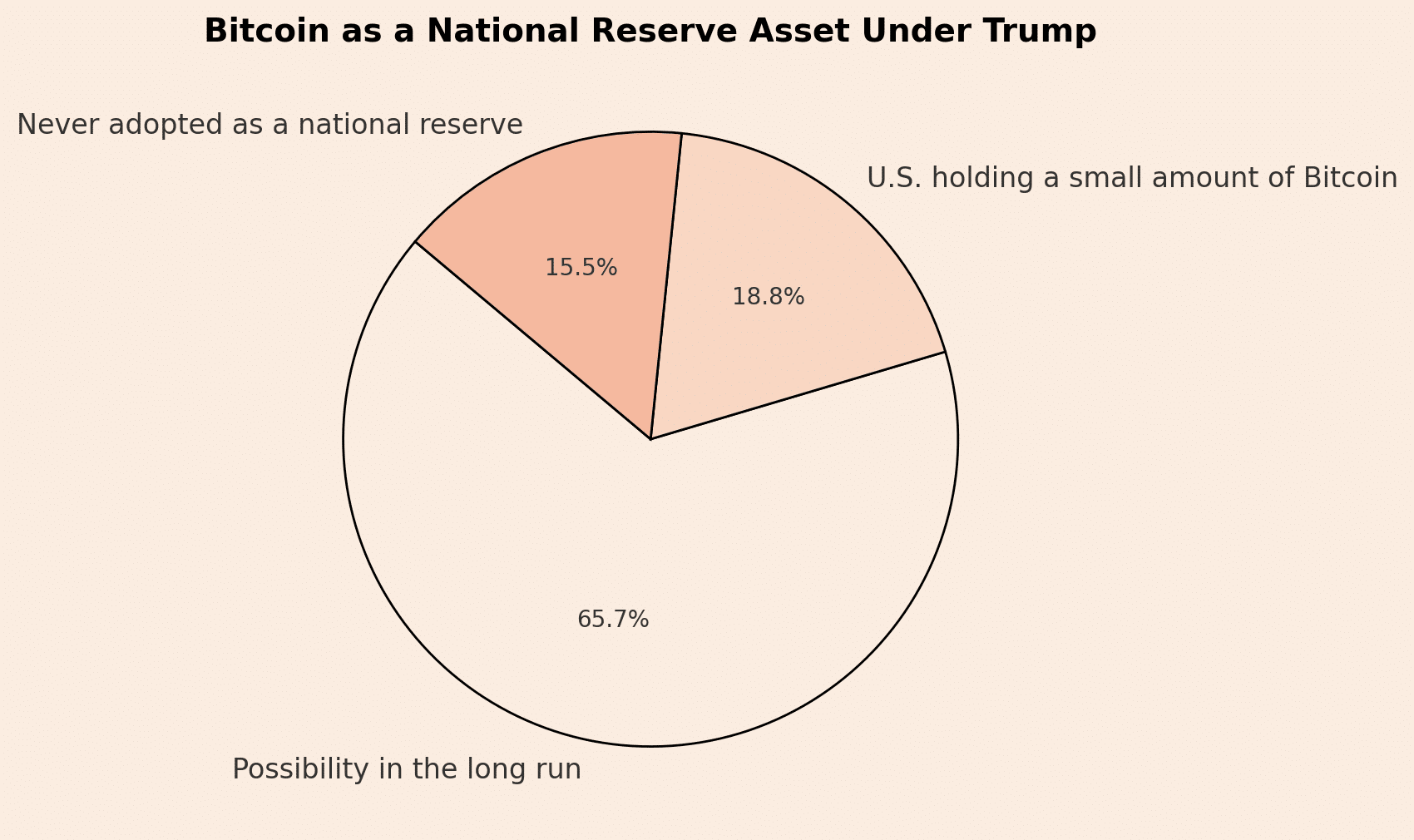

Could Bitcoin become a national reserve asset?

Bitcoin as a national reserve asset under Trump

One of the more ambitious ideas discussed in the survey was whether the U.S. government would hold Bitcoin as part of its national reserves under Trump’s leadership. While still a speculative concept, 65.7% of respondents said they see this as a possibility in the long run.

A more cautious 18.8% believe that while it might happen, the U.S. would only hold a small amount of Bitcoin. Meanwhile, 15.5% flatly rejected the idea, arguing that Bitcoin would never be adopted as part of the country’s reserves.

Hype or real impact? The community weighs in

Overall, AMBCrypto’s survey reveals a largely optimistic view of Trump’s potential impact on Bitcoin and the crypto market. While some skepticism remains, the prevailing sentiment is that his stance is more than just political posturing—it could genuinely shape the industry.

Respondents expect a more crypto-friendly regulatory environment, potential mainstream adoption, and even the possibility of Bitcoin as a national reserve asset. However, concerns persist about whether Trump’s focus on Bitcoin could sideline altcoins and stablecoins.

One respondent summed up the sentiment: “Trump backing Bitcoin might not be just hype, but whether it turns into meaningful action is the real question.”

Bitcoin’s February outlook: Volatility returns as BTC slips below $90K

February 2025 tested Bitcoin’s resilience, as it fell below $90K for the first time since November 2024, with selling pressure intensifying amid macro uncertainty and ETF outflows. Over $1.5B in BTC liquidations occurred in February, making it one of the most volatile months since the ETF approvals.

Bitcoin’s price action: From stability to sharp decline

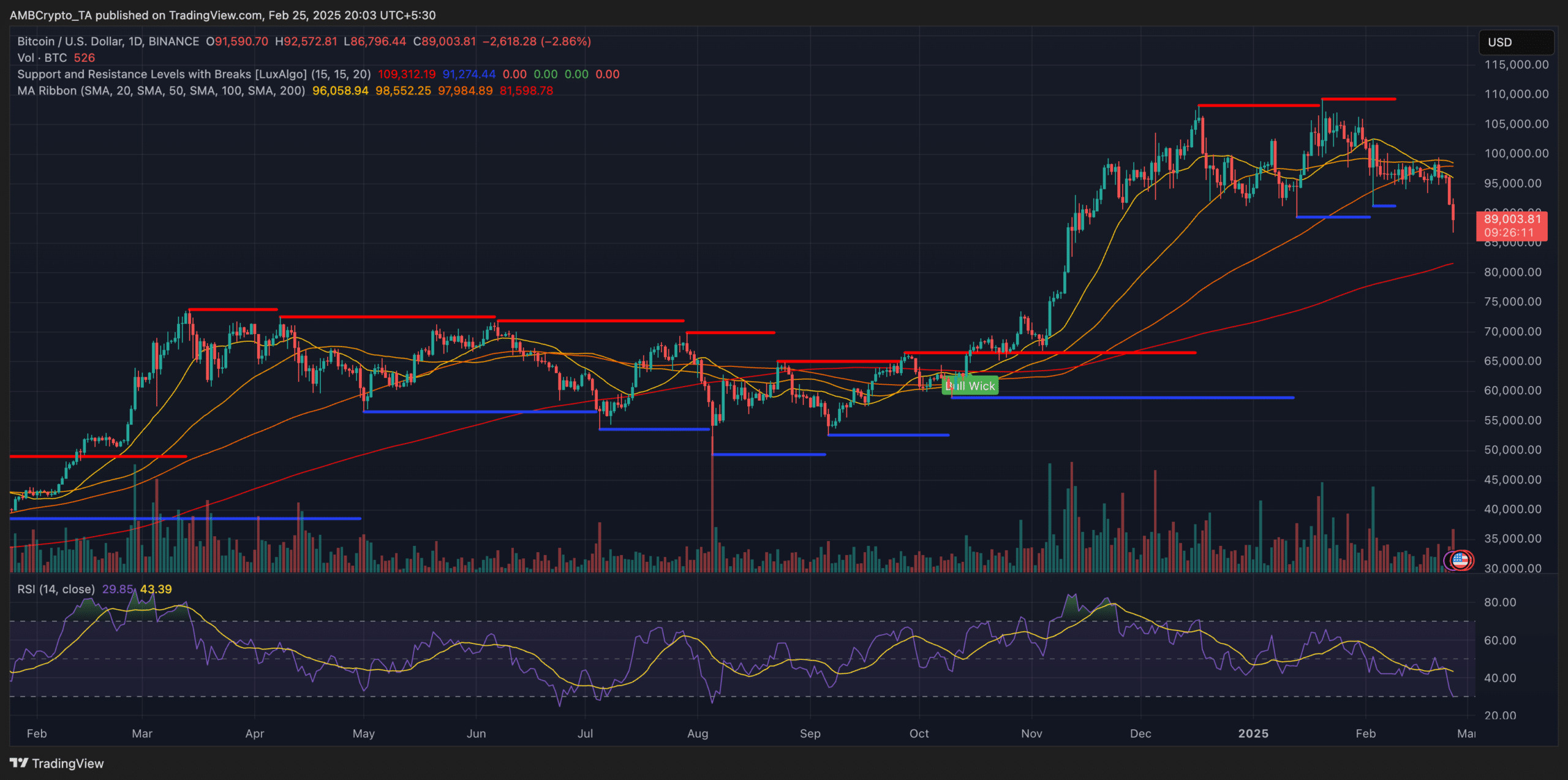

BTC’s price movement | Source: TradingView

Bitcoin entered February with strong momentum, trading above $100K following a bullish January fueled by institutional inflows. However, macroeconomic uncertainty and declining ETF demand triggered a mid-month sell-off, leading to Bitcoin’s sharp correction.

- BTC dropped from $105K to $86K in the final week of February, reflecting a nearly 20% correction.

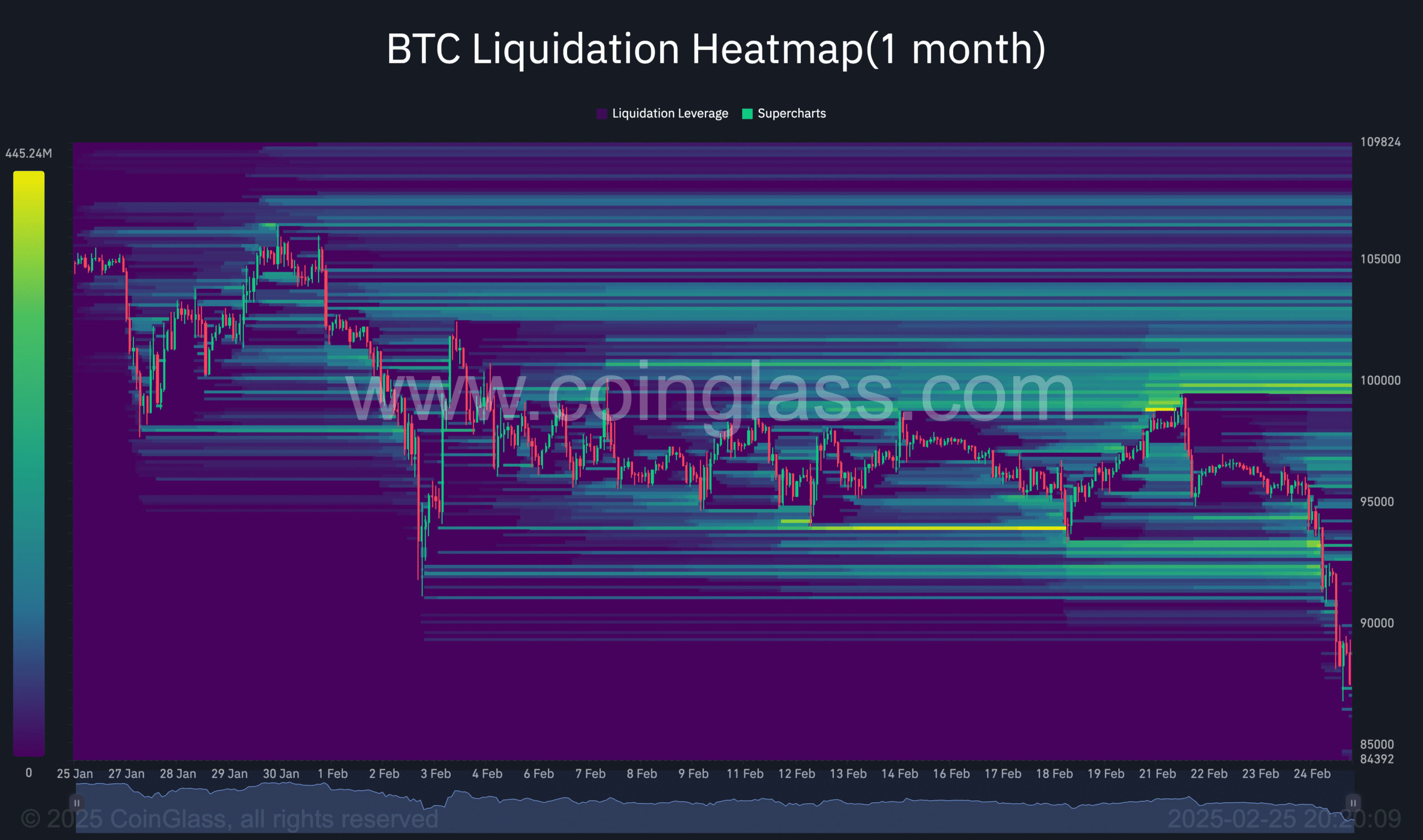

BTC Liquidation Heatmap (1 month) | Source: CoinGlass

- A major liquidation event exceeding $1.5B accelerated the decline, according to Coinglass data.

- The Relative Strength Index (RSI) dropped to 29.85, indicating oversold conditions.

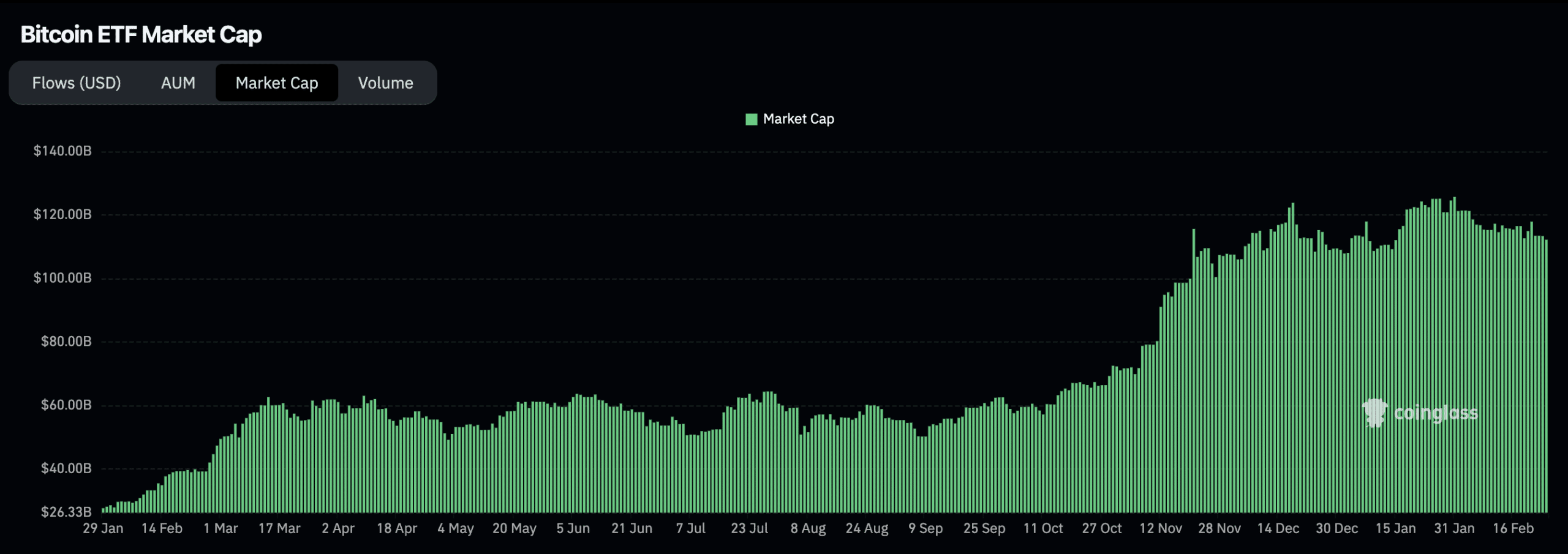

ETF market trends: Inflows slow, GBTC outflows continue

Bitcoin ETF market cap | Source: CoinGlass

After a record-breaking January, Bitcoin ETF inflows slowed significantly in February. The Bitcoin ETF market cap stood at $112.99B, but outflows outweighed new demand in the latter half of the month.

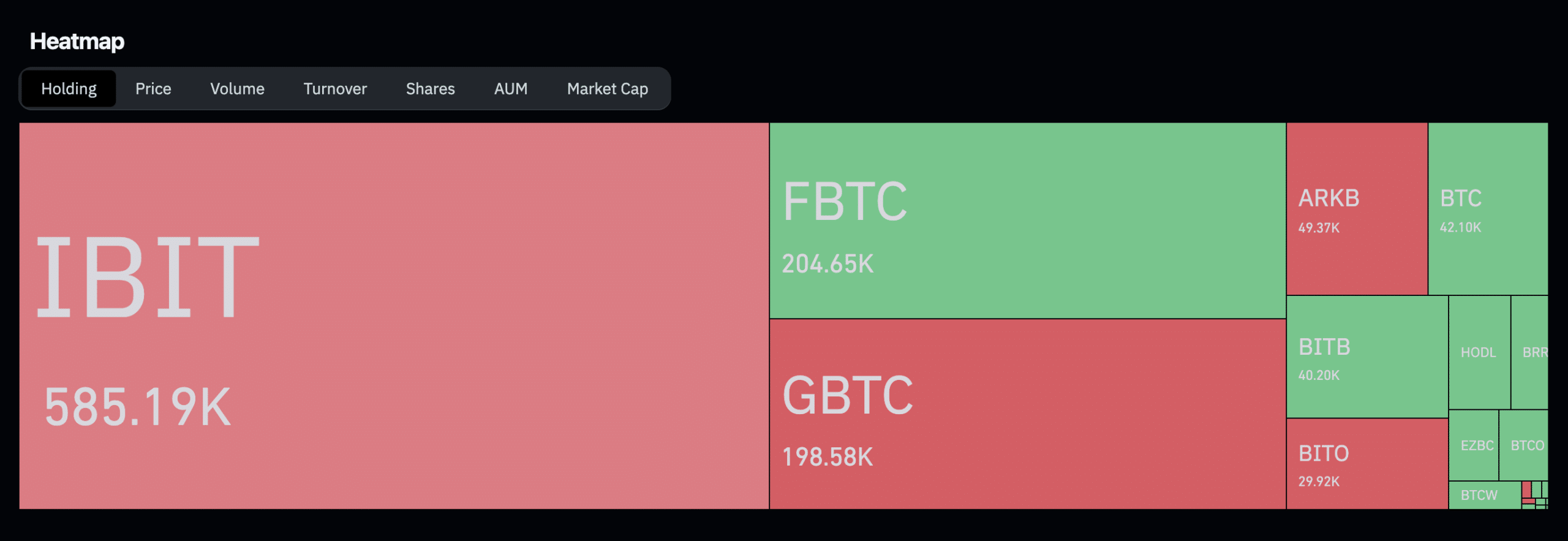

Bitcoin ETF heatmap | Source: CoinGlass

- IBIT led inflows with 585K BTC holdings, while GBTC continued to see outflows, pressuring BTC’s price.

- Net ETF flows turned negative in late February, contributing to Bitcoin’s drop below $90K.

On-chain activity: Retail demand weakens

Bitcoin’s on-chain metrics signaled a drop in retail participation amid the correction.

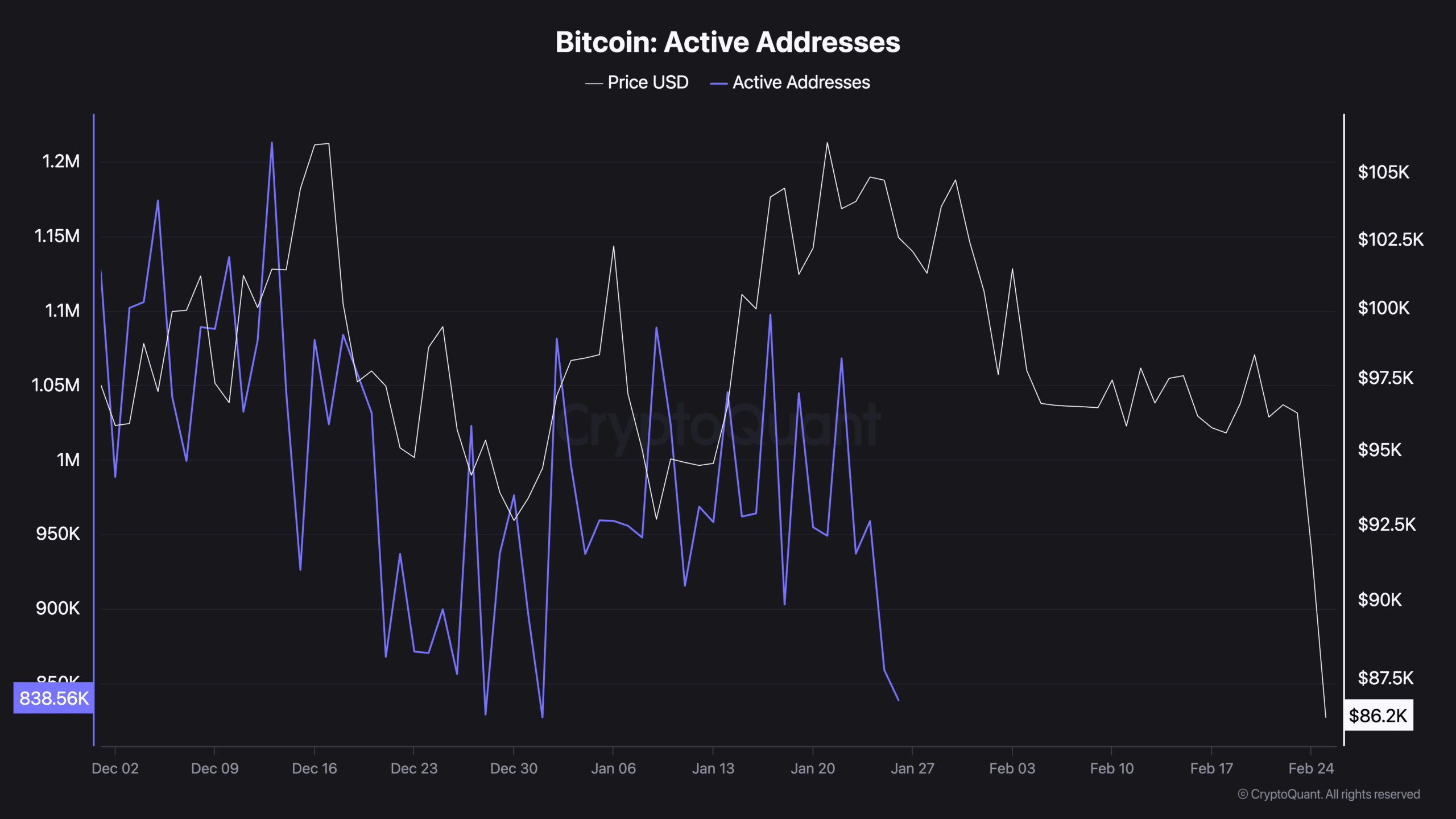

Bitcoin Active Addresses | Source: CryptoQuant

- Active addresses fell below 850K, marking a decline in network engagement.

- New BTC address creation dropped, reflecting reduced interest from new retail entrants.

- Exchange reserves saw an uptick, indicating potential profit-taking by investors.

Holders’ sentiment: Panic selling vs. long-term conviction

Short-term traders reacted to the market downturn, while long-term holders showed mixed signals.

- Short-term holder (STH) supply declined, suggesting a wave of selling from newer investors.

- Long-term holder (LTH) supply remained stable, though some profit-taking occurred at $100K levels.

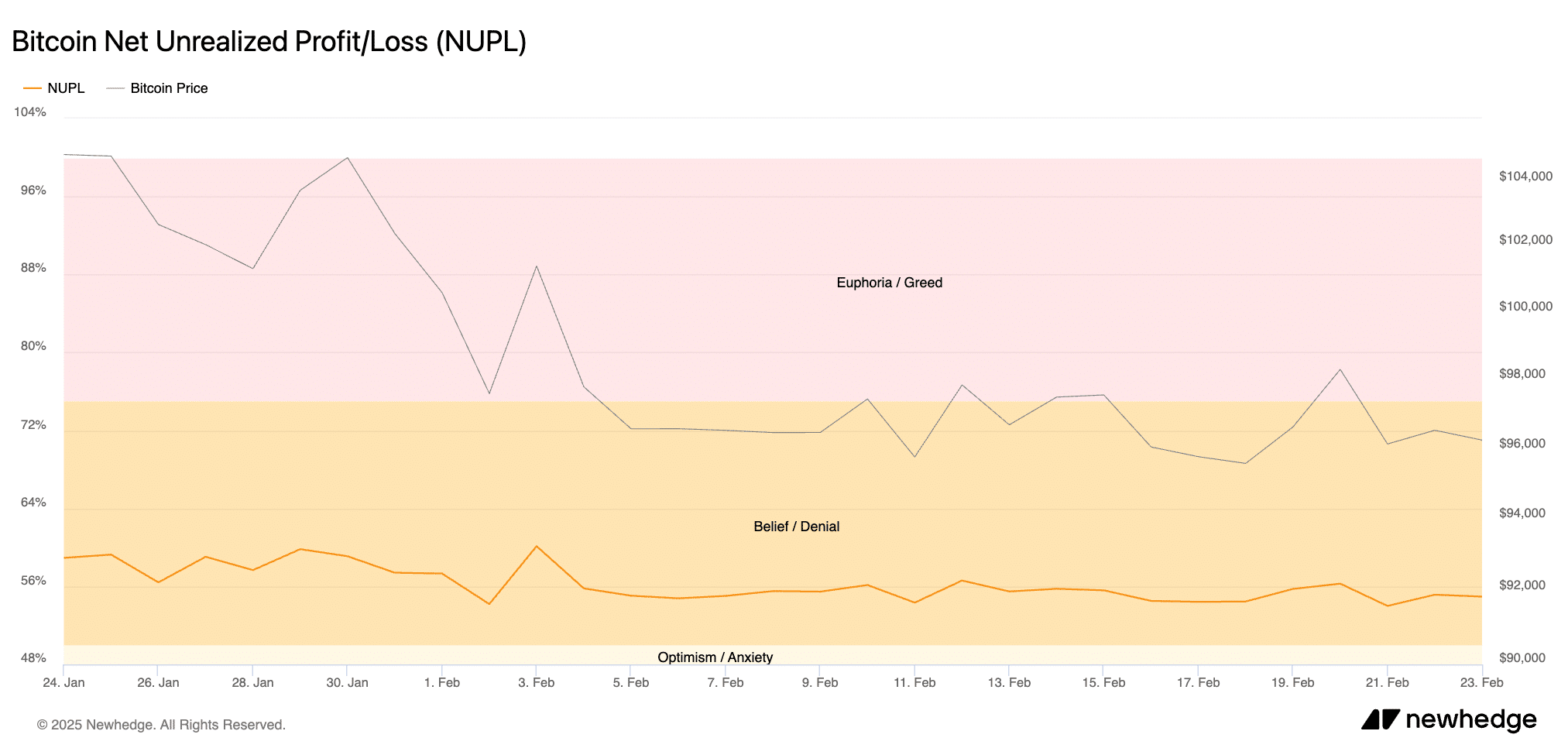

Bitcoin Net Unrealized Profit/Loss (NUPL) | Source: Newhedge

- Net Unrealized Profit/Loss (NUPL) entered the “Belief/Denial” zone, showing a fading bullish sentiment.

Market sentiment: Fear returns

Crypto Fear & Greed Index | Source: CoinGlass

Bitcoin’s drop below $90K coincided with a sharp decline in investor sentiment. The Crypto Fear & Greed Index fell to 21 (“Fear”), reflecting a shift from optimism to caution. However, despite the downturn, 73.33% of the month was spent in “Neutral”, indicating that panic selling wasn’t widespread, and investor confidence remained relatively intact.

What’s next for Bitcoin?

With BTC struggling to reclaim $95K, the market’s next moves will depend on ETF flows, macroeconomic policies, and investor sentiment.

- If ETF inflows recover, BTC could attempt to reclaim the $100K mark.

- However, continued macro uncertainty and further liquidations may extend Bitcoin’s correction.

- Long-term holders remain confident, but volatility is likely to persist in March.

Ethereum’s monthly market overview: ETF uncertainty weighs on ETH

Key points

- Ethereum’s price dropped from $3,500 to $2,337 before recovering to $2,413.

- Ethereum ETFs saw significant outflows, with daily net outflows exceeding 16,000 ETH.

- Staking remained strong, with over 30M ETH staked and 900K+ active validators.

- Derivatives markets turned bearish, with declining open interest and negative funding rates.

Ethereum’s price performance in February

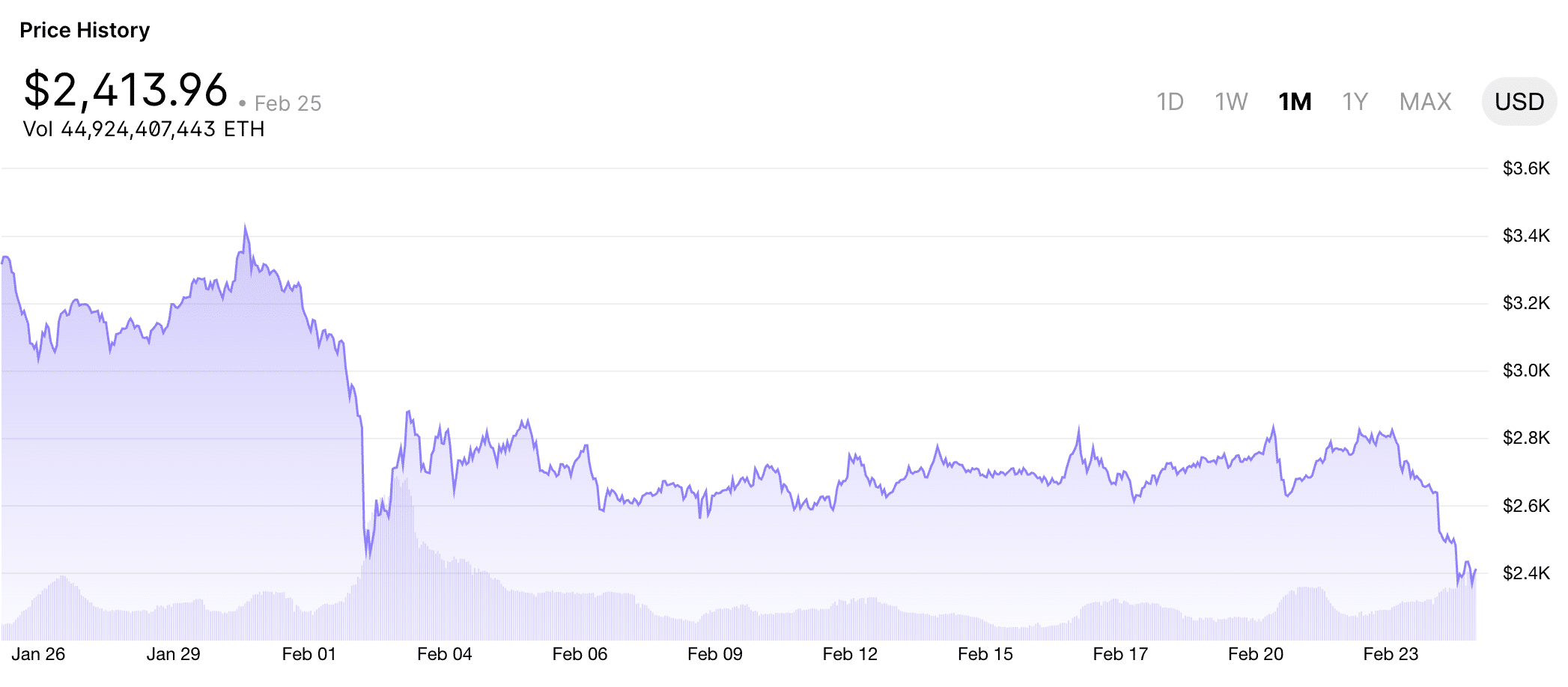

ETH price history | Source: Blockchain.com

Ethereum experienced a sharp correction in February, mirroring Bitcoin’s downward trajectory. After starting the month near $3,500, ETH faced heavy selling pressure, dipping to $2,337, its lowest level since October 2024. The decline was fueled by:

- ETF outflows leading to weaker institutional demand.

- Macroeconomic concerns, including rising U.S. inflation.

- Overall market sentiment shift, as the Fear & Greed Index hit extreme fear levels.

By the end of February, ETH rebounded slightly to $2,413, but the overall trend remained bearish.

ETF outflows and institutional sentiment

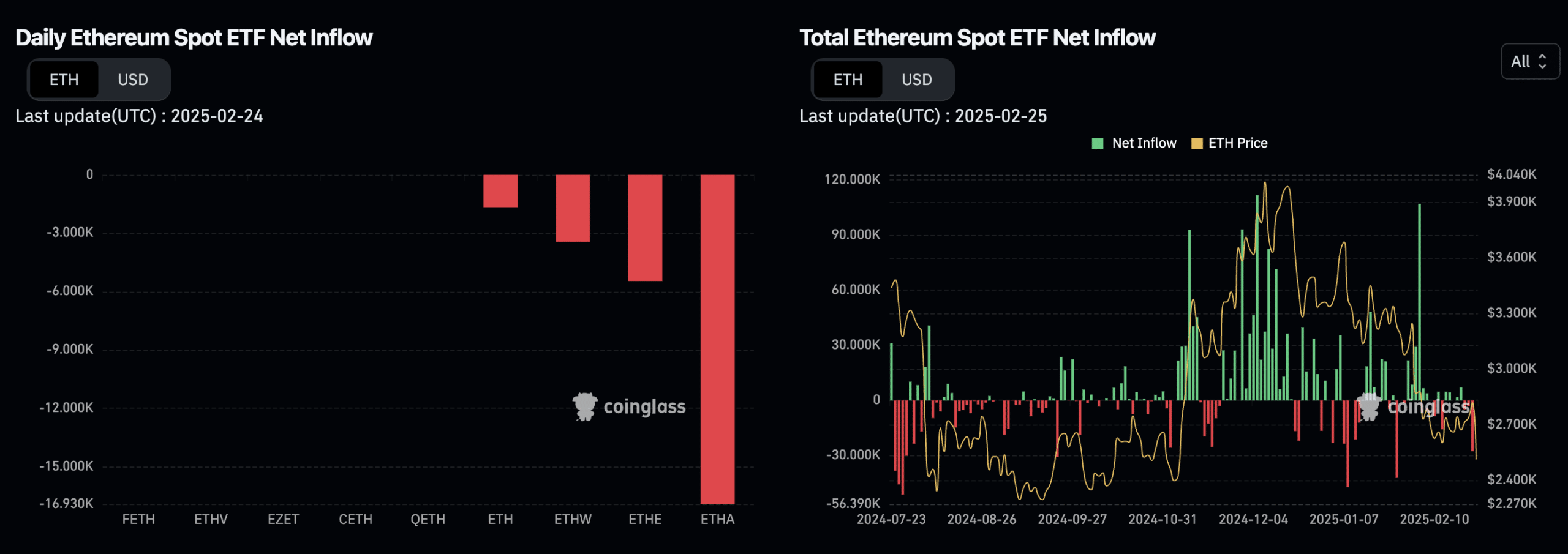

Daily Ethereum Spot ETF Net Inflow and Total Ethereum Spot ETF Net Inflow | Source: CoinGlass

Ethereum’s ETF market saw consistent outflows throughout February, contrasting with Bitcoin’s early ETF-driven momentum. Daily outflows exceeded 16,000 ETH, reflecting weak investor confidence in Ethereum’s ability to attract institutional capital compared to Bitcoin.

Ethereum ETF assets under management (AUM) declined to $10.18B, with major funds like iShares Ethereum Trust ETF (ETHA) and Grayscale Ethereum Trust ETF (ETHE) posting losses of -7.73% and -8.13%, respectively.

This ETF uncertainty contributed to ETH’s underperformance relative to BTC, reinforcing concerns that Ethereum may struggle to replicate Bitcoin’s institutional adoption.

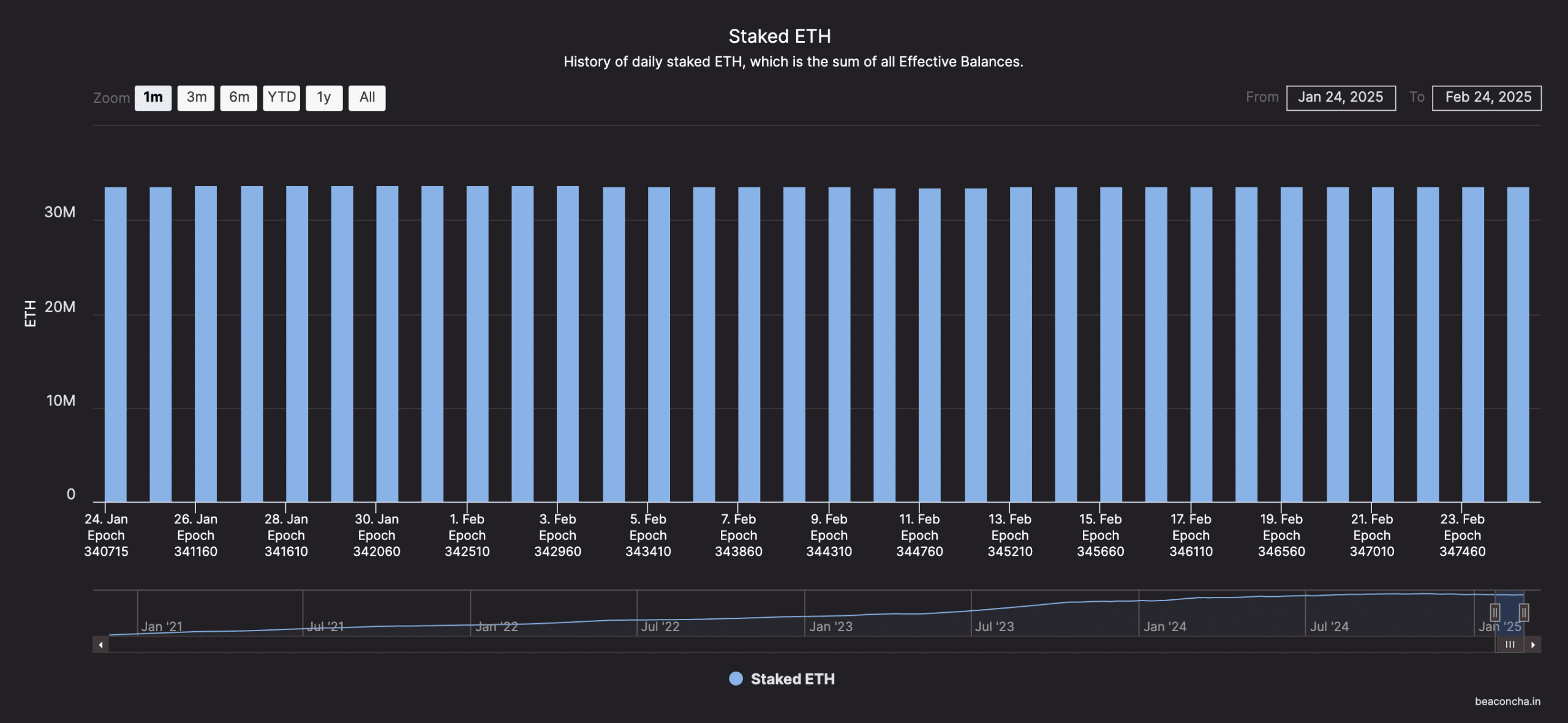

Staking and network security metrics

Staked ETH | Source: beaconcha.in

Despite price volatility, Ethereum staking remained robust, with 30M+ ETH staked and over 900K active validators ensuring network security.

- The number of validators remained stable throughout February, suggesting long-term holders continue to lock assets despite market fluctuations.

- Staked ETH supply reached an all-time high, further reducing Ethereum’s liquid supply on exchanges.

This highlights Ethereum’s resilience, as long-term network participants appear unfazed by short-term price action.

Market liquidity and derivatives trends

Ethereum’s futures and options markets signaled a shift in sentiment, with:

- Open interest declining, suggesting reduced leverage activity.

- Funding rates turning negative, indicating traders were shorting ETH more aggressively than going long.

- ETH liquidity on exchanges remaining flat, suggesting weaker buying interest.

These trends reflected a cautious outlook, with traders positioning for further downside or consolidation.

What’s next for Ethereum?

Looking ahead, Ethereum’s price direction will largely depend on ETF demand, macroeconomic conditions, and upcoming protocol developments.

- The Pectra upgrade, set for Q2 2025, could renew optimism if it brings expected network efficiency improvements.

- Further ETF approval clarity could revive institutional interest if market sentiment shifts favorably.

- Staking growth suggests long-term confidence, but short-term volatility is likely to persist.

Ethereum’s fundamentals remain strong, but price action will be dictated by external factors, particularly institutional participation and macroeconomic developments.

February’s altcoin market update: Early rally and correction

Altseason optimism meets reality

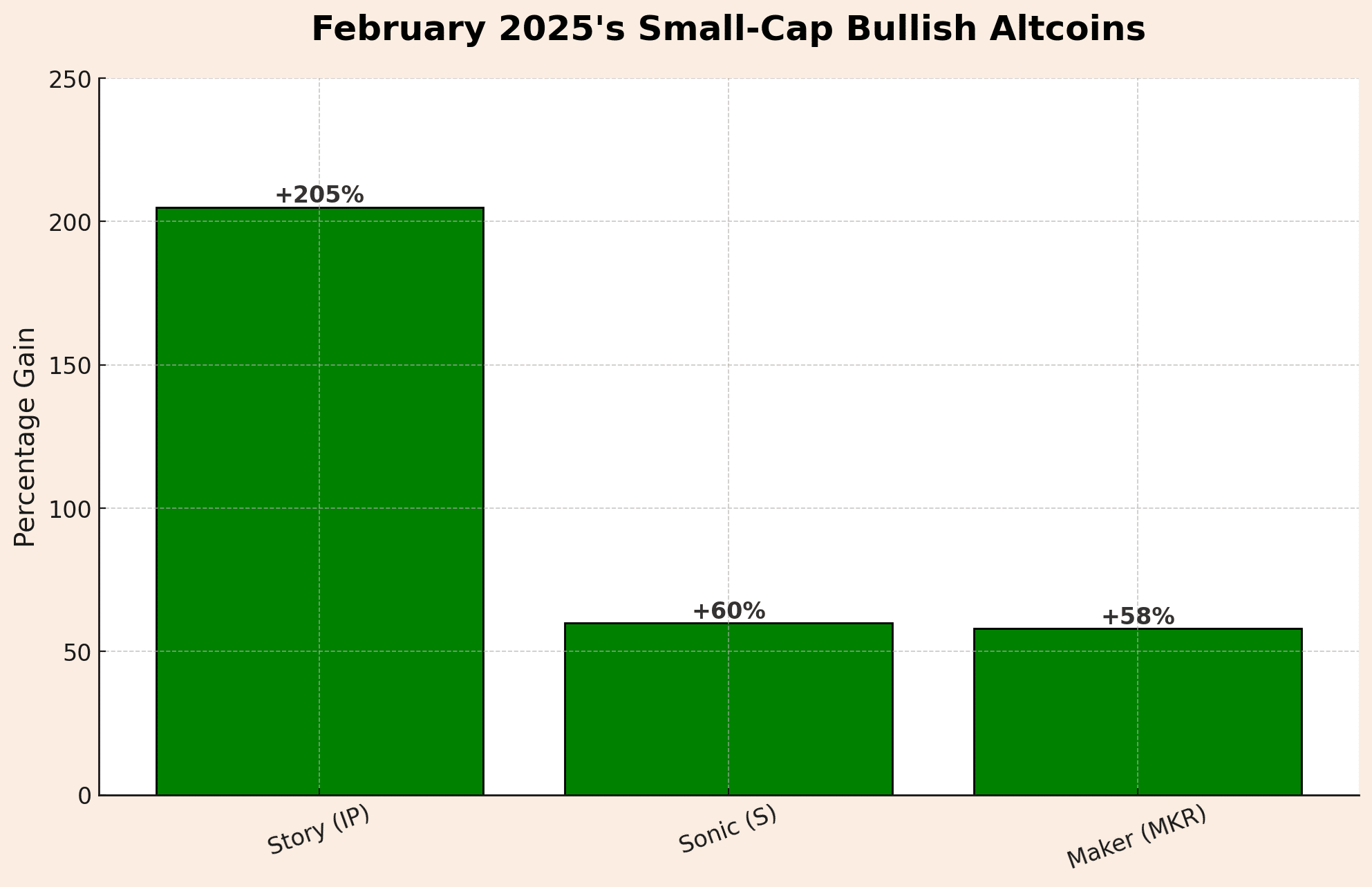

February 2025’s small-cap bullish altcoins

The bullish momentum from January spilled into early February, sparking renewed altseason optimism. Analysts anticipated a strong rotation into altcoins, with Ethereum’s early strength fueling speculation. Smaller caps witnessed explosive rallies—Story (IP) surged +205%, Sonic (S) jumped +60%, and Maker (MKR) gained +58% as traders sought high-growth opportunities.

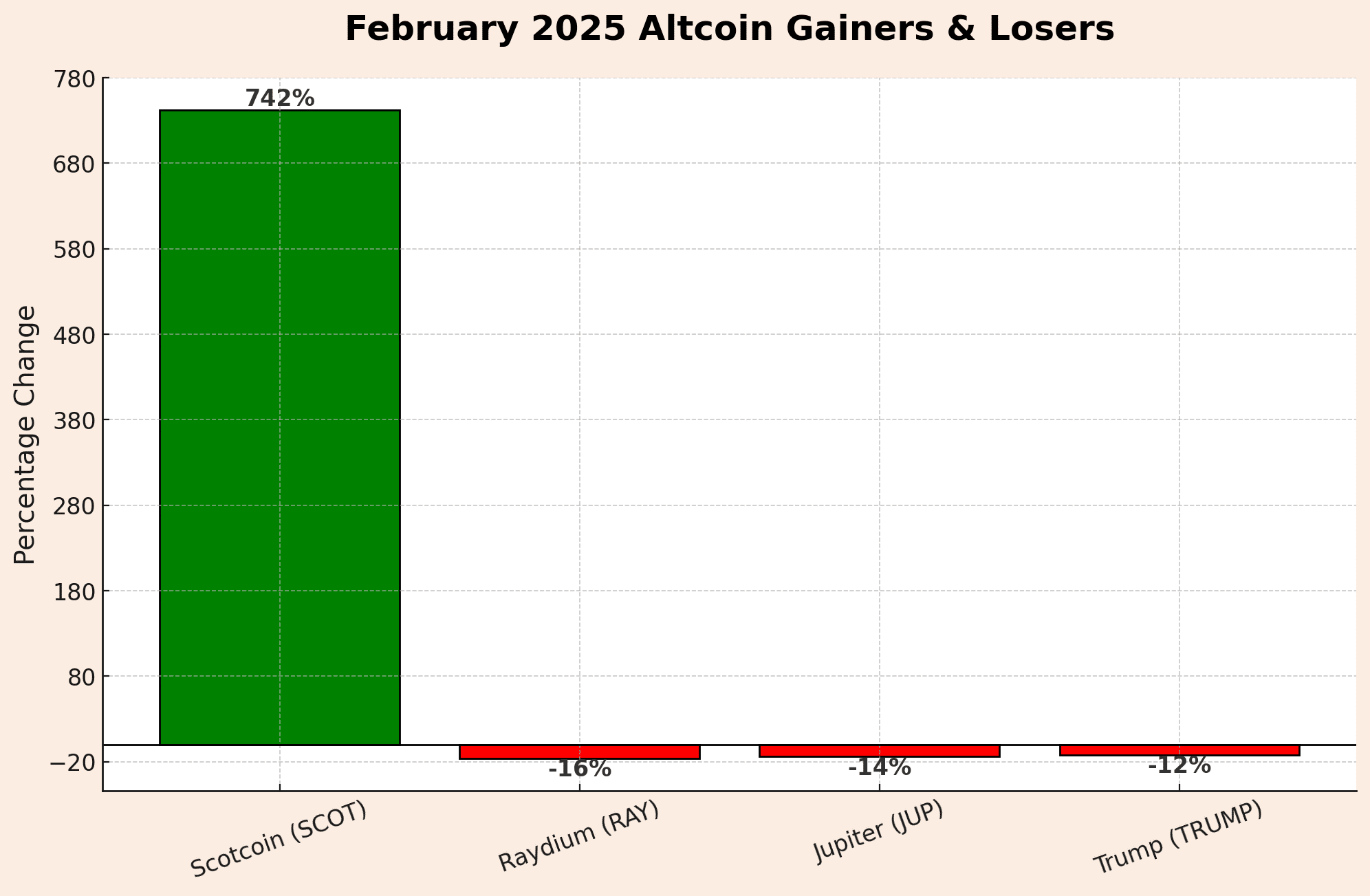

Winners vs. losers: A tale of two halves

February 2025 altcoin gainers & losers

The altcoin market saw divergent performances—some tokens skyrocketed on speculation, while others crumbled. Scotcoin (SCOT) led the rally with a staggering +742% gain, making it the top performer among the top 1000 tokens. However, the Solana ecosystem and memecoins struggled mid-month, with Raydium (RAY) dropping -16%, Jupiter (JUP) sliding -14%, and the once-hyped Trump (TRUMP) token losing -12%.

Major altcoins hit hard by late-February sell-off

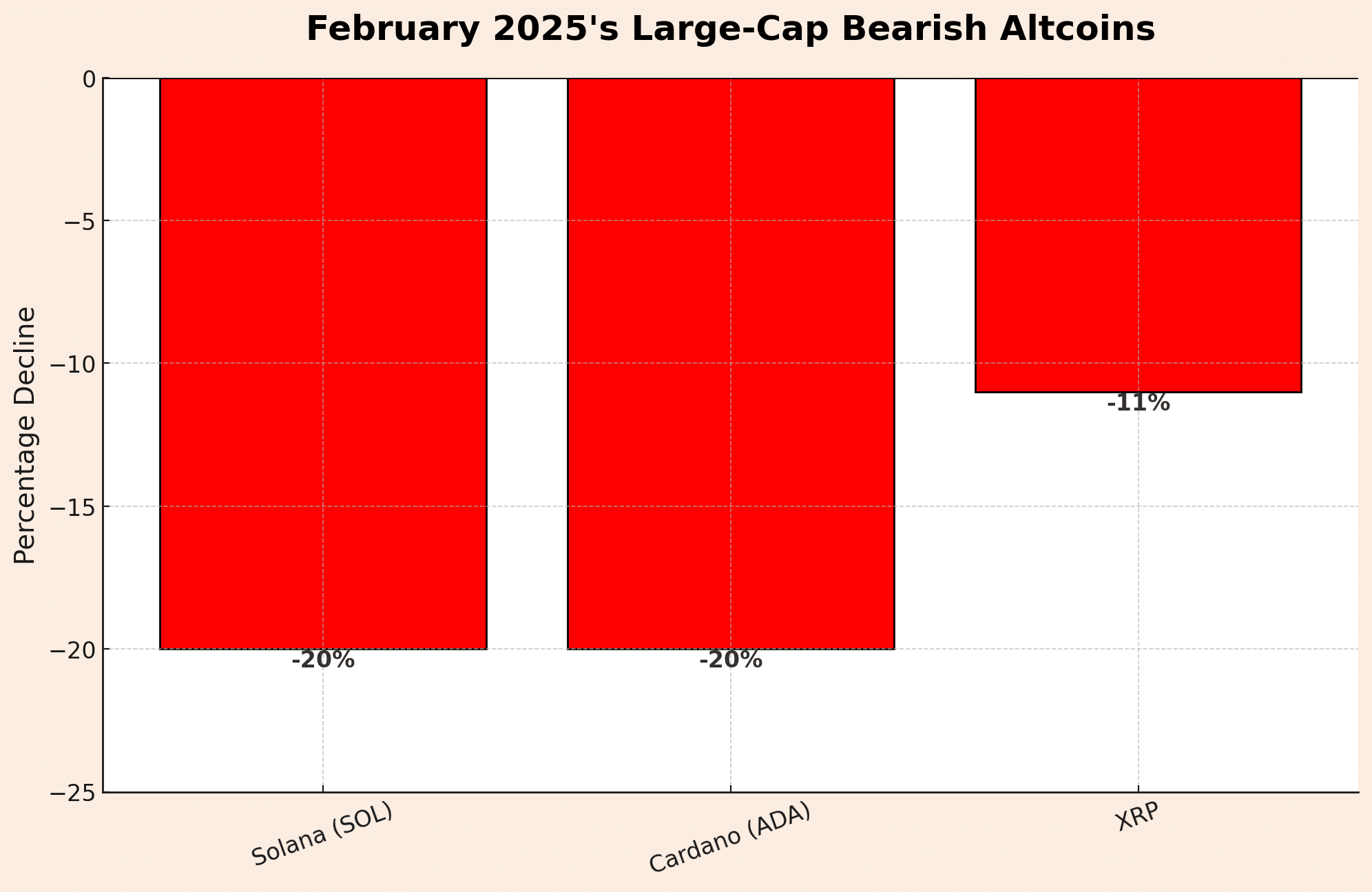

February 2025’s large-cap bearish altcoins

The late-month market correction disproportionately affected large-cap altcoins compared to Bitcoin. Solana (SOL) and Cardano (ADA) each plunged by ~20%, underperforming BTC. SOL, which had reached an all-time high of ~$295 in January, tumbled to ~$140, marking a significant drawdown. XRP, after a strong January, dropped ~11% to ~$2.21, reflecting a shift to a risk-off environment.

Memecoins & speculative tokens: Hype vs. reality

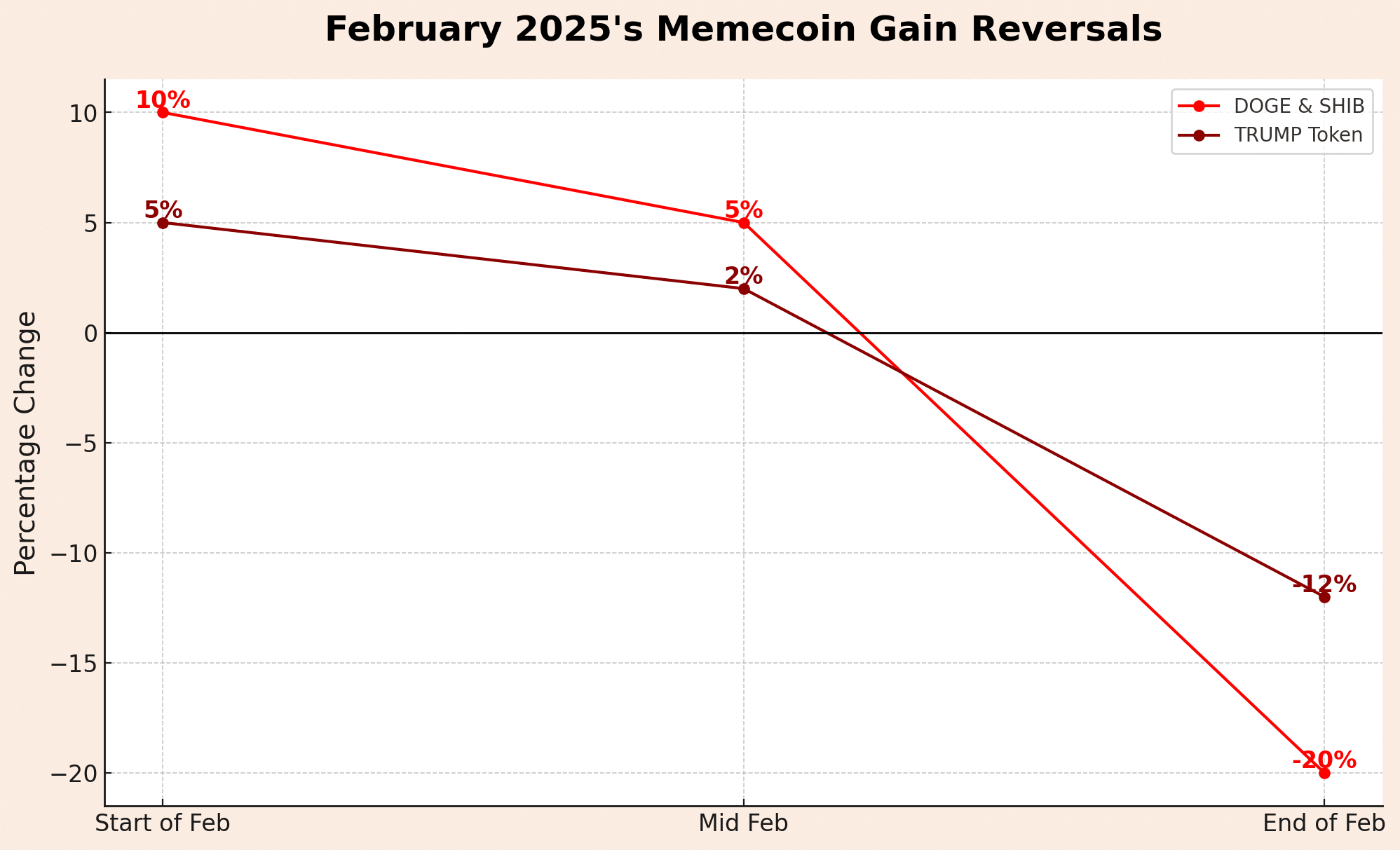

February 2025’s memecoin gain reversals

The memecoin frenzy cooled off in February, with many high-flying tokens reversing gains:

- DOGE and SHIB started strong but dropped ~20% by month-end, mirroring broader altcoin weakness.

- Official Trump (TRUMP) token lost −12% in a week as political speculation around the token died down.

- New speculative tokens like Book of Meme (BOME) and Cheems (CHEEMS) briefly surged but failed to maintain momentum.

Despite these declines, memecoins remained highly traded, showing that speculative interest persists even during corrections. Analysts noted that DOGE and SHIB still dominate memecoin market caps, and a renewed risk appetite could fuel another breakout.

Notable sectoral trends: AI and tokenized assets maintain growth

Despite volatility, some altcoin sectors remained resilient. AI-focused tokens like Fetch.ai and Render Network continued their upward trajectory, maintaining high trading volumes as investors explored AI-blockchain synergies.

Similarly, tokenized asset platforms (e.g., Ondo, MantraDAO) sustained their growth momentum from January, with the tokenized securities market cap reaching $72B, up ~7.7% in January and likely holding firm through February. These trends indicate that fundamentally strong altcoin narratives persisted even amid market turbulence.

Regulations, institutions, and macro trends: February’s market shapers

Institutional investment & market trends

Early-month inflows, late-month pullback

- Institutional enthusiasm remained strong in early February, fueled by the “Trump bump” and the ETF momentum from January.

- $1.9 billion flowed into Bitcoin and Ethereum ETFs in the first week, with BlackRock’s iShares Bitcoin Trust (IBIT) surpassing $60B in assets under management.

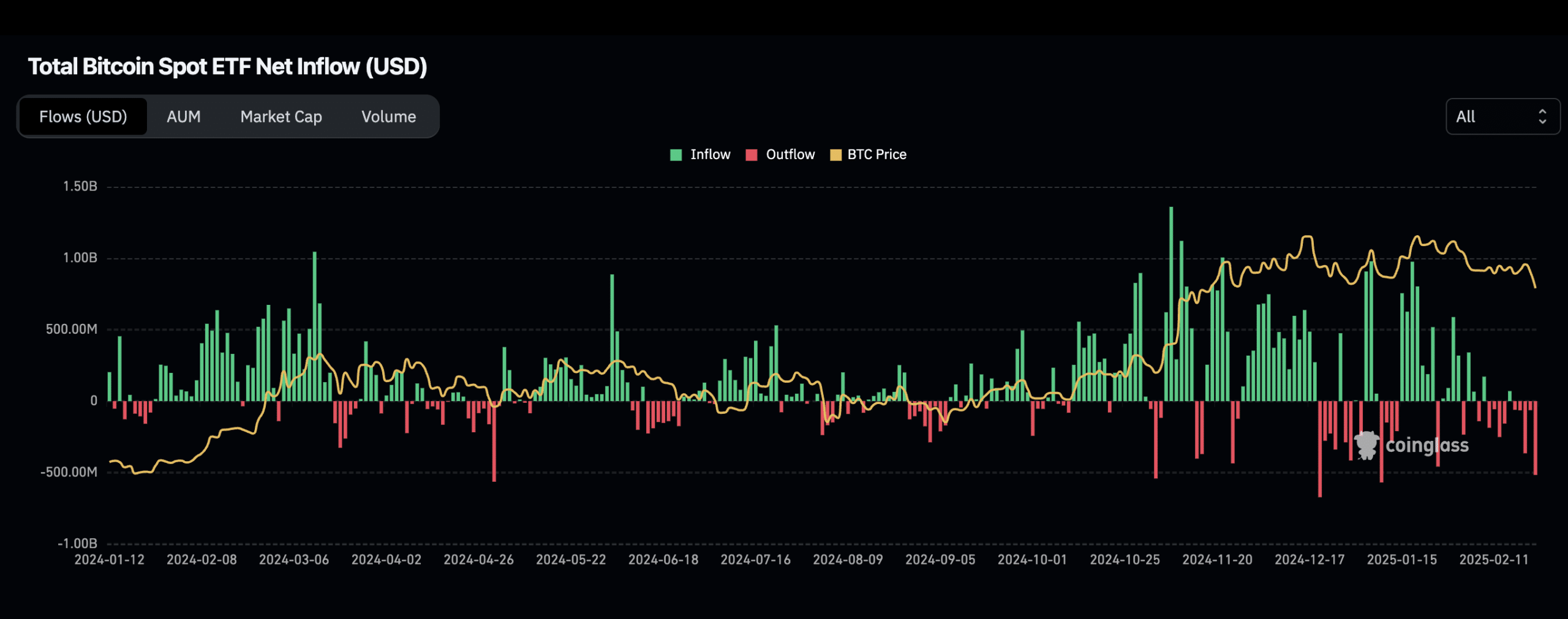

Total Bitcoin Spot ETF Net Inflow (USD) | Source: CoinGlass

- Net inflows into crypto investment products declined sharply in February, dropping by nearly 50% from approximately $52 billion earlier in the month to around $26.5 billion by the end of February. This reversal was driven by institutional outflows from Bitcoin ETFs, heightened macroeconomic uncertainty, and the fallout from the record-breaking $1.4 billion Bybit hack.

- However, despite the slowdown in new capital inflows, total assets under management (AUM) across crypto investment products remained well above $100 billion globally.

ETF market developments

- While no new ETFs were approved in the U.S., Bitcoin ETFs continued to trade between $3–4B weekly, signaling consistent institutional interest.

- Ethereum ETFs maintained relevance, averaging $300M+ in weekly volume, though price declines mirrored the broader market downturn.

- New ETF proposals emerged, including an Ethereum spot ETF, Bitcoin mining ETF, and a growing push for altcoin ETFs (Solana, Cardano, XRP).

Major institutional moves

- Bitcoin Depot (NASDAQ-listed crypto ATM firm) added 11 BTC to its corporate treasury, mimicking MicroStrategy’s Bitcoin accumulation model.

- Hedge funds re-entered Bitcoin positions near $90K after taking profits above $100K earlier in the month.

- Venture capital funding focused on crypto infrastructure and security startups, following a rise in high-profile hacks.

Regulatory shifts: The U.S. and global impact

Pro-crypto policies under Trump

- The SEC’s Crypto Task Force, led by Hester Peirce, outlined key priorities to clarify ETF approvals and crypto regulation.

- SAB 121 (restricting banks from holding crypto) was rescinded, enabling banks to explore crypto custody solutions.

- Congress informally discussed a U.S. Bitcoin reserve proposal, though it remains in early stages.

Global regulatory landscape

- Europe: Officials accelerated MiCA implementation, raising expectations for increased institutional crypto adoption in 2025.

- Asia: Hong Kong expanded its pro-crypto stance, with rising exchange licensing applications to accommodate retail crypto trading.

- Latin America & the Middle East:

- El Salvador’s Bitcoin bonds saw strong demand, reinforcing its Bitcoin-backed financial strategy.

- Dubai strengthened exchange oversight to prevent security breaches like the Bybit hack.

Macroeconomic influence on crypto markets

Federal Reserve policies & interest rates

- Speculation over potential rate cuts in 2025 drove risk-on sentiment in early February, supporting Bitcoin’s price action.

- However, mid-month inflation concerns triggered market volatility, leading institutions to reduce crypto exposure.

Strong U.S. dollar impact

- A stronger U.S. dollar pressured Bitcoin’s price, with institutions trimming crypto holdings amid currency strength.

Outlook: Institutional caution, but long-term adoption

- Despite February’s volatility, regulatory clarity and ETF integration strengthened crypto’s institutional appeal.

- If macro conditions stabilize, institutional inflows are likely to resume, reinforcing crypto’s growing role in traditional finance.

NFT market trends

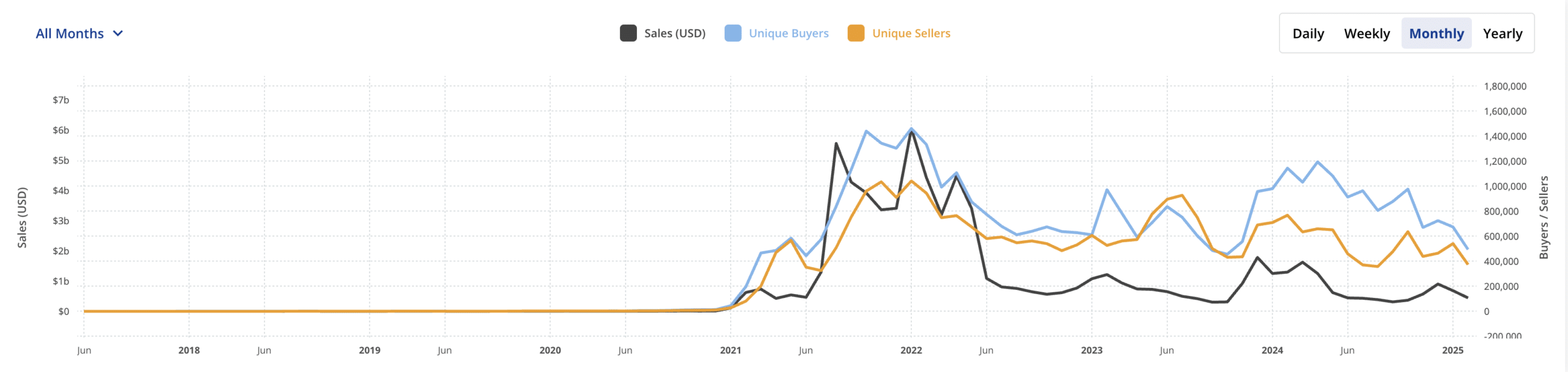

NFT Global Sales Volume | Source: CryptoSlam

The NFT market in February 2025 witnessed a sharp decline in sales volume and transaction activity, reflecting continued market consolidation post-hype. According to on-chain data:

- Total NFT sales volume for the month stood at $542.6M, representing a 41.46% decline from January’s $680.1M.

- Total transactions fell to 5.49M, down 20.7% MoM from January’s 5.47M.

- Wash trading volume remained a significant part of the market, totaling $117M, although it dropped 52.79% from January’s $188.2M.

- Wash transactions plummeted 81.35%, dropping to 71.2K from January’s 61.4K.

- Trade profit for the NFT market flipped negative, recording -$61.6M, a stark contrast to January’s -$8.2M.

- Supply growth remained positive, with total NFT supply increasing 5.24% MoM, reaching 1.38 billion NFTs.

Despite the decline in overall volume, buyer participation surged mid-month, with weekly buyer counts spiking 624%, indicating a shift toward lower-cost NFTs as new entrants tested the market.

NFT marketplace performance

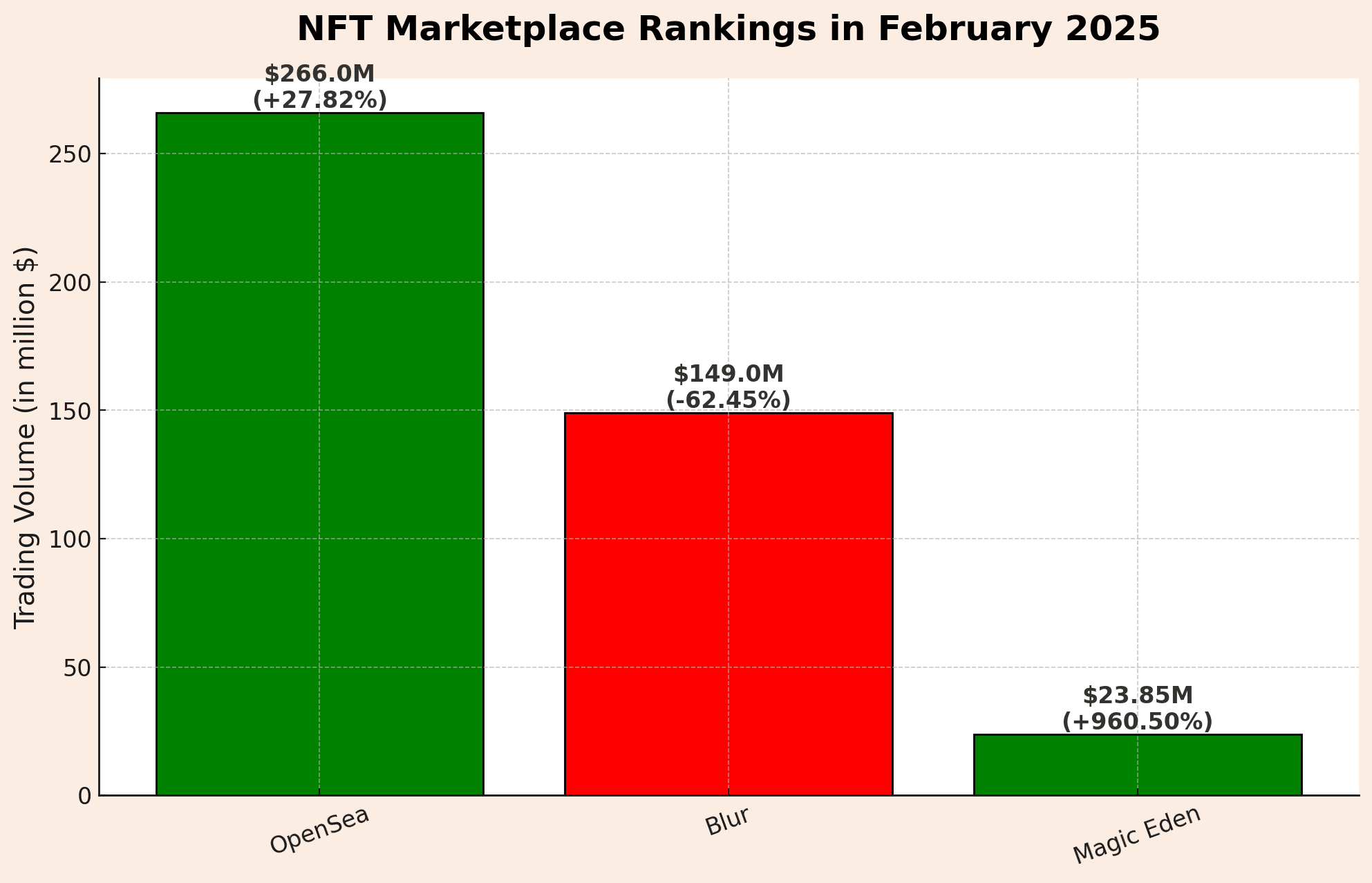

NFT marketplace rankings in February 2025

Marketplace rankings shifted as trading activity cooled:

- OpenSea remained the top NFT marketplace, logging $266M in volume, up 27.82% MoM.

- Blur, the previous market leader, saw a sharp 62.45% decline, with volumes dropping to $149M due to waning farming incentives.

- Magic Eden saw a surge in traders (+83.38%) but lower sales volume, recording $23.85M (+960.5%).

- Element Market and CryptoPunks marketplace maintained activity, but overall volumes dipped.

These figures indicate that while leading platforms retained market dominance, newer entrants continued to attract niche traders.

Top NFT sales & collections

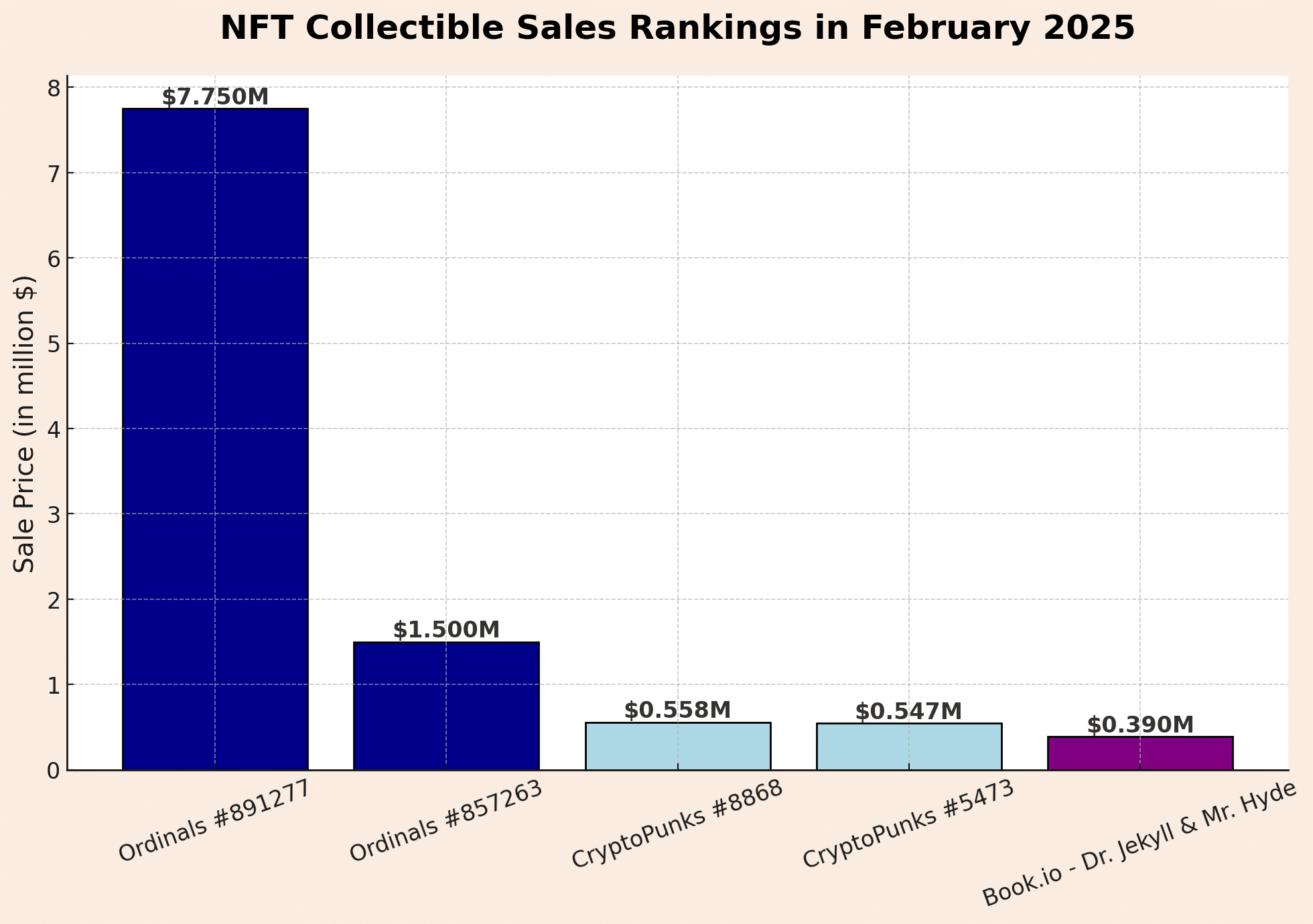

NFT collectible sales rankings in February 2025

The highest-grossing NFT collectibles for February were:

- Uncategorized Ordinals #891277 – Sold for $7.75M (80.12 BTC).

- Uncategorized Ordinals #857263 – Sold for $1.5M (15.53 BTC).

- CryptoPunks #8868 – Sold for $558K (206 ETH).

- CryptoPunks #5473 – Sold for $547K (162 ETH).

- Book.io – Dr. Jekyll and Mr. Hyde – Sold for $390K (600K ADA).

Ordinal NFTs (Bitcoin-based assets) led sales, underscoring the ongoing demand for high-value Bitcoin-native digital collectibles.

Among NFT collections:

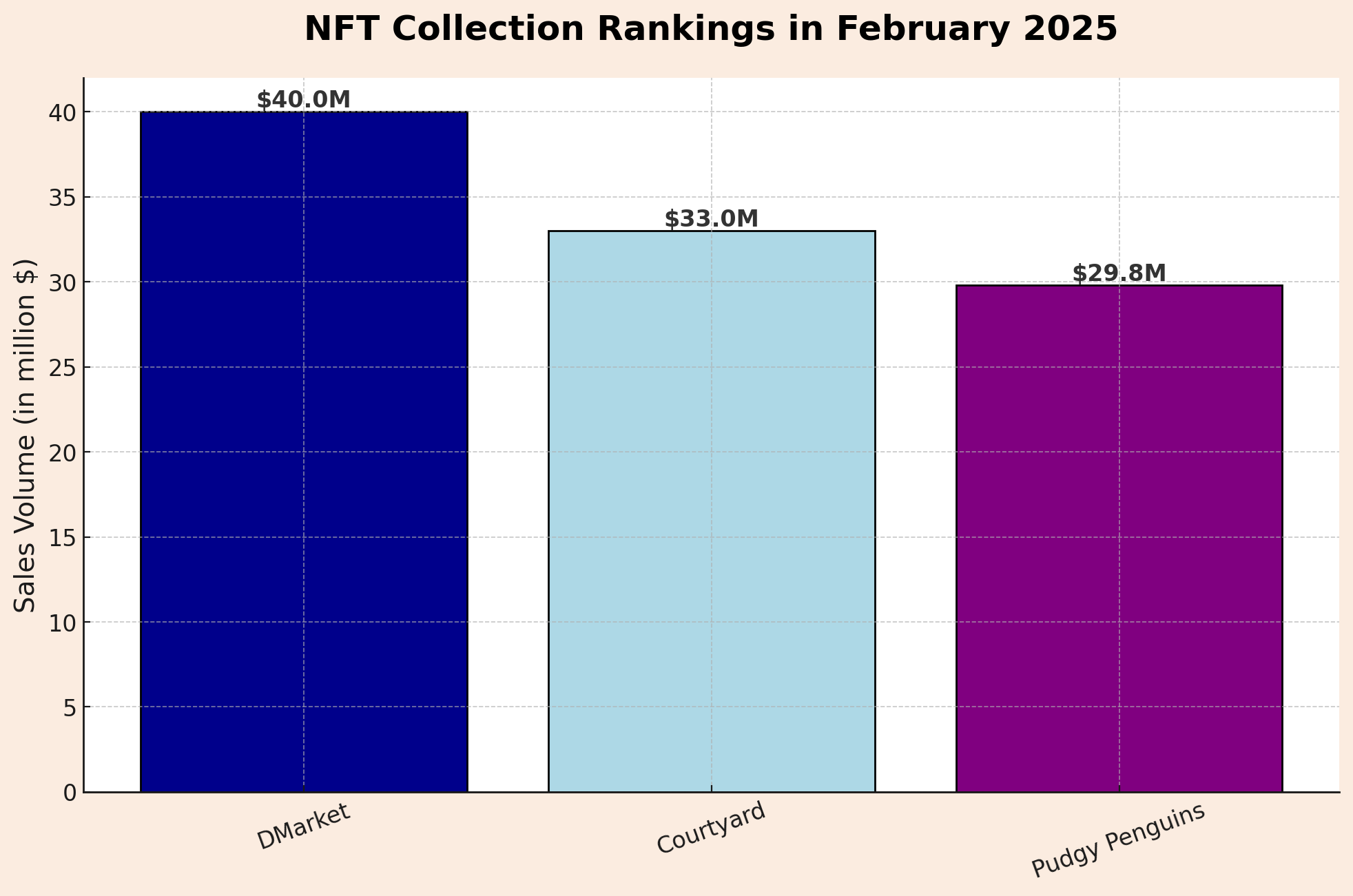

NFT collection rankings in February 2025

- DMarket (gaming-related NFTs) topped sales, generating $40M in volume, followed by Courtyard ($33M) and Pudgy Penguins ($29.8M).

- Ethereum-based collections (Doodles, Azuki, and CryptoPunks) continued to dominate the top ranks despite price retracements.

- The rise of gaming-related collections highlights that utility-driven NFTs—such as in-game assets—may hold stronger appeal than traditional profile-picture (PFP) collections in a market downturn.

Metaverse development continues amid token slump

Metaverse tokens followed broader market trends, facing steep corrections:

- Decentraland (MANA) and The Sandbox (SAND) both dropped by 15–20%, mirroring the altcoin market downturn.

- However, fundamental developments persisted, with Meta (Facebook’s parent company) investing $50 million into its Horizon Worlds metaverse platform to boost content creation. This move signals continued corporate confidence in the metaverse sector despite short-term price struggles.

- Major brands launched NFT-based loyalty programs and virtual world activations, signaling ongoing corporate interest in Web3.

Outlook: Short-term pain, long-term growth

February’s downturn in NFT sales and metaverse tokens suggests a market in post-hype consolidation, shedding speculative excess while reinforcing real use cases. While trading volumes declined, a steady influx of new users and major Web2 investments indicate that quality projects with strong utility and community engagement could be the biggest winners in the coming months.

Security & hacks: A record-breaking month for crypto exploits

Bybit $1.4B hack – The largest in crypto history

February 2025 witnessed one of the most severe security breaches in crypto history. On February 21, hackers infiltrated Bybit, a major global exchange, stealing approximately $1.4 billion in crypto assets, primarily Ethereum (ETH) and related tokens.

- This hack surpassed even Mt. Gox (2014) and the Poly Network hack (2021), making it the largest crypto theft ever recorded.

- The breach triggered a market-wide sell-off, as investors panicked over potential vulnerabilities in centralized exchanges (CeFi).

- Unlike previous high-profile hacks, Bybit chose to remain operational, assuring users that all losses would be covered—a bold move that helped prevent further market turmoil.

Forensic blockchain analysis traced the attack to North Korean state-sponsored hackers, indicating a level of sophistication comparable to traditional financial heists. Cybersecurity experts compared the incident to major historical bank robberies, further solidifying crypto’s status as a geopolitical risk vector.

Other major hacks & exploits in February 2025

While the Bybit hack dominated headlines, DeFi and NFT platforms also suffered high-profile security breaches, adding to the industry’s growing concerns.

Infini Protocol ($50M exploit, February 24)

- A rogue developer inserted a backdoor in the protocol’s smart contract, allowing unauthorized fund withdrawals.

- The attacker swiftly swapped and laundered stolen USDC, making recovery extremely difficult.

- This incident underscored the risks of insider threats in DeFi, proving that even audited projects remain vulnerable.

Smaller attacks across DeFi & NFTs

- Blur marketplace Phishing scams – NFT collectors lost millions due to sophisticated phishing attacks targeting wallet approvals.

- Ethereum layer-2 bridge exploits – Minor breaches resulted in cumulative losses of <$5M, highlighting ongoing bridge security risks.

Total losses from crypto hacks in February exceeded $1.5 billion—a single-month record surpassing some full-year losses in past cycles.

Industry response & security enhancements

The unprecedented losses prompted immediate security reforms across the crypto ecosystem:

Exchanges & wallet providers

- Bybit & other CEXs enhanced withdrawal security, temporarily tightening confirmation requirements to detect anomalies.

DeFi projects

- Platforms began implementing failsafe admin controls to prevent rogue developer exploits.

- Real-time smart contract auditing tools gained traction, improving proactive security.

Regulatory & law enforcement action

- Over $30M of Bybit’s stolen funds were frozen or recovered, proving that crypto’s forensic capabilities are improving.

- White-hat security firms like CertiK & Immunefi launched investigations, collaborating with law enforcement to trace stolen funds.

Decline in wash trading on NFTs

- Notably, the 40% drop in NFT wash trading since January indicated improved detection tools and market conditions filtering out manipulative actors.

Outlook: Strengthening crypto’s security infrastructure

February 2025 was a harsh reminder of the systemic security risks in crypto, reinforcing the need for:

- Stronger CeFi security frameworks to prevent large-scale hacks.

- More robust internal controls in DeFi to mitigate insider threats.

- Greater adoption of real-time monitoring tools to detect suspicious activity before major losses occur.

As security measures evolve, the crypto industry must balance decentralization with effective risk management, ensuring that mass adoption is not derailed by recurring vulnerabilities.

References

- CoinGlass

- CryptoQuant

- DeFiLlama

- Glassnode

- beaconcha.in

- CryptoSlam

- DappRadar

- Santiment

- IntoTheBlock

- Farside Investors

- CoinGecko

- CoinMarketCap

- Messari

- ETF.com

- TradingView

- Dune Analytics

- NFTGo

Disclaimer: This report analyzes data till February 25, 2025. It aims to provide comprehensive insights into market developments. All data presented is intended for informational and educational purposes. It’s crucial to note that no investment decisions should be made solely based on the information contained within this report. Ultimately, individuals are responsible for their own investment decisions and should conduct thorough research and analysis before making any financial commitments.

Source: https://ambcrypto.com/ambcrypto-february-2025-crypto-market-report-resilience-tested-by-volatility-and-hacks/