CryptoQuant analyst Axel Adler Jr. has identified a drop in Bitcoin long-term holders (LTHs) selloffs, predicting the next price at which the high selloffs could resume.

Citing on-chain data from CryptoQuant, Adler Jr. revealed that these investors, who have held Bitcoin for at least 155 days, have reduced their daily Bitcoin spending by 60%. Notably, they sold an average of 100,000 BTC per day when Bitcoin traded around the $100,000 range.

Now, their selloffs have reduced to about 40,000 BTC every day. This decline indicates a shift in market sentiment among these experienced investors, as they hold onto their assets, anticipating the next big move.

Next Bitcoin Price for Possible LTH Selloffs

According to Adler Jr., the next major price level where these investors could resume heavy selling is $120,000. If Bitcoin reaches this threshold, LTHs will have achieved a 500% profit on their holdings.

Historical trends indicate that this level of profitability typically triggers intense sell-offs. A similar scenario unfolded in March 2024, when Bitcoin surged to an all-time high of $73,000. At that point, long-term holders had reached a 500% profit, leading to a sharp increase in selling activity.

Another wave of significant selling took place in November 2024 when Bitcoin approached $100,000. Although it hadn’t quite reached the 500% profit mark, it was close enough to prompt many investors to cash out.

Since then, LTHs have slowed their selling, but Adler Jr. believes if Bitcoin crosses $120,000, a new all-time high, they will likely resume heavy sales, as profitability would reach the 500% mark. This resumption of high spending could potentially cap further price increases.

Bitcoin Needs to Close This Week Above $97,000

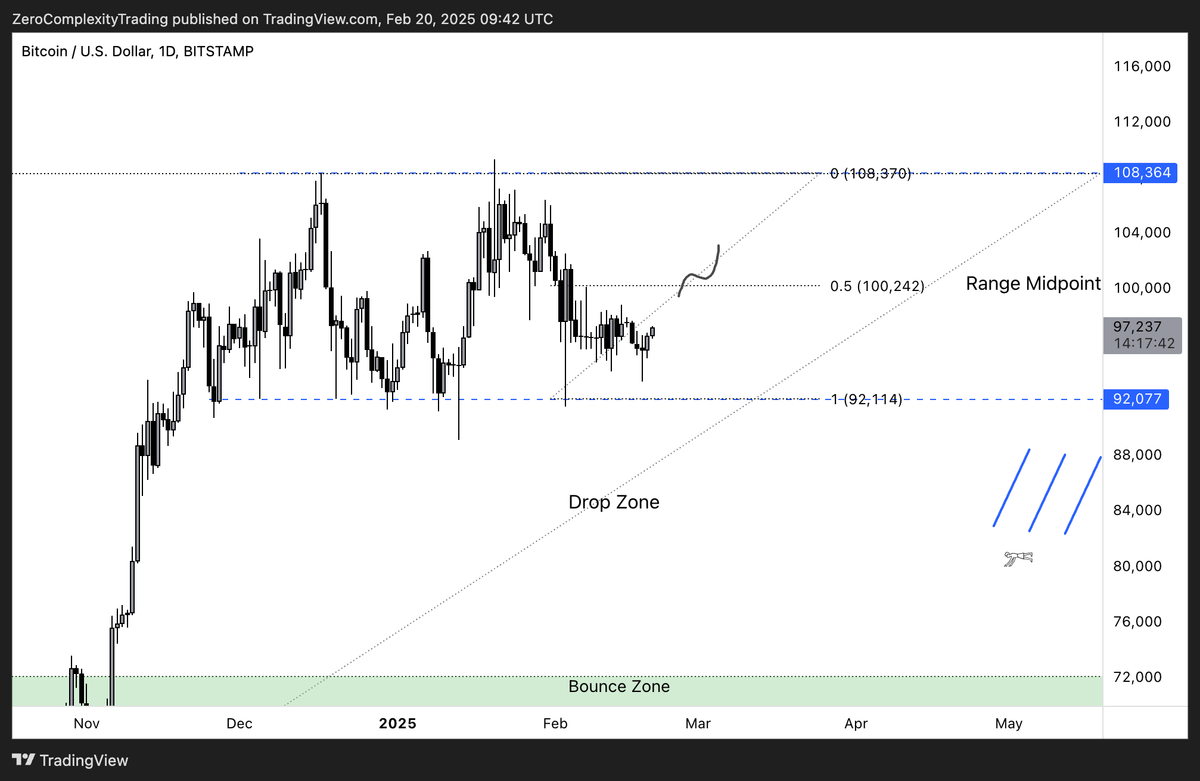

With Bitcoin currently consolidating below the $100,000 mark, analysts continue to anticipate the next decisive move. In a recent commentary, Koroush AK stressed that Bitcoin has shown resilience in holding above $92,000 despite prevailing uncertainty.

However, he is cautious, noting that he would avoid long positions until Bitcoin firmly reclaims $100,000 as support. He warned of potential rejections if Bitcoin fails to break past this psychological level convincingly.

Meanwhile, Rekt Capital, another prominent market analyst, pointed out that Bitcoin needs to secure a weekly close above $97,000. The asset has failed to do this over the past two weeks as bearish pressure mounts throughout February.

Bitcoin needs a Weekly Close above ~$97000 to continue holding the Higher Low as support

For the past three weeks now, Bitcoin has been downside wicking below the triangular market structure while keeping the pattern intact$BTC #Crypto #Bitcoin https://t.co/1drKMX79FA pic.twitter.com/dZJNSSvADQ

— Rekt Capital (@rektcapital) February 20, 2025

Rekt Capital noted that for the past three weeks, Bitcoin has been wicking below a key triangular market structure while still maintaining its overall pattern. Closing above this level would strengthen Bitcoin’s bullish trajectory and signal continued upward momentum.

BTC Remains Bullish

However, as bullish sentiments continue to wane, analyst Luca explained today that Bitcoin’s current price behavior fits into a recurring psychological cycle seen throughout this market cycle.

$BTC – Every consolidation range in this cycle has followed the same psychological pattern: skepticism, fear, anxiety and impatience.

First, it was considered a Bear Market Rally.

Then, the ETF launch was “sell the news,” with everyone calling for a 30K retest.

At 49K, many… https://t.co/lIqchm8aFy pic.twitter.com/QjWDSub0Rc

— Luca (@MirageMogul) February 20, 2025

He noted that each consolidation range has sparked skepticism, fear, and impatience among traders. Earlier in the cycle, Bitcoin’s rise was dismissed as a bear market rally, and later, when ETFs launched, many expected a steep correction.

At $49,000, recession fears fueled speculation that the cycle had peaked. Now, despite strong Bitcoin dominance and no major liquidity shifts into altcoins, some traders claim this phase represents a distribution period.

Luca argues that true distribution happens when price deviations move upward, shorts get massively squeezed, and euphoria dominates the market.

He believes the ultimate cycle top will form when traders become overly confident in Bitcoin’s continued growth, expecting an endless rally. At that point, massive liquidity shifts will occur, and the long-awaited altcoin season will begin.

Bitcoin currently trades at $97,744, with just three days left to secure a weekly close above $97,000. If the price remains stable, it could reinforce the bullish market structure. However, investors remain on edge, as macroeconomic uncertainty could trigger another surprise downturn.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/02/20/bitcoin-lths-reduce-sales-by-60-cryptoquant-analyst-identifies-next-price-at-which-they-could-resume/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-lths-reduce-sales-by-60-cryptoquant-analyst-identifies-next-price-at-which-they-could-resume