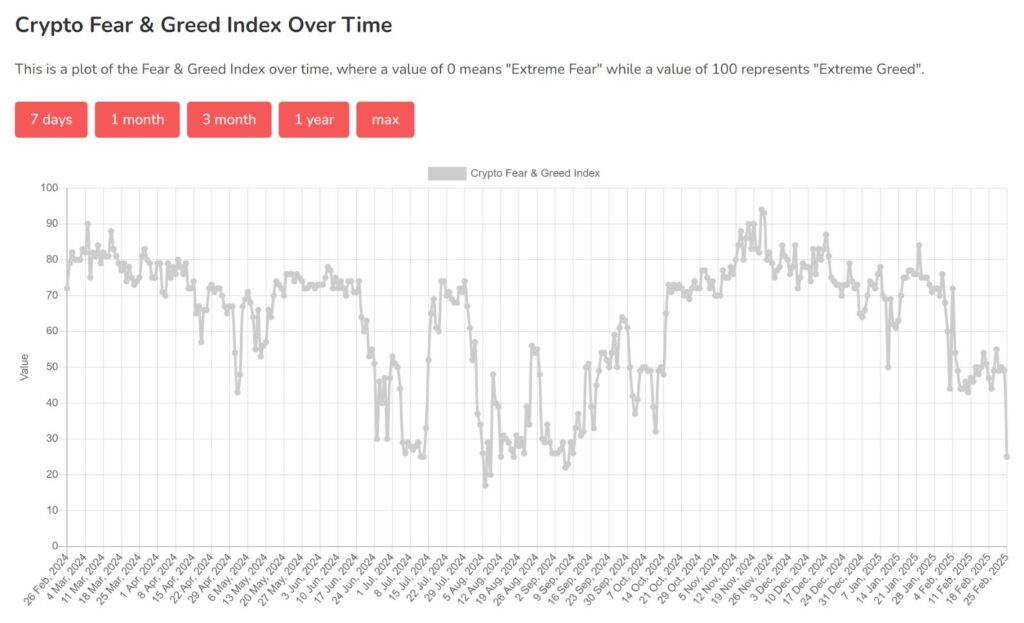

Alternative.me’s widely followed Crypto Fear and Greed Index dropped to 25 on Tuesday, signalling a shift into “extreme fear” territory, for the first time since early September last year.

The move coincides with the Bitcoin price falling to $86,100 on Binance, down nearly 11% from its weekly open and 20% from its all-time high.

However, Extreme Fear, especially during bull markets, typically represents an overly bearish sentiment and is often an indication that a local bottom is close.

Unsurprisingly, whales are buying the dip.

Crypto Fear And Greed Index Hits Extreme Fear

The investor sentiment surrounding global financial markets has turned extremely bearish.

For instance, CNN’s Fear and Greed Index, which tracks the US stock market has also reached Extreme Fear, despite $SPY trading just 3.3% below its all-time high.

Indeed, there isn’t a dearth of bearish narratives.

A few analysts believe investors could simply be deleveraging ahead of NVIDIA’s earnings call on Wednesday, which typically results in significant volatility on either side.

However, the macroeconomic outlook has also worsened considerably. Point72 founder and legendary investor Steve Cohen is now bearish for the time in a long while, citing the negative impact of Donald Trump’s tariffs, dwindling immigration and government austerity programs like Elon Musk’s Department of Government Efficiency.

The sticky inflation levels, largely a result of Trump’s tariff talk, are also contributing to the worsening macroeconomic sentiment. Combined with concerns over slowing growth, it has fueled investor fears of potential “stagflation.”

With the Bitcoin price strongly correlated to the tech-heavy NASDAQ-100, it is no surprise that the Crypto Fear and Greed Index has turned extremely bearish.

Extreme Bearishness Typically Indicates A Local Bottom

Warren Buffett famously advised, ‘Be fearful when others are greedy, and greedy when others are fearful.‘

The Crypto Fear and Greed Index hitting “extreme fear” could be an indication that a local bottom is imminent.

For instance, there is a notable resemblance between the index’s movement from early March to early July and from late November to now.

At the beginning of both periods, the index surged to 90 or above as Bitcoin hit a new all-time high. It then formed lower highs and fell to 25. If the pattern continues, the index could skyrocket to above 70 as in July, signalling a strong recovery in crypto prices.

As such, whales are already buying the dip, data from CryptoQuant reveals.

FireCharts also reveals that there is significant bidding for $BTC at above $85k. Material Indicators claim that this is the highest bid liquidity seen at one level since before Christmas. Smart money investors are buying, and so should the small-scale retail investors.

Smart Money Investors Also Bet Big On These Altcoins

If the Bitcoin price recovers, it would likely pave the way for the highly-anticipated altseason. There is a growing consensus that the ETHBTC bottom is in, which suggests that the Ethereum ecosystem could deliver outsized returns in the coming months.

It is not without any reason that whales have been buying hundreds of millions of dollars worth of ETH in a single day.

Several ETH-based altcoins are already showing strength. For instance, Layer-2 coin Optimism ($OP) is down just 1.30% on Tuesday and is up nearly 7% against BTC.

Whales are also buying low-cap tokens with long-term viability. For instance, most AI agent coins are built on Solana. Considering the upcoming rotation to Ethereum, smart money investors are buying MIND of Pepe (MIND).

The project is building a self-sovereign, self-evolving AI agent, with its own social media accounts and crypto wallet. It is designed to collect reliable market alpha online, deliver actionable intelligence to MIND holders and launch meme coins of its own.

The Pepe meme coin is already viewed as an excellent beta bet on ETH. Now, a frog-themed AI agent coin is being backed as the next 100x crypto by several influencers.

Visit MIND of Pepe Presale

Source: https://en.cryptonomist.ch/2025/02/25/crypto-fear-and-greed-index-hits-extreme-fear-why-it-may-actually-be-bullish/