- TON’s TVL has declined in recent months, possibly reflecting reduced network activity.

- TON’s netflows revealed a significant spike in aggregated exchange inflows around mid-February 2025.

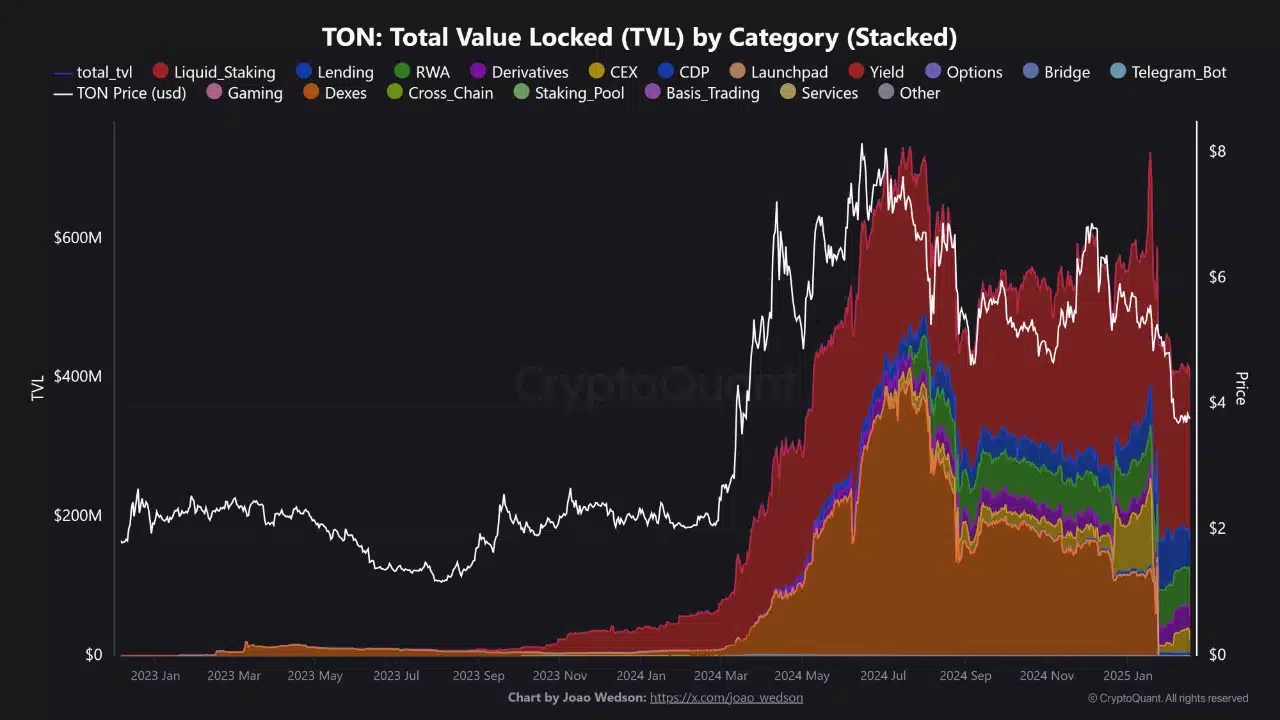

The Toncoin [TON] blockchain has witnessed a decline in Total Value Locked (TVL) over recent months. Despite this, there has been a notable surge in staking participation, highlighting a shift in investor behavior.

Understanding the decline

AMBCrypto’s analysis of TON’s TVL from mid-2024 to early 2025 illustrated a significant drop. This decline could signal a slowdown in network activity or a withdrawal from decentralized finance (DeFi) protocols.

Source: CryptoQuant

However, it is worth noting that Liquid Staking has remained a substantial component of the TVL. This indicates that, while the overall locked value has decreased, staking continues to attract a significant share of investment.

This shift away from higher-risk DeFi investments could reduce the volatility traditionally associated with DeFi exposure.

If the trend of decreasing TVL persists, TON’s price may stabilize as more funds are locked in less volatile staking activities.

A growing shift toward secure yield

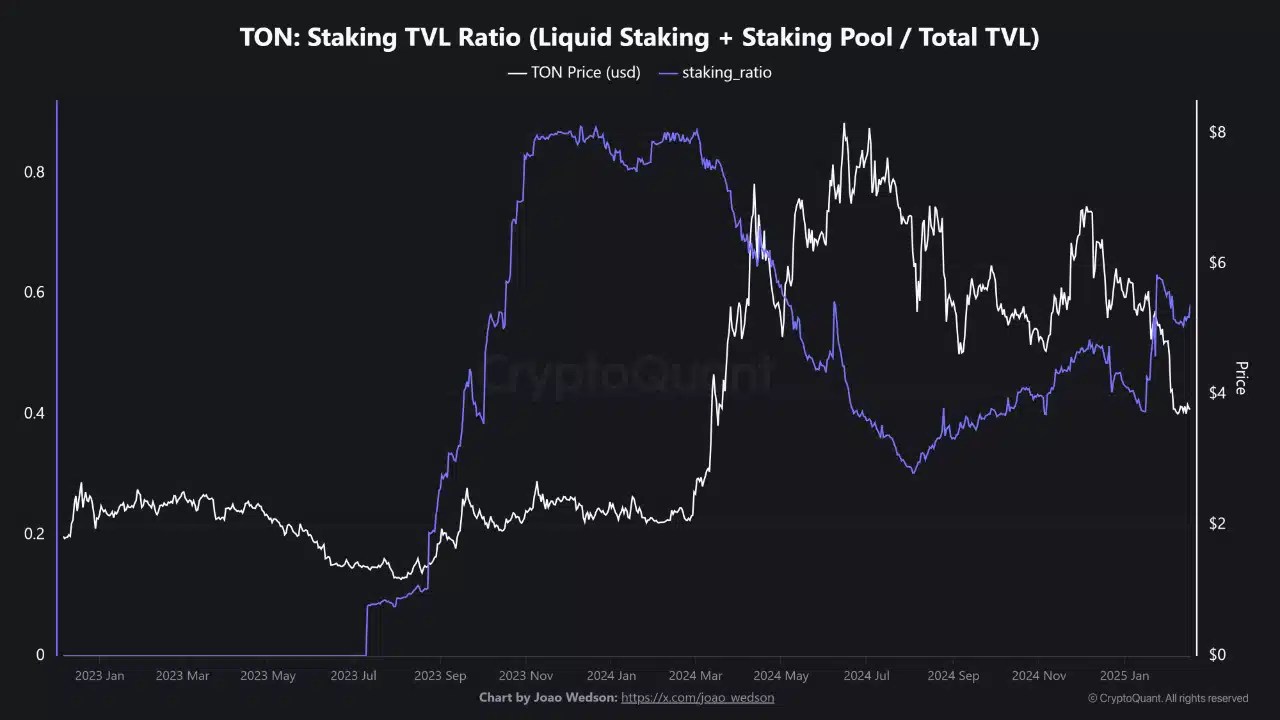

Further analysis showed an upward trajectory in the Staking TVL Ratio, despite the overall drop in TVL. This ratio, representing the portion of TVL in Liquid Staking and Staking Pools, has reached new highs.

Source: CryptoQuant

The growing preference for staking implies that investors are focusing on earning rewards rather than engaging in riskier DeFi strategies.

This trend could provide more price stability for TON, as the influx of locked tokens reduces the pressure to sell.

The rising staking ratio suggests that price movements may become less erratic, with a potential for price appreciation as staking rewards accumulate over time.

Speculation or stability?

Further, analysis of Netflows reveals a significant spike in aggregated exchange inflows around mid-February 2025, coinciding with a price peak.

After this surge, Netflows stabilized, suggesting that the initial influx was likely driven by market speculation or a specific event.

Source: IntoTheBlock

The subsequent stabilization indicates that the market may have absorbed this shock, which could signal a period of consolidation for TON’s price.

After speculative spikes, TON’s price may enter a consolidation phase, potentially setting the groundwork for future growth as market sentiment stabilizes.

The impact of active participation

Finally, analysis of active addresses shows steady growth, especially among addresses holding a balance, from late 2024 into 2025.

This increase in activity correlates with the rise in staking participation, indicating that both new and existing users are engaging more with the staking ecosystem.

Source: IntoTheBlock

A growing number of active addresses typically reflects a healthier network, which could lead to increased demand for TON and bolster price increases.

The growth in active addresses, particularly those with balances, signals a positive outlook for TON, suggesting a bullish trend as network participation expands.

Despite the recent decline in TON’s TVL, the increasing staking participation and rising number of active addresses suggest a shift towards stability and growth.

These trends suggest that TON is entering a phase where staking-driven stability could support long-term value growth.

Source: https://ambcrypto.com/toncoin-tvl-falls-but-staking-activity-surges-is-investor-behavior-shifting/