- Declining short-term holder (STH) profits could have a positive impact on BTC’s price.

- Lower selling incentives and increasing stablecoin inflows into the crypto market could contribute to BTC’s rally.

After briefly reaching the $100,000 region on the 7th of February, Bitcoin [BTC] has struggled to sustain that level, currently trading at $95,811.80, down 2.65% in the past 24 hours.

However, as profit margins remain low for short-term holders, they have fewer reasons to sell, which could exert upward pressure on BTC’s price.

Market reset signals potential upside

According to Glassnode’s Bitcoin Short-Term Holders Profit/Loss Ratio, the market appears to have reset, with the ratio currently at 1.08.

Short-term holders are addresses that held BTC for less than 155 days before selling. A ratio of 1.08 suggests that STHs are in slight profit, as it is only marginally above 1.

For every $1.08 of BTC sold at a profit, $1 is sold at a loss.

Source: Glassnode

This ratio has dropped below its 90-day average, indicating the market is shifting toward a more neutral position as realized profits decline.

AMBCrypto noted that with BTC trading around $95,000 and the market in a reset phase, a significant breakout from this level could follow.

Declining profits could trigger a supply squeeze

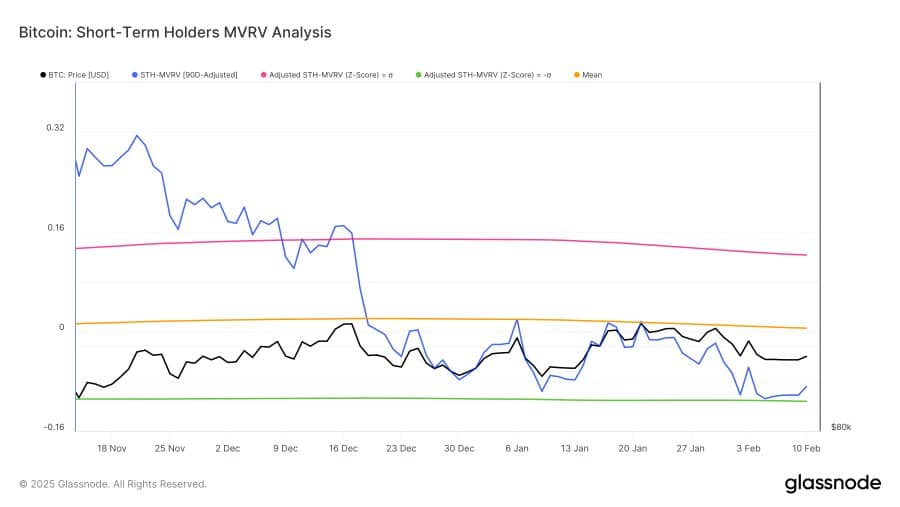

The Market Value to Realized Value (MVRV) ratio for short-term BTC holders has also declined below its 90-day average.

This aligned with broader market conditions.

Source: Glassnode

At the time of writing, the STH-MVRV stood at 1.05, meaning BTC’s current price is only slightly above the average purchase price of short-term holders.

AMBCrypto observed that such declines typically reduce selling pressure from this cohort, as they anticipate higher prices before exiting.

Glassnode’s data on realized profit-taking supports this trend, showing a decline in BTC distribution among short-term holders. This shift in behavior is linked to the decreasing profitability of selling.

As fewer short-term holders realize profits, the circulating BTC supply contracts, which could drive prices higher due to reduced selling pressure.

AMBCrypto also identified other market factors supporting a potential rally.

Stablecoin inflows point to increased buying power

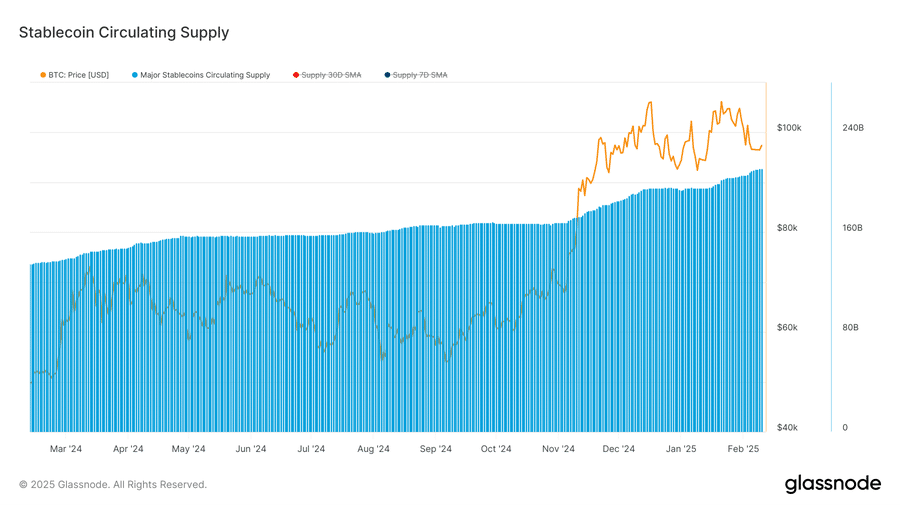

Stablecoin supply has surged significantly, indicating growing capital inflows into the crypto market. In 2025 alone, the total stablecoin supply increased by approximately $16.97 billion.

It rose from $194.2 billion to $211.2 billion, with the largest inflows occurring in February.

Source: Glassnode

A rising stablecoin supply suggests increased liquidity, which often precedes higher crypto purchases.

Given Bitcoin’s growing adoption—both as a strategic reserve asset for governments and among institutional investors—it is likely to benefit from this trend.

Source: https://ambcrypto.com/how-bitcoins-short-term-holders-can-push-btc-past-100000/