Bitcoin holders recently showed signs of confidence, with both short-term and long-term investors reducing sell-offs.

Blockchain data indicates traders are selling fewer coins at a loss, suggesting reduced panic. Notably, this trend could set the stage for a potential price rebound, with macroeconomic factors and institutions potentially driving growth.

Short-Term Holders Reduce Sell-Offs at Loss

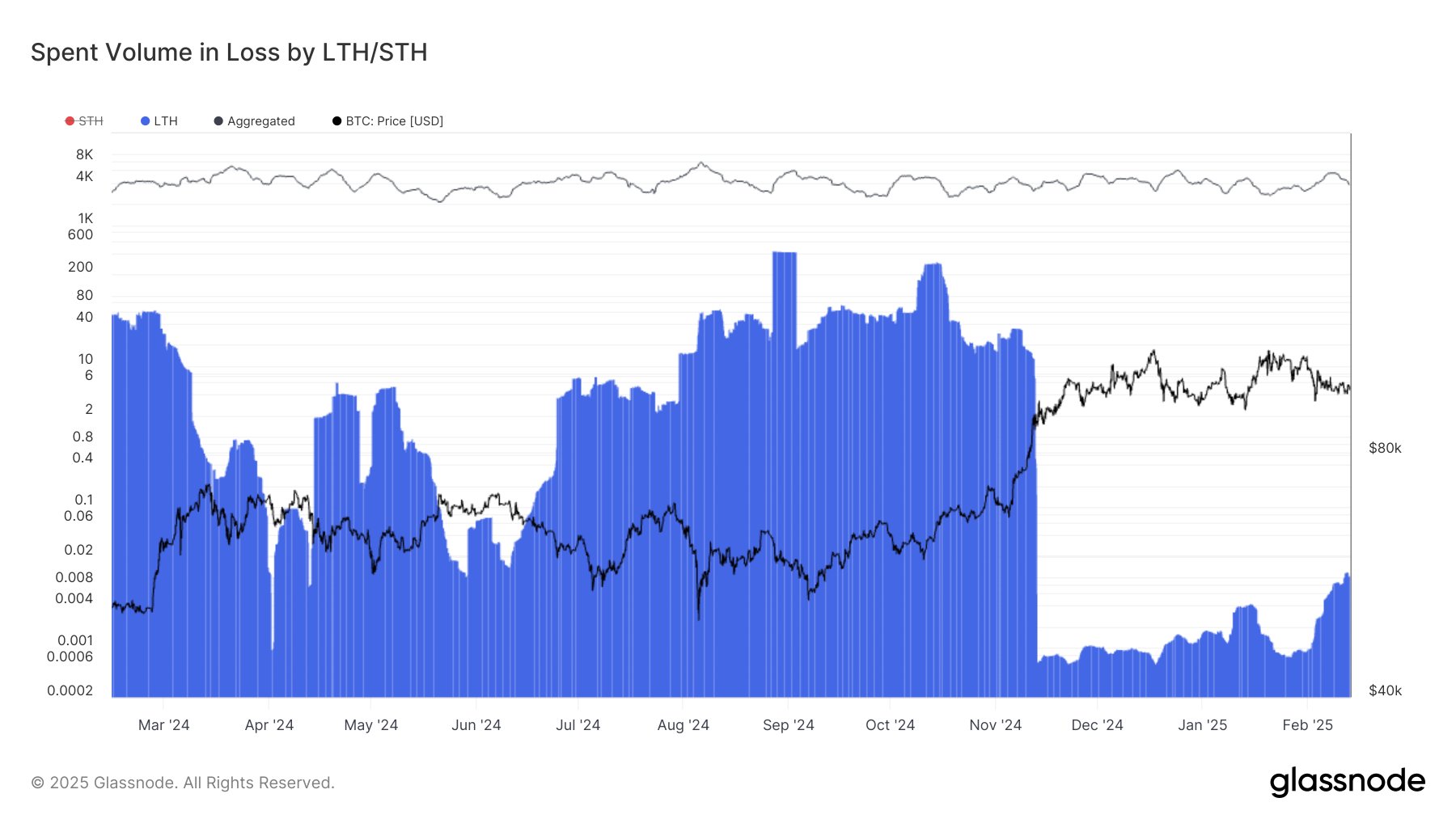

In one of its latest analyses, Glassnode reported that short-term Bitcoin holders, those who held BTC for less than 155 days, significantly reduced their sell-offs at a loss.

The seven-day moving average of Bitcoin sold in loss had risen to a high of about 5,500 BTC earlier this month. However, this figure has now dropped to about 3,800 BTC, aligning with the yearly average of 3,500 BTC.

Although February’s sell-off volume is mildly higher, it stays below the August 2023 top of 7,500 BTC. According to Glassnode, this suggests that short-term holders are under less pressure to sell in comparison to previous market downturns.

February’s spent volume in loss was slightly elevated but remained well below the August peak of ~7.5K #BTC. The current trend suggests that short-term holders are experiencing less distress compared to previous sell-offs.

— glassnode (@glassnode) February 13, 2025

Long-Term Holders Maintain Stability

Moreover, the analytics firm also highlighted that long-term Bitcoin holders, those who have held their BTC for more than 155 days, remained largely unaffected by volatility.

Their losses had been rather minimal over the past year, with the weekly average never going above 500 BTC. Glassnode confirmed that by recent measurements, this number had fallen to nearly zero.

The resilience of long-term investors indicates that they are not reacting to short-term price movements, bolstering Bitcoin’s strong support levels. Specifically, their reluctance to sell suggests confidence in Bitcoin’s long-term growth.

Bitcoin Whale Activity Shows Strong Support

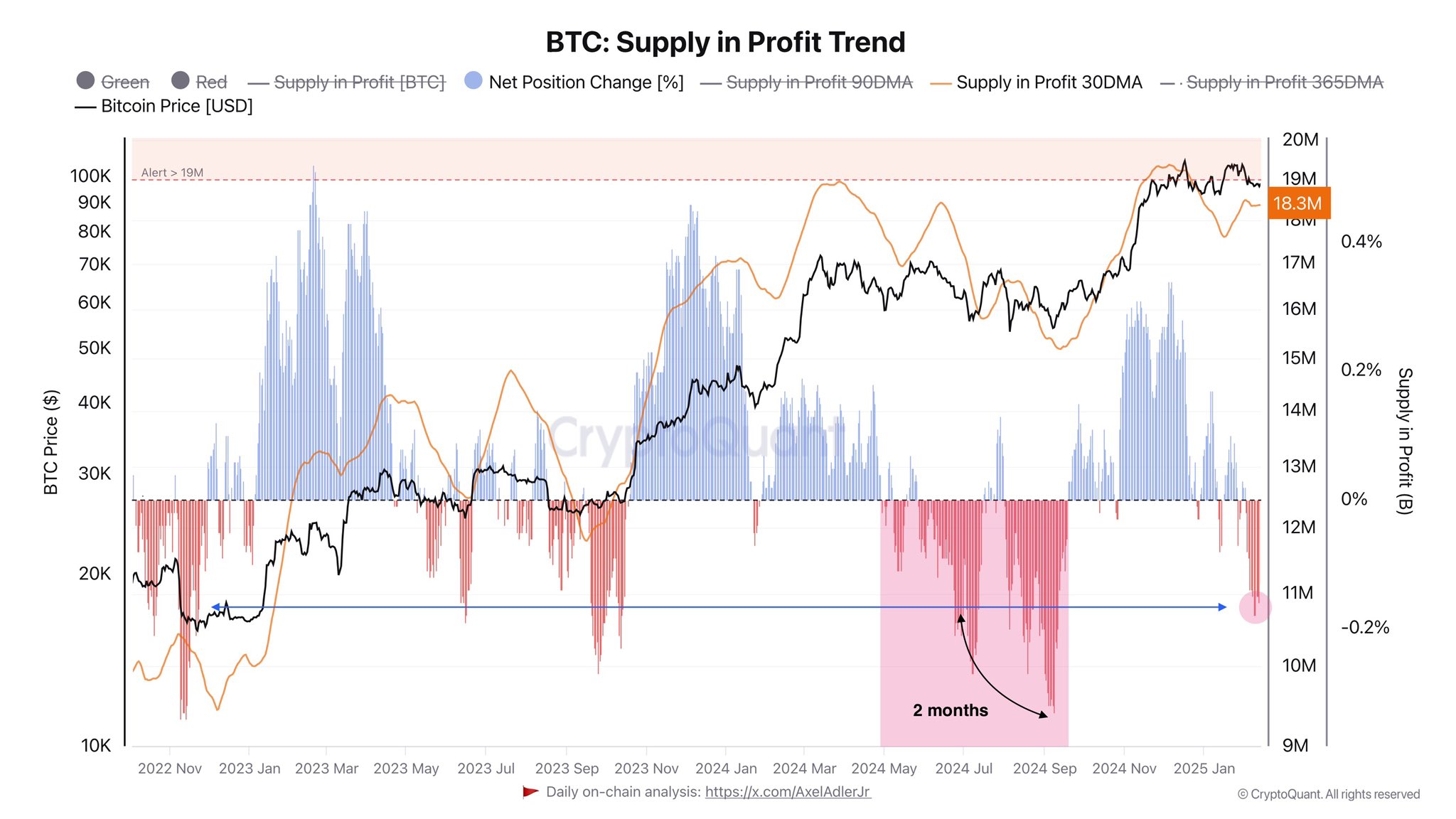

Meanwhile, CryptoQuant analyst Axel Adler Jr. recently observed that new Bitcoin whales, or large holders who have held BTC for less than 155 days, have an average realized price of $89,200. He believes this level has become a major support zone during Bitcoin’s current consolidation phase.

The realized price of new whales = $89.2K, which is essentially the strongest support level for the current consolidation.

Large players who bought BTC at this price are unlikely to sell at a loss. pic.twitter.com/P85xJz3aw2

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) February 12, 2025

Adler Jr. noted that whales who bought at this price would likely not sell at a loss, which could help market stability. He also pointed out that, besides a major panic-driven sell-off in September 2023, Bitcoin holders had mostly realized more profits than losses.

In a separate disclosure, Adler Jr. further argued that the relatively low amount of Bitcoin sold at a loss makes profit trends more significant in this market cycle. He noted that during Bitcoin’s previous consolidation at $70,000, it took about two months to establish momentum for the next rally.

However, he believes the current market dynamics have shifted. He noted that Bitcoin’s price movements were now more influenced by external news events, particularly discussions surrounding the U.S. President Donald Trump and the potential Bitcoin strategic reserve.

He suggested that such developments could speed up Bitcoin’s next upward push, deviating from past macro cycles.

Liquidity Factors Could Boost Bitcoin Price

To add to the bullish outlook, crypto analyst Miles Deutscher highlighted a potential liquidity boost from the U.S. Treasury General Account (TGA) drawdown, which could occur as a result of issues around the debt ceiling.

We might not be getting QE anytime soon, but we ARE potentially getting a Treasury General Account drawdown due to the debt ceiling.

This is effectively a form of “stealth QE”, as liquidity is injected into the economy.

The last 2 times we had this drawdown, $BTC rallied:… pic.twitter.com/l87RqLod0w

— Miles Deutscher (@milesdeutscher) February 13, 2025

He argued that this situation functions similarly to quantitative easing (QE), effectively injecting liquidity into the economy. Deutscher pointed out that Bitcoin had rallied significantly during previous TGA drawdowns. In December 2022, BTC surged 84%, while in June 2023, it gained 23%.

Currently, Bitcoin changes hands at $95,896. From this level, an 84% rally would push the asset to $176,448, while a 23% increase would send it to $117,952, both of which would represent new all-time highs.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/02/13/short-term-and-long-term-bitcoin-holders-have-now-reduced-sell-offs-is-a-rebound-imminent/?utm_source=rss&utm_medium=rss&utm_campaign=short-term-and-long-term-bitcoin-holders-have-now-reduced-sell-offs-is-a-rebound-imminent