- ADA’s traders were over-leveraged at $0.634 on the lower side and at $0.708 on the upper side.

- On-chain metrics revealed that exchanges have witnessed an outflow of over $8 million worth of ADA tokens.

Cardano [ADA] is garnering attention from crypto enthusiasts due to its significant price drop in the past 24 hours.

With a 13% decline, ADA has reached a crucial level where trader and investor participation has surged, leading to a notable increase in trading volume.

ADA’s current price momentum

At press time, ADA was trading near $0.665. It has seen a 90% surge in trading volume over the past 24 hours. However, this spike in trading volume doesn’t necessarily indicate a price rally.

Such increases typically occur when an asset breaks out or breaks down from a price pattern. Significant volatility prompts traders and investors to either liquidate their open positions or offload holdings for profit booking.

Cardano price action and upcoming level

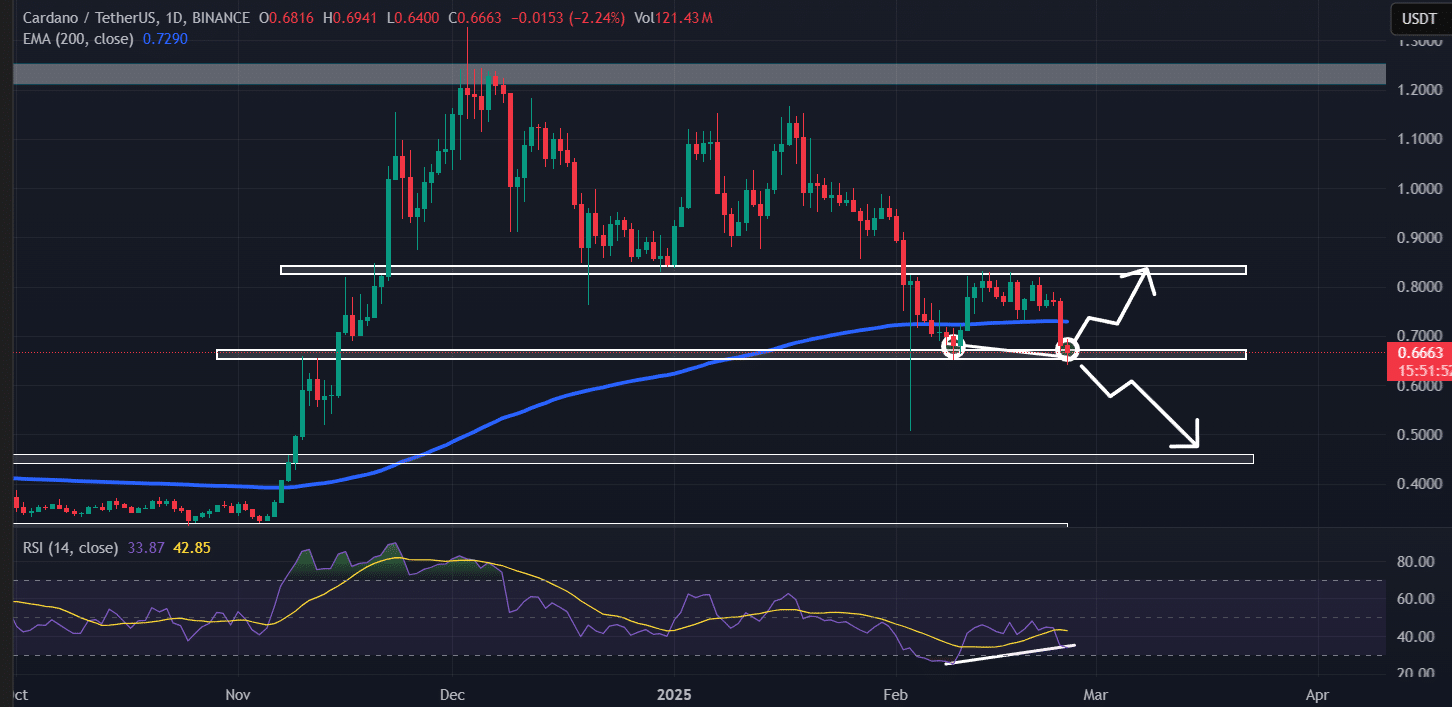

According to AMBCrypto’s technical analysis, ADA appears to be forming a bullish double-bottom pattern on the daily timeframe. However, the recent price drop has pushed the asset to a crucial support level of $0.65.

This level has a strong history of price reversals, further reinforcing this bullish outlook.

Source: TradingView

Additionally, ADA’s technical indicators have flashed a bullish divergence, signaling significant upside potential.

Based on historical price momentum, if ADA holds above the $0.65 level, there is a strong possibility it could soar by 25% to reach $0.85 in the future.

On the other hand, if ADA breaches the $0.65 level, it could drop by 30% to reach $0.45.

$8 million worth of ADA outflow

Despite the continuous price drop, long-term holders appear to be accumulating ADA tokens and following price action, as the on-chain analytics firm Coinglass reported.

Data from Spot Inflows/Outflows reveals that exchanges have witnessed an outflow of over $8 million worth of ADA tokens in the past 24 hours.

Source: Coinglass

However, in a market condition where prices continue to decline, exchange outflows indicate potential accumulation, which can create buying pressure and drive further upside momentum.

ADA traders’ $17 million bet on the short side

Meanwhile, intraday traders appear to be following the current market sentiment, betting on the short side, as reported by the on-chain analytics firm Coinglass.

At the time of writing, short positions dominate, while long traders seem to be exhausted.

Data shows that the major liquidation levels are at $0.634 on the lower side and $0.708 on the upper side, with traders being over-leveraged at these levels.

Source: Coinglass

If market sentiment remains unchanged and the price falls to $0.634, nearly $3.08 million worth of long positions will be liquidated.

Conversely, if sentiment shifts and the price soars to $0.708, approximately $17.30 million worth of short positions will be liquidated.

This on-chain metric indicates that short traders still believe ADA’s price won’t recover soon. This belief might be the reason for the formation of $17.30 million worth of short positions.

Source: https://ambcrypto.com/cardanos-ada-next-move-depends-on-this-price-level-heres-why/