- Analysts believe Abu Dhabi owns more Bitcoin than what has been previously reported

- Other pundits have called for the United States to include BTC in its sovereign wealth fund

Abu Dhabi’s sovereign wealth fund, Mubadala Investments, is now the 7th largest holder of BlackRock Bitcoin ETF, IBIT, with a $461M investment in Q4 2024.

Since it is one of the Emirates of the UAE, this news has intensified the initial speculation that Abu Dhabi might have as much as $40 billion in Bitcoin holdings.

Source: Bloomberg

Commenting on this update, Bloomberg ETF analyst James Seyffart noted,

“The rumors were not just rumors!”

Interestingly, the UAE has never officially shared or notified its BTC stash. According to Binance founder CZ, the reported $461M BTC holding could be just the tip of the iceberg for AD alone. He stated,

“This report is just from one of the Sovereign Wealth Funds (Mubadala) in AD. There are a few other SWFs in AD.”

Will the U.S follow UAE’s model?

According to David Bailey, CEO of Bitcoin Magazine, Abu Dhabi has more holdings than stated and other Gulf Cooperation Council (GCC) members are now jumping on the trend. He stated,

“Abu Dhabi has gone in much bigger than today’s filing. There’s a couple other GCC members that are making moves too. Was hoping this would be announced at BitcoinMENA but they weren’t ready.”

The update has increased calls for the U.S to establish or include a National BTC Reserve in President Trump’s recently announced sovereign wealth fund (SWF).

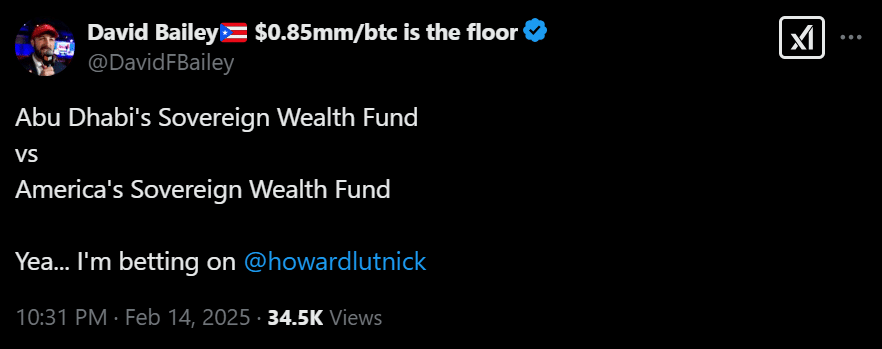

In fact, Bailey also speculated that President Trump’s Commerce Secretary pick, Howard Lutnick, could follow the UAE’s steps and include BTC in the United States’ SWF.

Source: X

A similar call was made by the Bitcoin Policy Institute, an advocacy group for the cryptocurrency. Part of the group’s report read,

“The U.S could use the ~200,000 BTC already in U.S. federal custody from law enforcement seizures to allocate these holdings as seed capital for the SWF without requiring new taxpayer funding.”

Worth pointing out, however, that such a move is still massively underpriced by the market, going by Polymarket’s latest odds. In fact, at the time of writing, the predictions site was pricing the possibility at a mere 14% by summer 2025.

Source: Polymarket

That being said, despite the bullish updates and apparent ‘nation-state’ moves on Bitcoin, the cryptocurrency remained muted at press time. It has struggled below $100k for ten days now, with the crypto valued at $97k or 12% from its ATH at press time.

Source: https://ambcrypto.com/inside-abu-dhabis-461-million-investment-in-blackrocks-bitcoin-etf/