Digital asset mobile wallets hit new heights in Q4 2024 as millions of passive investors explored decentralized applications (dApps), a new report has revealed.

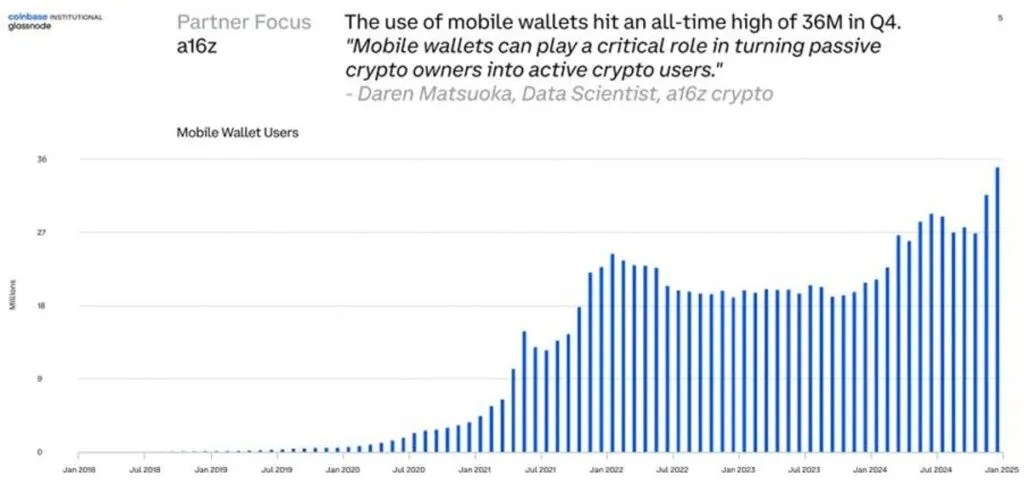

The “Guide to Crypto Markets” report by Coinbase (NASDAQ: COIN) revealed that digital asset mobile wallets hit 36 million toward the end of the year, a new record, amid sustained growth since mid-2023.

Commenting on the report, a16z’s data scientist, Daren Matsuoka, noted that mobile wallets have played a significant role in converting passive digital asset owners into active users.

The number of mobile wallets represents 6% of the 560 million global digital asset owners, according to data from Triple-A. Most digital asset owners only hold the tokens for speculative purposes, and their sole interaction with their wallets is when purchasing, transferring, or selling their assets. The Coinbase report’s figure accounts for digital asset holders who have interacted with blockchain applications, including decentralized finance (DeFi), tokenization, and non-fungible tokens (NFTs).

Unsurprisingly, most digital asset holders don’t interact with dApps and only hold their assets to profit from market rallies. After all, ‘crypto’ leaders have long pushed the false narrative that Bitcoin was meant to be digital gold. The rise and domination of Wall Street behemoths like BlackRock (NASDAQ: BLK) and corporates like MicroStrategy (NASDAQ: MSTR) have further hammered down this narrative, diverting millions from the transformative power of blockchain technology in payments, artificial intelligence (AI), supply chain management, digital identity, governance, intellectual property (IP), gaming, Internet of Things (IoT), and more.

The Coinbase report also highlighted the surge in stablecoin use; in Q4 last year, stablecoin supply shot up 18%, surpassing $200 billion in market cap. Stablecoin volume hit $30 trillion last year, with December setting the record at $5 trillion.

The exchange acknowledged that most of the stablecoin growth was directly linked to increased on-chain liquidity for ‘crypto’ speculation. However, stablecoin usage in payments, remittances, and other financial services also rapidly surged in 2024.

“Behind this growth lies a simple but powerful fact: stablecoins can make it faster and cheaper for both businesses and individuals to move money around the globe,” the report noted.

However, for stablecoins to meet their full potential, ‘clearer regulations’ are critical, the report added. Indeed, regulators are taking a keener look at stablecoins globally, and some, like the European Union, have already implemented new guidelines for the sector. The Markets in Crypto-Assets (MiCA) framework requires stablecoin issuers to obtain an EU license and adhere to prudential requirements such as asset segregation and liquid and audited reserves.

Hong Kong issues two VASP licenses

Elsewhere, Hong Kong’s Securities and Futures Commission (SFC) has issued two virtual asset service provider (VASP) licenses, the first of the new year.

The regulator issued the licenses to PantherTrade and YAX, two local digital asset exchanges. It brings the total number of licensed VASPs under the SFC’s regulatory regime to nine, which falls just short of the 11 exchanges the SFC intended to license by the end of 2024. SFC CEO Julia Leung stated last October that the agency would endeavor to issue licenses to the applicants who, at the time, were operating under a “deemed to be licensed” model as they awaited the SFC’s decision.

HashKey and OSL exchanges were the first two to secure the license in August 2023. Other licensees include HKVAX, EX.IO, DFX Labs, and HKbitEX. Some global giants like OKX and Huobi stated years ago that they had applied for the license, but to date, none has received the regulatory green light.

SFC has maintained that its framework is balanced to protect investors while “facilitating continuous development for the virtual asset ecosystem.” The agency came under fire following the collapse of JPEX, a Dubai-based exchange with a heavy presence in Hong Kong, which went down with over $160 million in investor funds. In response, the agency listed all the VASPs that had applied for a license to allow investors to better vet the exchanges they engaged with.

While its VASP licensing has moved at a slower pace than its rivals, Hong Kong remains a global leader in the digital asset and blockchain sector. Tokenization is one of the sectors in which it has been setting the pace, being home to the world’s largest and most advanced token issuances. In January, the Hong Kong subsidiary of one of China’s largest lenders, the Bank of Communications (BoCom), issued a $300 million digital bond in the city. A new incubator for local banks, established by the Hong Kong Monetary Authority (HKMA) last month, is further expected to boost tokenization efforts by the city’s lenders.

Watch: RockWallet is the go-to app for everyone

title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen>

Source: https://coingeek.com/mobile-wallets-hit-36m-as-investors-explore-dapps-report/