Shiba Inu (SHIB) is gaining traction after a period of price consolidation, with bullish signals emerging across technical indicators and on-chain metrics. The meme coin is nearing a critical breakout level, fueled by increased whale accumulation and a notable spike in its burn rate.

SHIB Whale Inflows and Rising Burn Rate Signal Strength

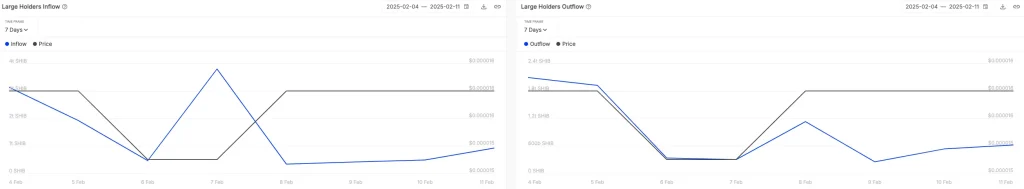

In the past 24 hours, Shiba Inu whales have accumulated 922.87 billion tokens, a 100% increase compared to the previous day. This surge in large-scale accumulation suggests renewed confidence among high-net-worth investors.

Notably, despite an increase in whale outflows—619.44 billion SHIB tokens—the net inflow remains positive at 303.43 billion SHIB coins, marking a sharp reversal from the previous day’s net outflow of -48.41 billion SHIB. Additionally, the cryptocurrency’s burn rate has skyrocketed by nearly 400%, with 16.5 million tokens permanently removed from circulation in the past 24 hours.

HOURLY SHIB UPDATE$SHIB Price: $0.00001571 (1hr 0.89% ▲ | 24hr -3.82% ▼ )

Market Cap: $9,256,702,638 (-3.78% ▼)

Total Supply: 589,255,583,299,874TOKENS BURNT

Past 24Hrs: 16,479,283 (389.77% ▲)

Past 7 Days: 61,082,353 (-94.82% ▼)— Shibburn (@shibburn) February 12, 2025

While this number is relatively small in USD terms, the continued reduction in supply could contribute to long-term price appreciation if demand holds steady. To date, over 410.7 trillion Shiba Inu tokens have been burned, leaving approximately 589 trillion tokens in circulation.

Technical Indicators Flash Bullish Reversal Potential

On the technical front, SHIB cryptocurrency trades within an ascending triangle formation on the four-hour chart. Historically, the token has struggled to break past its resistance zone, but the recent sentiment shift could alter this trend. If the cryptocurrency successfully closes a four-hour candle above $0.000017, a breakout rally toward $0.000020—a 20% upside—is likely.

Besides, according to crypto analyst Ali Martinez, the TD Sequential Indicator, a tool that identifies trend reversals, has flashed a buy signal on Shiba Inu’s weekly chart. This suggests the ongoing price consolidation may soon give way to an upward move.

Market Liquidity Levels to Watch

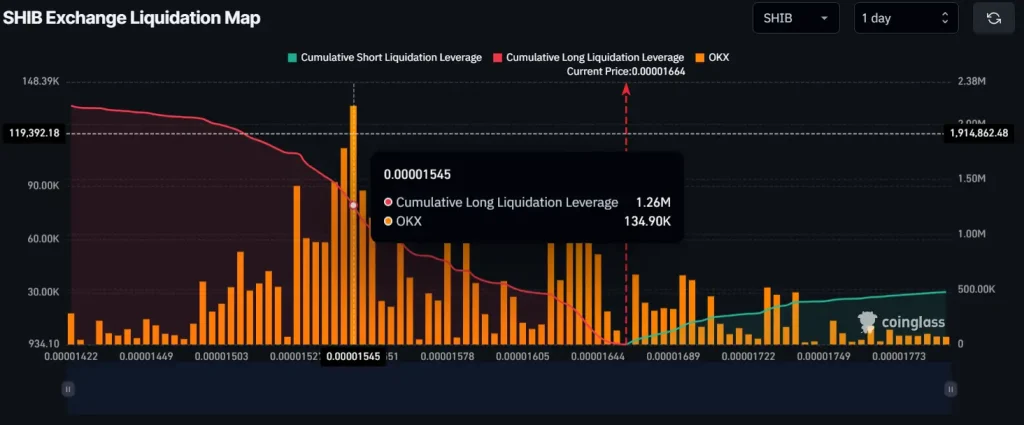

Not to be left out, liquidation data from Coinglass highlights key price zones where leveraged traders are heavily positioned. Per the on-chain data, the cryptocurrency’s primary liquidation levels are at $0.00001545 on the downside and $0.00001695 on the upside, with $1.26 million in long positions and only $166,369 in shorts at these levels.

This imbalance favors bullish momentum if the price breaks higher. With strong whale activity, increasing burn rates, and bullish technical indicators, Shiba Inu appears poised for an upside move. However, a decisive break above $0.000017 remains the key trigger for a sustained rally. Traders should closely monitor SHIB’s price action, as a failure to break resistance could lead to renewed consolidation.

Also Read: HYPE Token’s Bullish Setup Strengthens as Funding Rate Soars

Source: https://www.cryptonewsz.com/shib-eyes-breakout-as-whales-buy-burn-spike/