- Bitcoin miners faced squeezed profits as transaction fees hit historic lows.

- Network difficulty and rising costs are challenging smaller miners’ survival.

Bitcoin [BTC] miners are facing a challenging landscape in 2025 as key factors squeeze profitability. Transaction fees have hit their lowest levels since 2012, while network difficulty continues to climb.

The 2024 halving has increased competition, and revenue per unit of computational power is rapidly declining.

In addition, USD-denominated mining revenue remains volatile, creating uncertainty even for major players.

As profit margins tighten, miners are being forced to optimize operations, shut down obsolete equipment, or consider mergers.

With smaller players at risk of exiting, industry consolidation seems imminent, leaving only the most efficient and well-capitalized operations to survive.

Bitcoin mining faces profitability strain

Source: Alphractal

The Bitcoin mining ecosystem is facing significant challenges, as several key metrics point toward declining profitability.

The Bitcoin mempool, which tracks unconfirmed transactions, has fallen to its lowest level in years, signaling reduced network demand.

This drop directly impacts miners’ revenue from transaction fees, which are vital alongside block rewards.

Historically, similar declines in transaction activity have been followed by bear markets, and this downturn – despite Bitcoin’s high price — may indicate a structural shift in the network.

Source: Alphractal

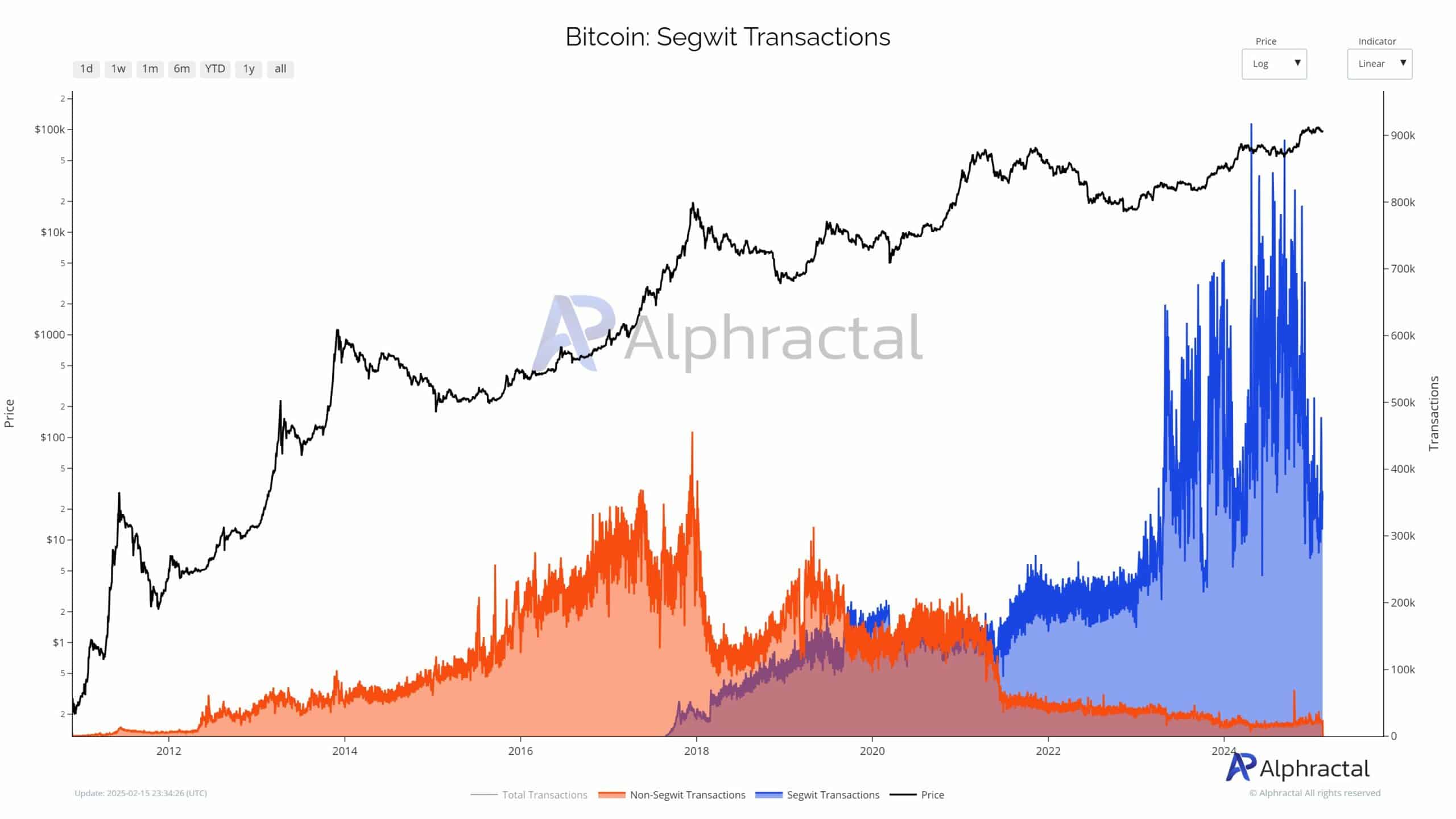

Moreover, SegWit transactions, which were once the dominant and efficient transaction type, are now in decline.

This reduces overall network efficiency, increasing the demand for block space, and putting further pressure on miners’ earnings.

Source: Alphractal

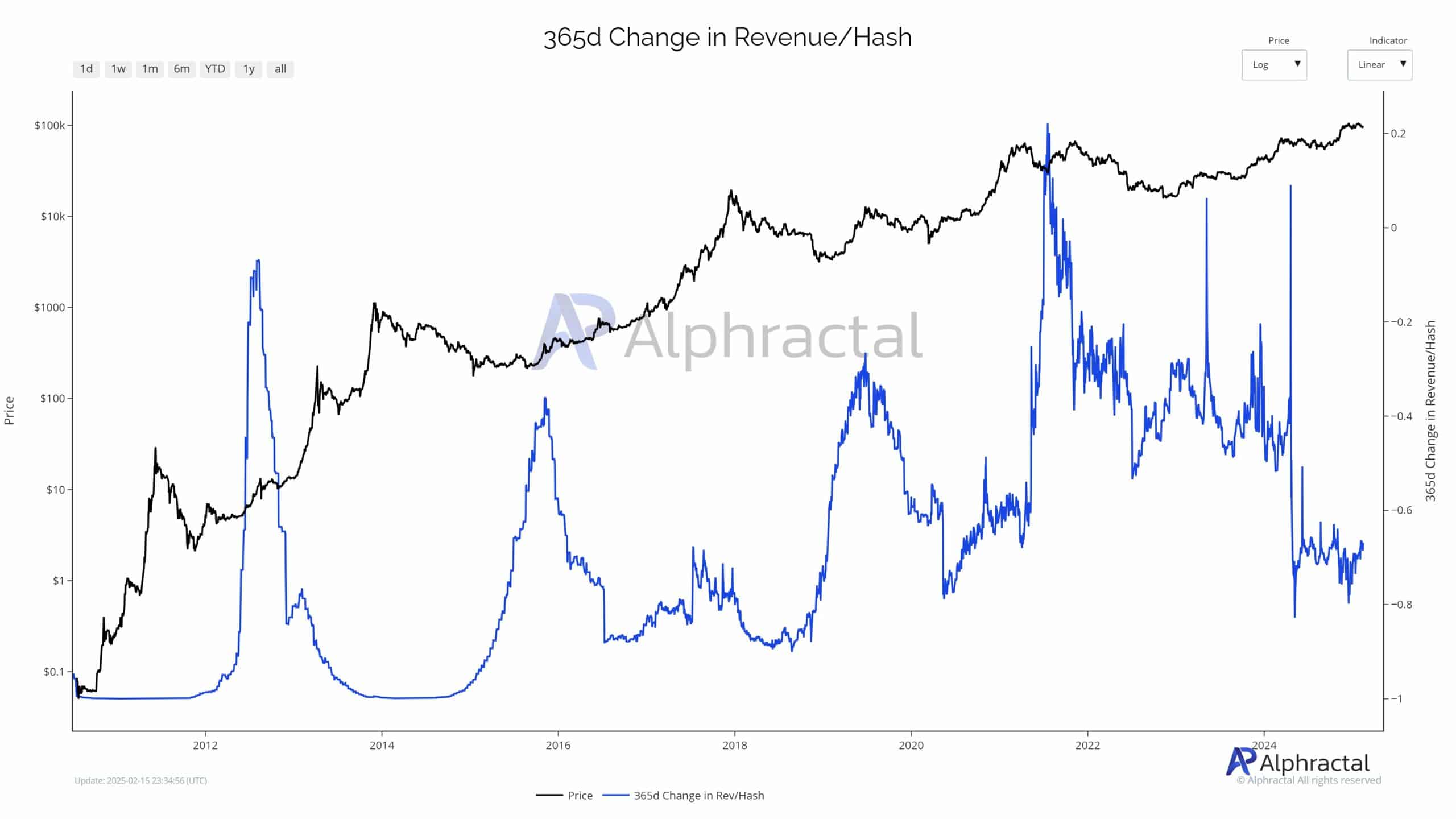

The Revenue/Hash ratio, a key metric for miners, is at historic lows. Despite Bitcoin’s rising price, diminishing returns indicate that rising network difficulty and competition are eroding profitability.

With the halving approaching, reducing block rewards, smaller operations may struggle to remain profitable.

This dynamic could lead to increased centralization, where only large, technologically advanced miners will thrive, potentially forcing smaller players out of the market.

Increasing difficulty and rising costs

Bitcoin miners are facing an increasing squeeze on profitability as network difficulty reaches record highs.

The declining revenue per hash is making it harder for smaller operators with outdated equipment to compete, especially as energy and hardware costs continue to rise.

To survive, many miners are migrating to regions with cheaper, more sustainable energy sources, such as hydro or geothermal power.

Some are also diversifying revenue streams by branching into computing services, while others are seeking mergers and acquisitions.

These efforts may lead to further centralization in the industry, with only the most capitalized and efficient mining firms surviving.

This could have broader implications for Bitcoin’s decentralization, particularly regarding the geographic distribution of mining power.

A reshaping of Bitcoin’s security model may follow, raising concerns about the long-term health of its decentralized nature.

Market rebalancing

As operational costs surge and profitability declines, Bitcoin’s hashrate may see a natural downturn, with inefficient miners shutting down.

This rebalancing will likely leave only the most capitalized and technologically advanced players standing, reinforcing mining as a high-barrier industry.

However, this shift raises concerns over centralization. With a shrinking pool of dominant miners, Bitcoin’s decentralized ethos could be at risk, potentially concentrating network security in fewer hands.

While larger entities may ensure stability, this consolidation could lead to questions about censorship resistance and trust in the network’s long-term integrity.

The 2024 halving has already tested the resilience of the Bitcoin mining ecosystem.

The aftermath of this event is a crucial period in determining whether Bitcoin mining remains an open, competitive field, or whether the sector continues to consolidate into the hands of a few dominant players.

Source: https://ambcrypto.com/bitcoin-miners-are-earning-less-despite-btcs-high-price-heres-why/